Personal Finance/Market Insights] Tariffs, AI, and the 401(k) Revolution: A Global Rebalancing of Capital & Opportunity for Impact Investing

![Personal Finance/Market Insights] Tariffs, AI, and the 401(k) Revolution: A Global Rebalancing of Capital & Opportunity for Impact Investing](https://images.unsplash.com/photo-1546436836-07a91091f160?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDJ8fG5ldyUyMHlvcmslMjBjaXR5fGVufDB8fHx8MTc1NTQ2MTAzMHww&ixlib=rb-4.1.0&q=80&w=1200)

Executive Summary

The global capital markets stand at an inflection point. Three disruptive forces—tariff realignments, AI-driven productivity, and the democratization of retirement capital through alternative assets—are colliding to reshape investment paradigms.

President Trump’s August 2025 executive order allowing 401(k) retirement plans to invest directly in crypto, private equity, and other alternatives represents the most significant structural shift in retirement savings since the 1974 ERISA Act. This policy, coming amid tariff-induced volatility and an AI productivity boom highlighted by the Federal Reserve’s July 2024 research, signals a new equilibrium for both institutional and retail investors.

The opportunity is clear: retirement savers, policymakers, and capital allocators now have a chance to channel democratized capital into purposeful, impact-oriented investments that shape not only financial returns but also the sustainability of our societies. Yet the risks—from illiquidity, volatility, and opaque fee structures—are equally daunting.

From my perspective, the intersection of tariffs, AI productivity, and capital democratization is not just an American phenomenon, but a global reset for allocators, regulators, and academics. This moment demands vision, discipline, and alignment of capital with broader planetary outcomes.

Top Three Key Takeaways

- 401(k) Inclusion of Alternatives Redefines Retirement Capital

Trump’s executive order allowing alternatives and digital assets in 401(k)s democratizes access to institutional-grade investments. While this broadens opportunity, it also introduces systemic risks—opaque fees, long lock-ups, and crypto volatility—that could destabilize unsophisticated portfolios. - AI Productivity Offsets Tariff Volatility

The Federal Reserve’s research underscores that AI-driven investment is structurally boosting U.S. productivity. Markets are already “pre-pricing” these gains, meaning long-term allocators must integrate AI as a central force of growth even while tariffs unsettle trade flows. - Impact Investing is the Equilibrium Pathway

The democratization of capital presents a fork: it can either amplify speculative bubbles, or be directed toward impact—climate, health, education, and sustainable infrastructure. For allocators and policymakers worldwide, the challenge is not just balancing risk and return, but ensuring capital advances purpose alongside profit.

I. A Policy Shock: The 401(k) Executive Order

On August 10, 2025, President Trump signed an executive order that permits retirement accounts, including 401(k) plans, to invest directly in digital assets, private equity, and other alternatives. Business Insider called it a “paradigm shift in retirement investing, with enormous upside potential and equally dangerous downside risks” (Business Insider, 2025).

For nearly half a century, U.S. retirement savers have been locked into a menu of mutual funds, index trackers, and fixed income instruments. Alternatives were largely reserved for pensions, endowments, sovereign wealth funds, and family offices. This policy democratizes access, but in doing so, it opens the gates to an asset class ecosystem fraught with opacity, liquidity mismatches, and asymmetric knowledge.

The policy is as political as it is financial. It comes at a moment when tariffs and trade barriers have unsettled U.S. markets and when traditional inflation hedges are under strain. Giving retirement savers “exposure” to alternatives and crypto is framed as empowerment—but it also transfers a significant amount of risk from the institutional balance sheet onto households.

Globally, this move will not be seen in isolation. Already, policymakers in Europe and Asia are asking whether they too should broaden retirement investment menus—or whether guardrails must be erected to prevent household savings from being overexposed to speculative volatility.

II. Tariffs, Uncertainty, and the Search for Stability

The policy cannot be separated from its macroeconomic context. Tariffs, particularly those aimed at China, have reintroduced uncertainty into global supply chains. The IMF and OECD both warn that renewed trade fragmentation could shave long-term growth off both developed and emerging economies.

