Sustainable/Impact Investing] COP30 in the Amazon: Baker Institute’s strategic dialogue on Recalibration of Climate Leadership and Capital (Oct 15, 2025)

Investor brief from the Baker Institute dialogue on COP30 in the Amazon—exploring Brazil’s emergence as a renewable powerhouse, the shift from negotiation to implementation, and why supply chain resilience will define the next era of climate and capital leadership.

![Sustainable/Impact Investing] COP30 in the Amazon: Baker Institute’s strategic dialogue on Recalibration of Climate Leadership and Capital (Oct 15, 2025)](https://images.unsplash.com/photo-1591081658714-f576fb7ea3ed?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDJ8fEFNQVpPTiUyMEZPUkVTVHxlbnwwfHx8fDE3NjA5NTY1OTh8MA&ixlib=rb-4.1.0&q=80&w=1200)

The Moment Before the Turn

Hi All, on October 15th, I attended a strategic dialogue at the Baker Institute that felt less like a typical conference and more like a preview of what's coming—a shift in how we think about climate leadership, energy transition, and who gets to shape that future.

The virtual room brought together Brazilian ministers, industry leaders, and economists to discuss COP30, which Brazil will host in the Amazon next month. It's the first COP held in the Amazon, and the first in the Western Hemisphere in over a decade. That geography isn't incidental—it's the entire point.

What struck me most was the tone. This wasn't about lofty declarations or aspirational timelines. It was pragmatic, grounded, and deeply aware of trade-offs. Brazil is positioning itself as both a biodiversity custodian and an industrial powerhouse—a dual identity that challenges the old binary of environment versus economy. For investors and capital allocators, the message was clear: credibility, resilience, and delivery now matter more than promises.

Below, I've shared my notes and reflections from the day. If you're tracking where climate policy, energy markets, and Latin American leadership intersect, hope you find this conversation helpful.

For capital allocators: are you viewing Brazil's dual role as biodiversity custodian and industrial powerhouse as a hedge, a bet, or a new asset class entirely?

The event was hosted by the Baker Institute for Public Policy, the Brazilian Petroleum Institute, and the Brazil-Texas Chamber of Commerce.

Executive Summary — Key Insights for Investors and Policy Leaders

- Implementation is the new ambition. COP30 marks the shift from negotiation to delivery — translating the Global Stocktake into measurable, investable action.

- Brazil is the renewable testbed of the world. With 84% of the Amazon preserved, 50% of total energy renewable, and 93% of electricity clean, Brazil anchors the intersection of climate credibility and industrial competitiveness.

- Resilience defines the next frontier. Decarbonization’s success now depends on resilient, diversified supply chains — from minerals to manufacturing to grid infrastructure.

- Finance is the constraint and catalyst. Scaling the transition demands new vehicles for blended and concessional capital, local-currency mechanisms, and credit enhancement.

- Just transition = political durability. Climate action must embed inclusion, reskilling, and social value creation to remain investable and socially sustainable.

- Private sector credibility is rising. Corporate commitments in Brazil demonstrate that industrial decarbonization can expand growth while reinforcing community stability.

Session I – From Negotiation to Implementation

Speaker: João Marcos Paes Leme, Deputy Minister for Energy, Brazil

Session Overview

Deputy Minister Paes Leme framed COP30 in Belém as the “Implementation COP” — a turning point from pledge to performance. Brazil’s presidency aims to operationalize the Global Stocktake through thirty measurable objectives, many rooted in the energy sector. The Amazon, he argued, must now be seen not just as ecological heritage but as economic infrastructure — a living asset for value creation through sustainable industries and technology.

Investor Takeaways

- Execution replaces aspiration. COP30’s credibility will rest on policy-to-capital translation and delivery metrics.

- Energy sector = decisive arena. Responsible for ~75% of global emissions, energy transitions remain the key determinant of success.

- Renewables expansion, uneven capital flows. IRENA reports a 15.1% YoY rise in global renewables, yet 85% of capacity sits in the Global North — underscoring Brazil’s call for concessional finance to bridge the gap.

- Belém ×4 Pledge. Brazil and the IEA launched a target to quadruple global sustainable fuel output, addressing hard-to-abate sectors and inviting industrial investors into the next “molecule market.”

- Transition realism. Expect hybrid portfolios — renewables, low-carbon hydrocarbons, sustainable fuels — as the pathway to an orderly, just transition.

- Carbon accounting convergence. Harmonized MRV standards will define the next stage of market credibility and green capital formation.

Session II – How COPs Work, What’s Unresolved, and Where Private Capital Moves Next

Speakers: Carla Lacerda (Moderator), Arthur Lee (Chevron; IPCC Contributor)

Session Overview

This discussion demystified the architecture of COP negotiations and positioned Brazil’s presidency as a bridge between developed and emerging economies. The focus: financing the transition, formalizing the Global Stocktake, and operationalizing the Just Transition Work Programme (JTWP) — all foundational to creating investable climate pathways.

Investor Takeaways

- Financing remains the fault line. Loss & Damage pledges (~US$800m) are a fraction of need; the long-term finance goal (>US$300bn/yr) will dominate Baku-to-Belém negotiations.