For investors, tariffs do two things at once:

- They raise costs and distort markets, making near-term corporate earnings harder to predict.

- They redirect capital toward “safe” or “domestic” havens—often government bonds, commodities, or domestic champions.

This reallocation creates instability. Households and institutions alike find themselves hungry for returns in a landscape of constrained growth and unpredictable trade dynamics. Against this backdrop, the 401(k) executive order looks less like financial innovation and more like a political safety valve: offering access to “new returns” in alternatives when traditional equity markets feel trapped by tariff headwinds.

But as any allocator knows, chasing returns without regard for liquidity, governance, or impact is a recipe for crisis.

III. The Counterbalance: AI as a Productivity Engine

If tariffs are a headwind, AI is the tailwind.

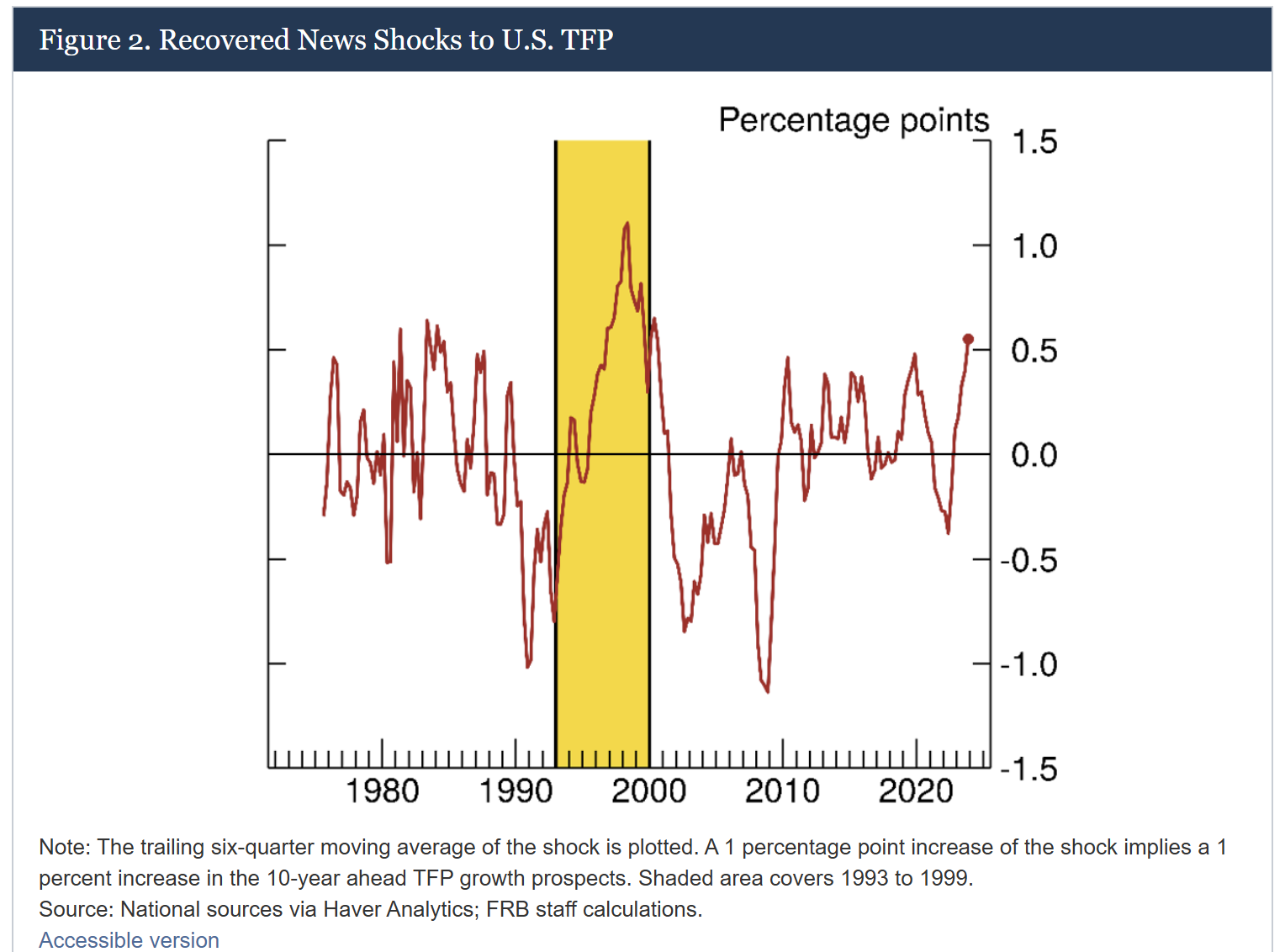

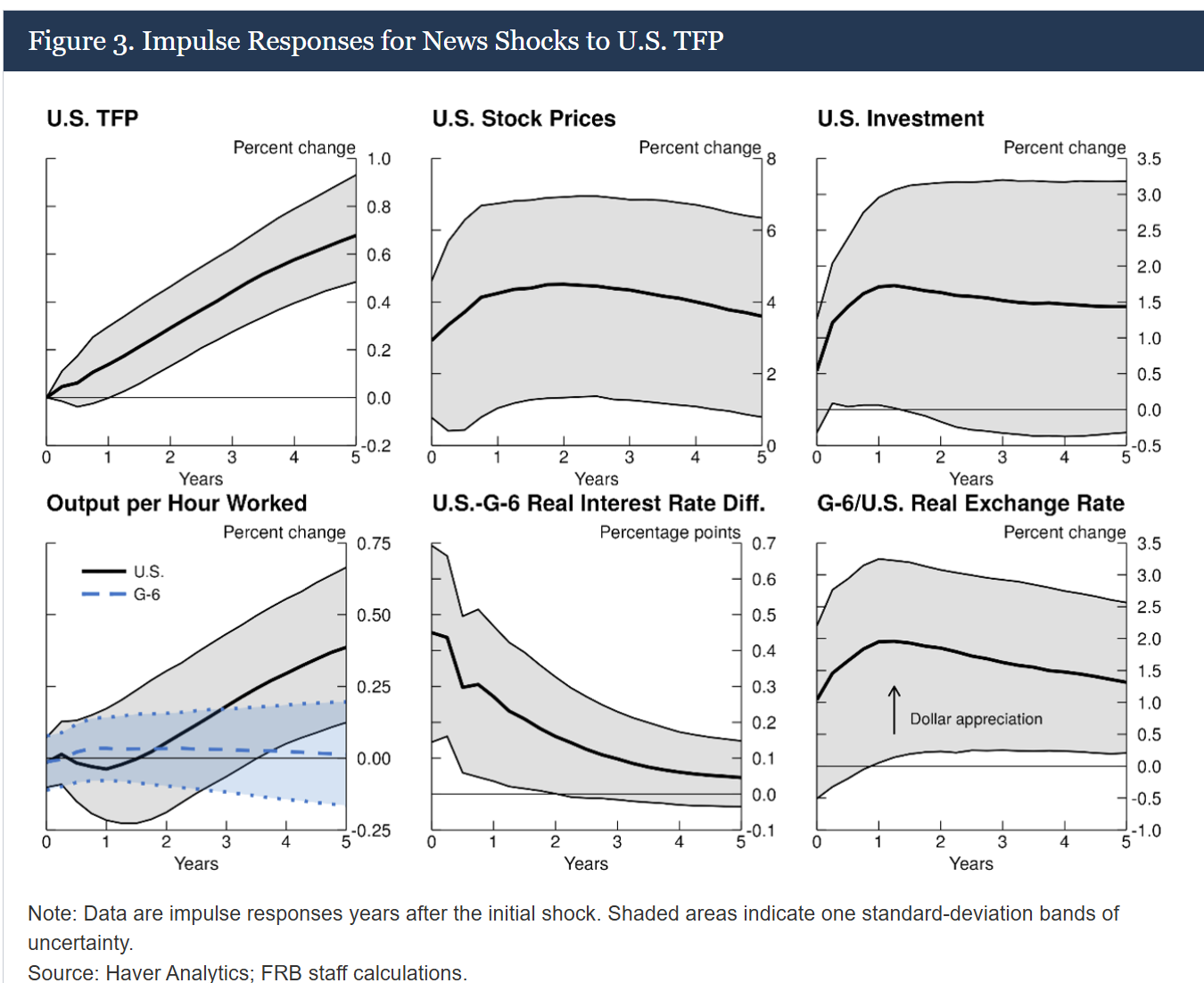

The Federal Reserve’s July 2024 research note, “Global Implications of Brighter U.S. Productivity Prospects”, highlights that AI-related investment is expanding faster in the U.S. than in peer economies (Federal Reserve, 2024). Productivity gains are already being priced into valuations, particularly in tech-heavy indices, and could lift long-run U.S. growth trajectories.

Key insights from the Fed note:

- AI investment is front-loaded: The U.S. is outpacing other countries in both private sector and venture flows into AI.

- Markets are anticipatory: Equity valuations already embed expectations of long-run productivity improvements.

- Global spillovers are inevitable: Because U.S. capital markets remain the deepest and most liquid, these productivity dynamics influence global asset allocation.

For allocators, this means that AI is no longer a sectoral bet—it is a structural phenomenon. Whether one is investing in infrastructure, consumer goods, or healthcare, AI adoption and productivity must be integrated into asset valuation models.

IV. Democratization or Destabilization? The Risks of Alternatives in Retirement Accounts

Opening the gates of 401(k) plans to alternatives and crypto is an experiment with unprecedented systemic risk.

Business Insider highlights three major concerns:

- Volatility in Crypto – Bitcoin and other digital assets can swing 20–30% in a single week. For retirement portfolios, this level of volatility is destabilizing.

- Illiquidity of Private Equity – Lock-up periods can last 7–10 years. For savers expecting flexibility, this creates severe mismatches.

- Opaque Fee Structures – Unlike index funds with transparent costs, private equity and hedge funds often employ layered fees that erode long-term returns.

This is where the global lesson emerges. Other retirement systems—in Europe, Asia, and Latin America—will be watching closely. If U.S. households bear losses from opaque or volatile alternatives, the backlash could be political as much as financial. Conversely, if returns flow and households embrace the diversification, this could set a precedent for global pension reform.

401(k) Alternatives & Crypto: Risk–Reward Matrix

| Dimension | Potential Upside (Pros) | Risks & Challenges (Cons) |

|---|---|---|