- Standardized NDCs = bankability. Comparable, time-bound climate plans are preconditions for scalable private investment.

- Just Transition → credit variable. Project-level social safeguards, labor reskilling, and inclusion are emerging as cost-of-capital determinants.

- Brazil’s presidency will prize pragmatism. Expect deal-making that balances ambition with executability.

- China’s industrial weight = price floor. Chinese cost leadership in clean-tech manufacturing shapes the economics of decarbonization; Brazil’s policy stability offers context-driven opportunity.

- COP30 strategy for investors. Use COP to pre-wire partnerships, blended structures, and MRV-based transactions with policy visibility.

Session III – The Systemic View of Sustainability

Speaker: Rachel Meidl, Fellow, Baker Institute for Public Policy

Session Overview

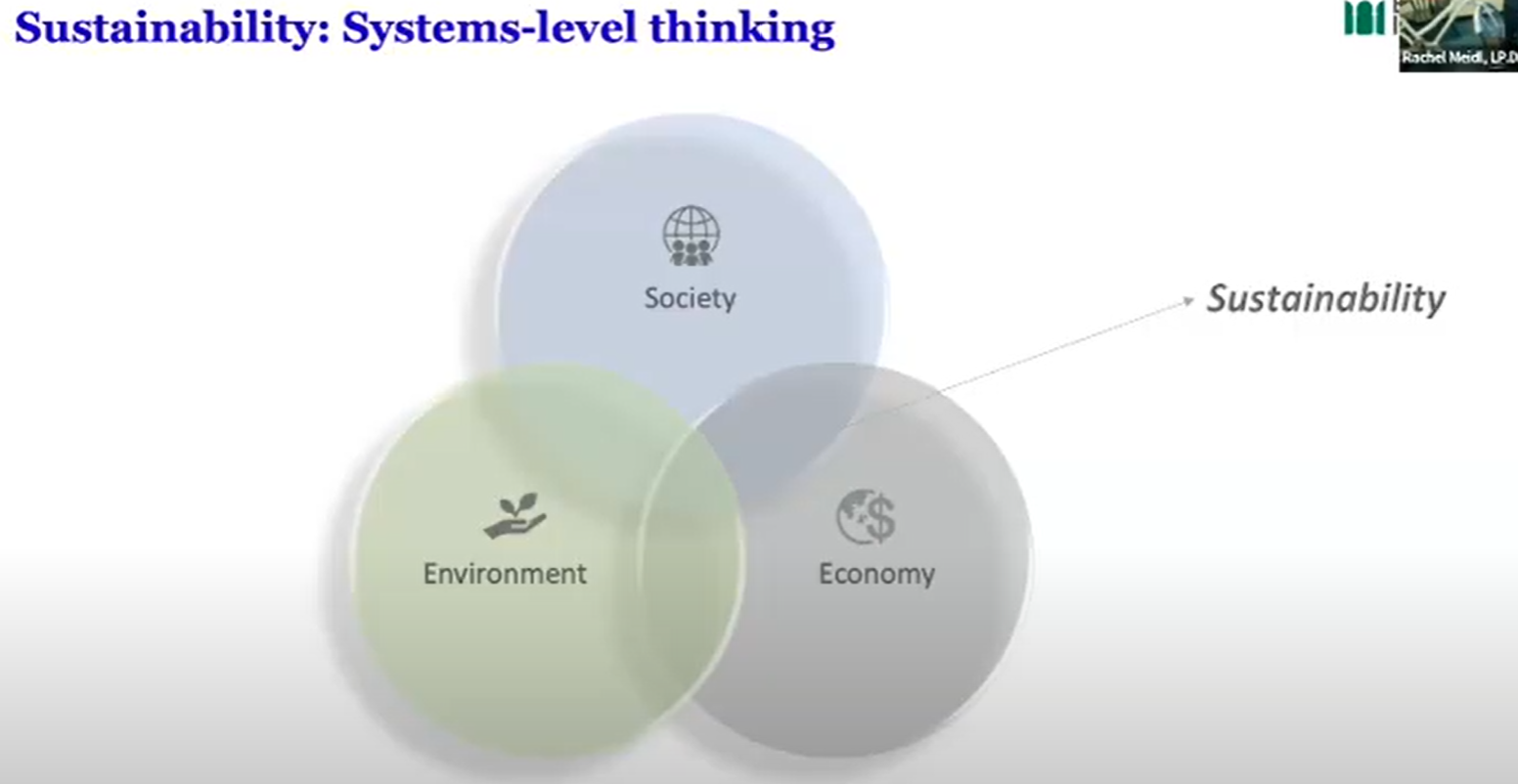

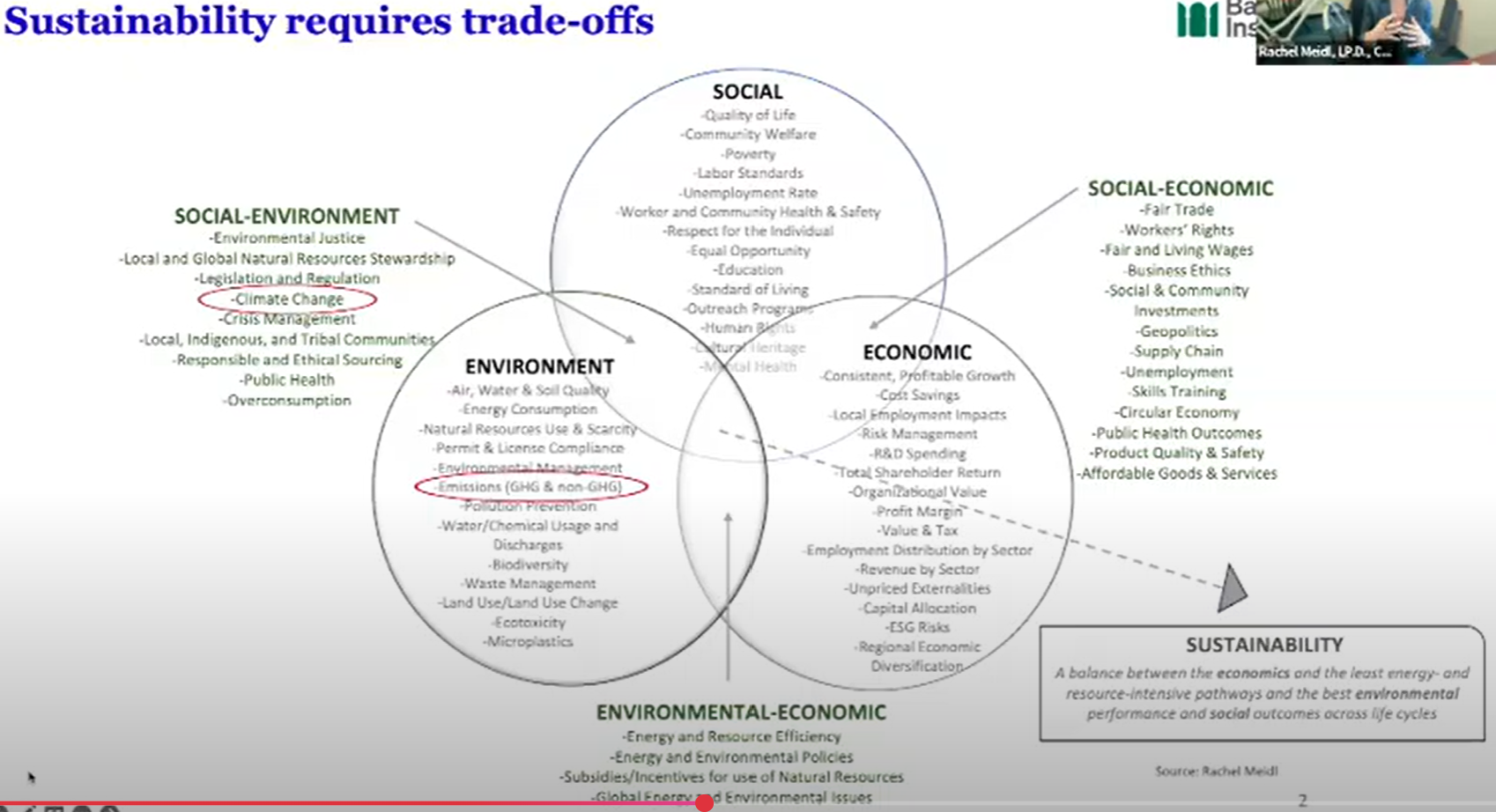

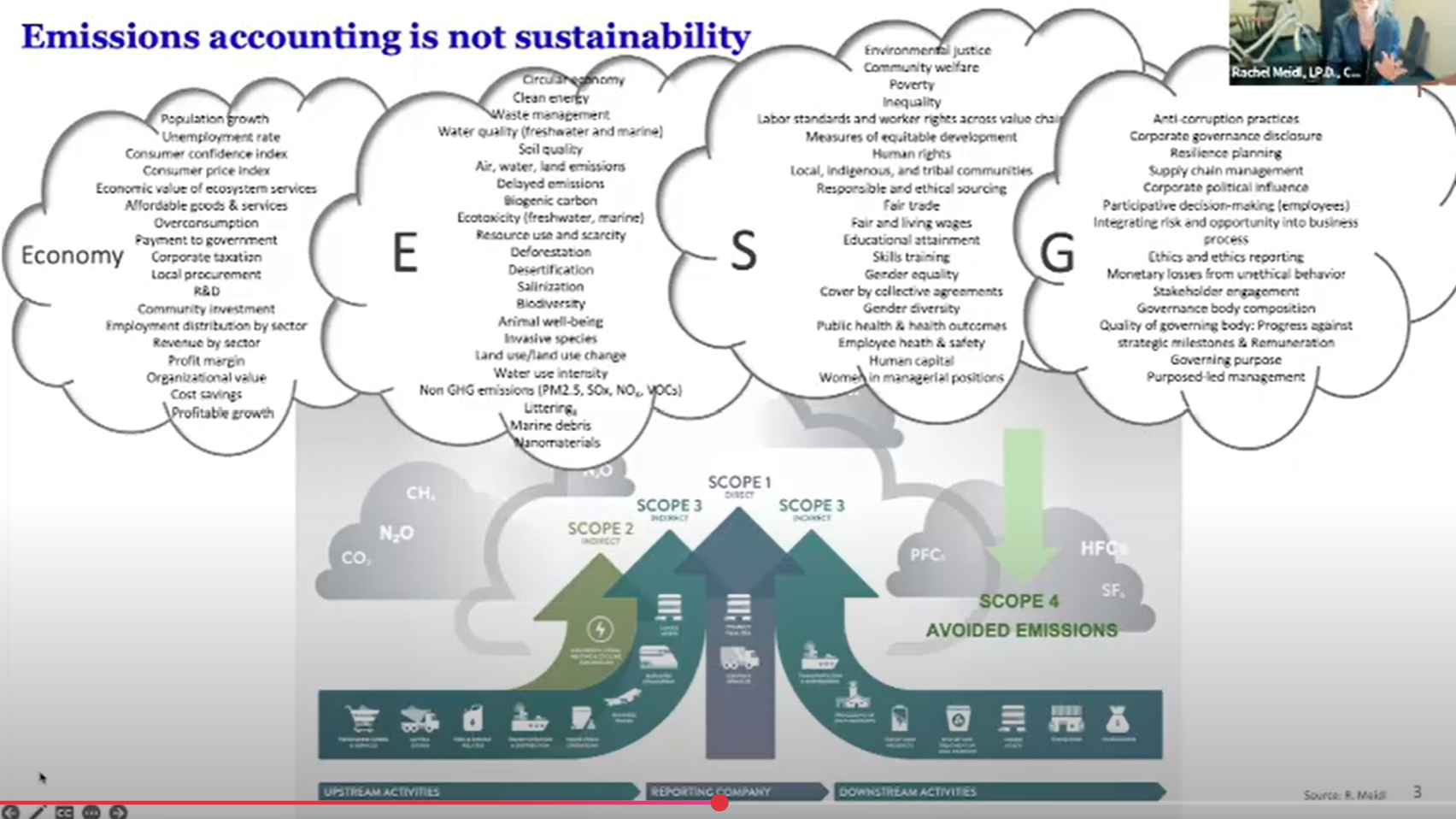

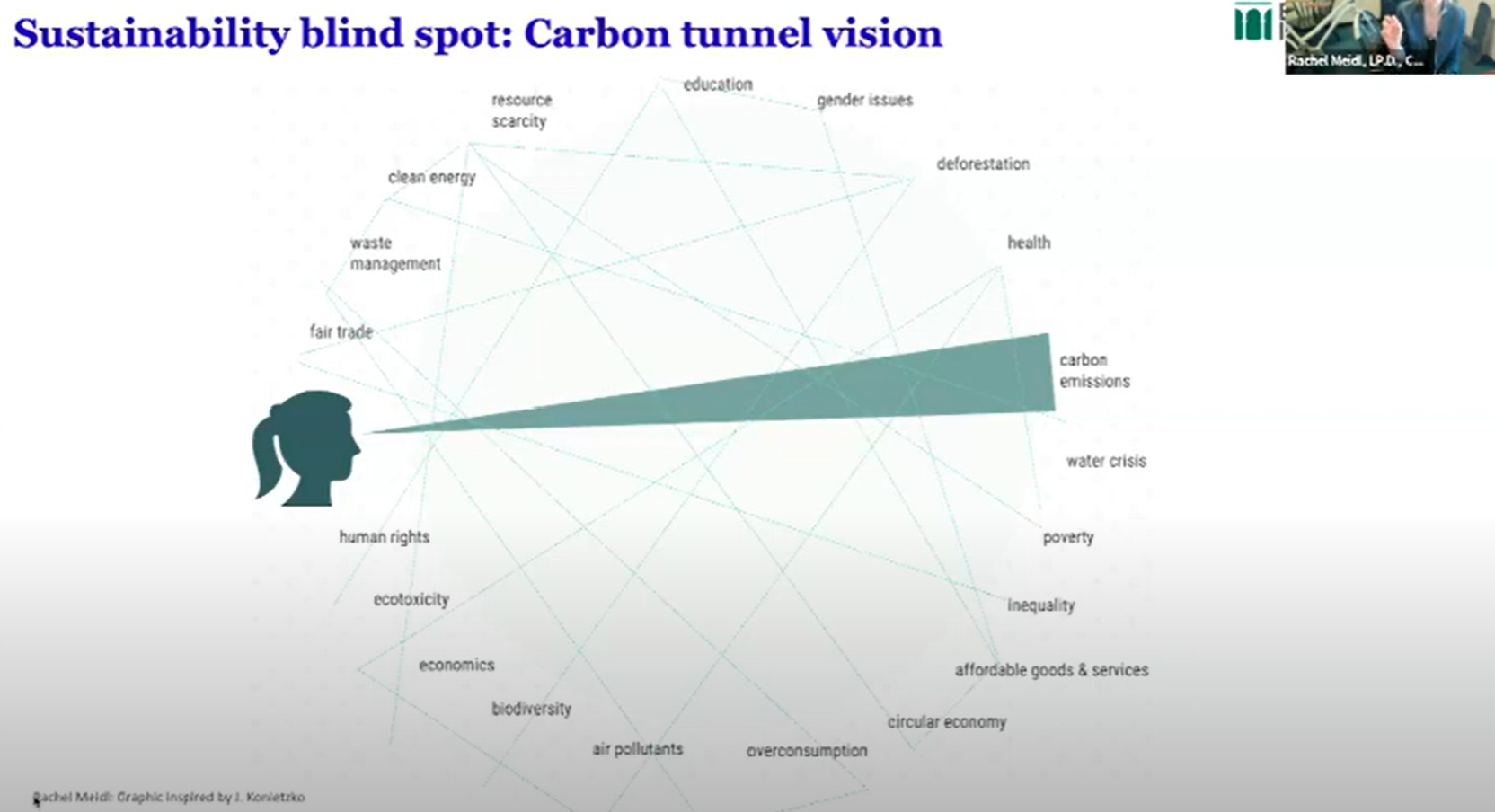

Meidl reframed sustainability as a systems problem, not a carbon problem. True resilience, she argued, arises from harmonizing environmental, social, and economic objectives — ensuring that the net-zero agenda does not create new inequities or blind spots.

Investor Takeaways

- Beyond emissions accounting. Sustainability is a multi-variable optimization challenge; ESG screens must capture lifecycle impacts, not just Scope 1–3.

- Avoid carbon tunnel vision. Overemphasis on emissions reduction can obscure biodiversity, community resilience, and waste management risks.

- Lifecycle economics = alpha source. Cradle-to-cradle thinking unlocks material efficiency and margin opportunities across industrial portfolios.

- New disclosure frontiers. Expect expansion from carbon to holistic resource efficiency metrics — water, waste, circularity — in both policy and finance frameworks.

- Social equity as risk management. Inclusive growth underpins long-term asset stability in emerging markets.