| Returns | Higher return potential for younger savers with long horizons (private equity, crypto, private credit). | Volatility in crypto; uncertain long-term performance of private equity for retail portfolios. |

| Access & Equity | Democratizes access to institutional-grade strategies (e.g., BlackRock’s planned retirement funds). | Complexity may disadvantage less financially literate savers; access ≠ ability to manage risk effectively. |

| Market Alignment | Positions retirement savings alongside innovation and global capital market trends. | Assets less transparent and harder to liquidate than traditional stocks and bonds. |

| Costs | Potential for diversification benefits that can offset inflation and low yields in public markets. | Higher management/performance fees can erode savings; opaque fee structures common in private funds. |

| Legal/Policy | Reflects regulatory recognition of alternatives and digital assets as legitimate components of retirement. | Significant litigation risk; political overlay (e.g., “debanking” order) creates regulatory and reputational uncertainty. |

V. Impact Investing as the Equilibrium Path

The democratization of capital, however, need not collapse into speculation. Impact investing offers a stabilizing pathway.

If new flows into alternatives and digital assets are intentionally directed toward climate solutions, health innovations, educational access, and sustainable infrastructure, the risks of democratization can be transformed into opportunities for resilience.

Consider:

- Climate – Capital allocators can use this opening to scale green bonds, renewable infrastructure funds, and carbon-transition strategies.

- Health & Education – Private equity and venture flows can be steered toward life sciences, AI-enabled healthcare, and EdTech with equitable access goals.

- Digital Infrastructure – Crypto and blockchain can fund decentralized, inclusive financial services rather than purely speculative token cycles.

This is not naive idealism. It is pragmatic capital strategy. With trillions of dollars in retirement savings now inching toward alternatives, the question is not whether the flows will come—but whether policymakers and allocators will ensure those flows build sustainable futures rather than bubbles.

VI. A Global Reset, Not Just an American Story

It is tempting to see the August 2025 policy as uniquely American. But its reverberations are already global:

- European pension regulators are fielding questions on “parity access” for alternatives.

- Asian sovereign wealth funds are exploring co-investment frameworks with U.S. retirement vehicles.

- Emerging markets are bracing for capital flight—or inflows—depending on how U.S. savers deploy this new flexibility.

The globalization of both tariff disruptions and AI productivity gains means that the 401(k) revolution is not confined to U.S. households. It sets a precedent that could reshape retirement systems worldwide.

VII. Conclusion: From Policy Shock to Capital Discipline

The convergence of tariffs, AI productivity, and retirement democratization is a once-in-a-generation rebalancing of capital.

For allocators, retail investors, policymakers, and academics, the central challenge is discipline. The temptation to chase speculative returns is real. But the opportunity to redirect democratized capital into productive, impactful, and sustainable pathways is even greater.

I believe this moment calls for a global conversation across asset classes, borders, and disciplines. Whether we emerge into a decade of destabilization or a decade of rebalanced, purpose-driven growth will depend on the decisions we make now.

*Question for the Obsidian Odyssey Community:

If alternative assets like crypto, private equity, and real estate become standard in retirement portfolios, how should fiduciaries and policymakers balance the promise of higher returns with the duty to protect savers from volatility, opacity, and litigation risk?

Further Reading & Resources

- Federal Reserve (2024). Global Implications of Brighter U.S. Productivity Prospects – Highlights AI-led productivity gains in the U.S. and how markets have pre-priced these future gains. (Fed)

- Business Insider (2025). “Thinking of adding crypto and private equity to your 401(k)? Here are the 2 biggest risks you should know.” – Deep dive into the volatility, illiquidity, and fee risks of incorporating alternatives into retirement accounts. (Business Insider)

- Financial Times (2025). Coverage of Trump’s executive order opening 401(k) plans to alternative investments. (Financial Times, Business Insider)

- OECD (2023). Pension Markets in Focus 2023 – Comprehensive analysis of retirement markets globally, investment performance under inflation and interest-rate shocks, and evolving asset allocations. (OECD)

- World Economic Forum (2025). “How AI impacts value creation, jobs and productivity is coming into focus.” – Sectoral analysis showing AI-enabled productivity growth of nearly 5× in leading sectors. (weforum.org)

- IMF (2025). Policy Challenges in a Fragmenting World: Global Trade, Exchange Rates, Capital Flows – Explores the impact of geopolitical fragmentation and trade tensions on global capital mobility. (imf.org)

Note) Further reading and resources have been prepared by AI.

![Obsidian Memo] 1929 — Lessons from the 1929 Crash & A Reminder That Craft Still Wins (ft. Andrew Ross Sorkin's London Talk)](/content/images/size/w720/2026/01/WhatsApp-Image-2026-01-18-at-11.51.11-1.jpeg)

![Leadership] FII - the Board of Changemakers Summary: Geo-Economics 2025: AI Power, Tokenized Finance, and the New Capital Map](/content/images/size/w720/2025/10/Screenshot-2025-10-31-130048.png)

![Leadership] The new face of wealth: The rise of the female investor (ft. McKinsey Report)](https://images.unsplash.com/photo-1618662062577-1e1483c7b6c4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDN8fGNhcGl0YWx8ZW58MHx8fHwxNzU5MzQ4ODIwfDA&ixlib=rb-4.1.0&q=80&w=720)

Comments ()