Energy Transition Outlook

Speaker: Jon Ødegård Hansen, Rystad Energy

Session Overview

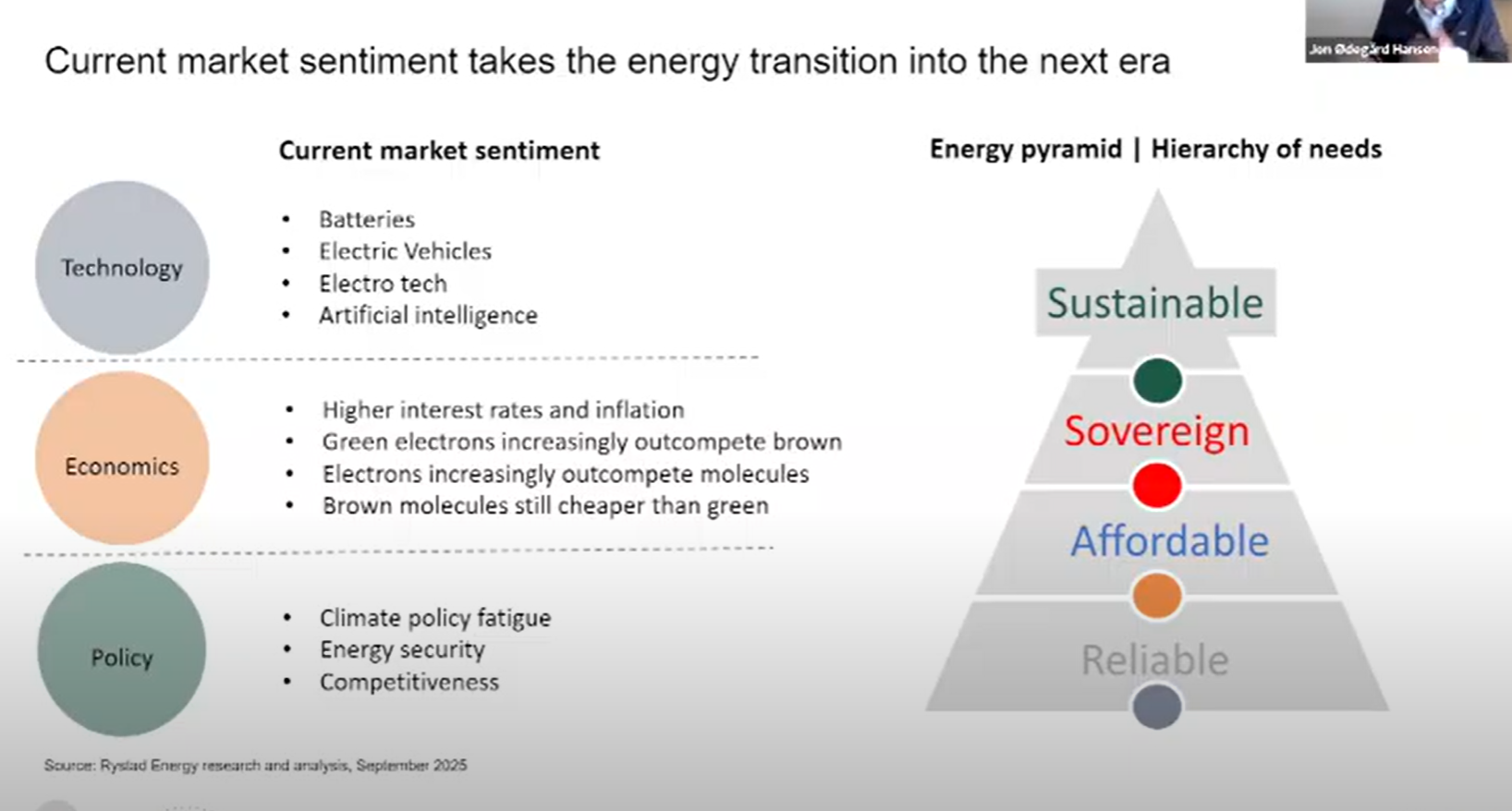

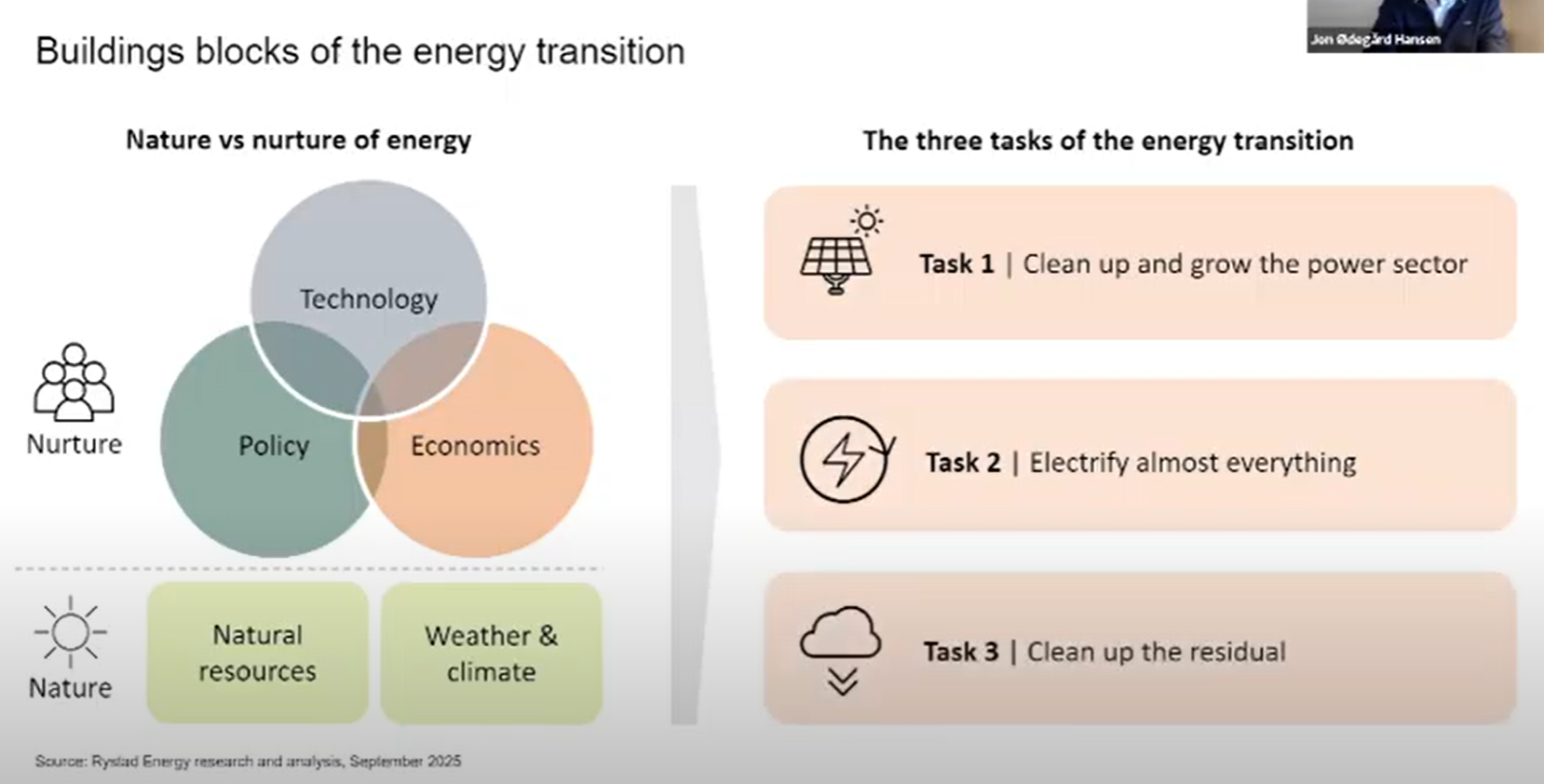

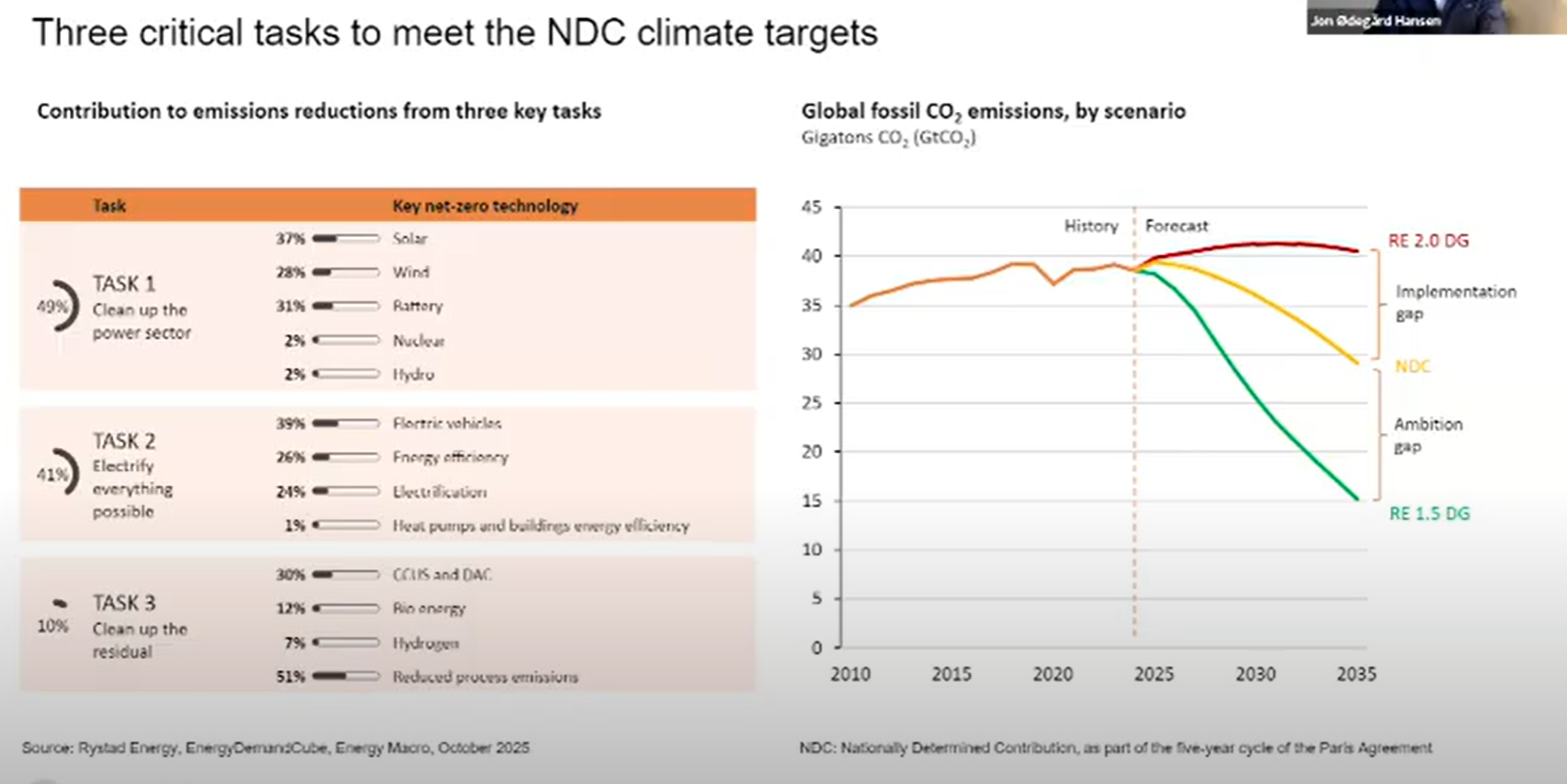

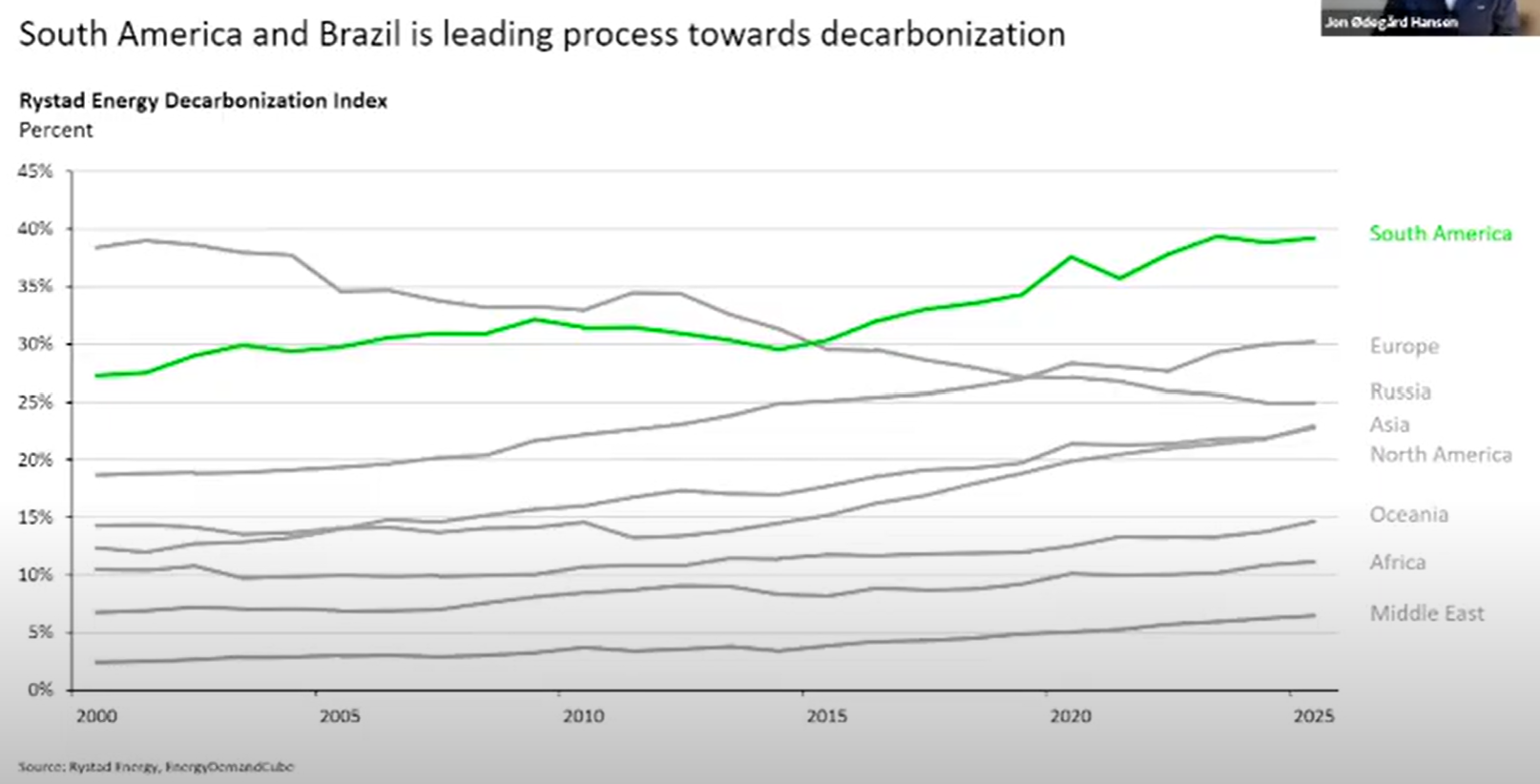

Hansen outlined the “three tasks” of the global energy transition and quantified the delivery gap between stated ambition and feasible implementation. His analysis underscored why Brazil’s energy mix and market reforms represent a pragmatic pathway for emerging economies.

Investor Takeaways

- Three core tasks. Power sector decarbonization (50–70% of reductions), electrification of end uses (40%), and advanced solutions (hydrogen, CCUS) — together define the transition roadmap.

- Implementation deficit. Current NDCs cover only ~30% of global emissions and target a 25% cut by 2035 — well short of the 60% reduction needed for 1.5°C.

- Investment signal. Tasks 1 & 2 represent ~90% of achievable reductions by 2035 — the clearest frontier for capital deployment.

- Technology tailwinds, macro headwinds. Battery innovation and EV scale-up meet higher capital costs due to interest rate drag.

- Brazil leads the index. The country ranks highest globally on decarbonization readiness — non-fossil electricity and biofuel integration create unique investment depth.

Brazil’s Industrial and Mining Transition

Speakers: Isadora Santiago Rodrigues (Ministry of Mines and Energy); Julio Cesar Nery Ferreira (Brazilian Mining Association); Claudia Schaefer (Dow Chemical)

Session Overview

This multi-sector dialogue highlighted how Brazil is embedding industrial decarbonization, social inclusion, and mineral value capture into its national energy and resource strategy — effectively turning the Amazon into a coordinated development zone.

Investor Takeaways

- Tripling renewables by 2030. Brazil’s G20 commitments on renewables and efficiency define clear policy alignment for infrastructure capital.

- Inclusive transition. Energy and social programs (“Gas for the People,” “Amazon Energy”) integrate poverty alleviation and resilience-building.

- Mining as catalyst. With mining emissions at just 0.6% of national totals, Brazil demonstrates coexistence of extractive industry and conservation — a model for traceable critical mineral sourcing.

- Corporate proof points. Dow’s nine Brazil plants now operate on 100% renewable electricity; its Pará site delivers low-carbon silicon for global markets.

- Biofuels heritage = future engine. Fifty years of ethanol leadership position Brazil as a dual energy and agricultural power.

- Investor takeaway. Brazil’s “just, orderly, and investable” model blends industrial credibility with climate integrity — offering hybrid opportunities in biofuels, electrification, and value-chain localization.

Session IV – Supply Chain Resilience as the Hidden Variable in the Energy Transition

Speaker: Ken Medlock, Senior Director, Baker Institute for Energy Studies

Session Overview

Medlock closed the dialogue by reframing supply chain resilience as the linchpin of credible decarbonization. He drew historical parallels between the 1970s oil crises and today’s dependence on concentrated mineral and technology supply chains — warning that net-zero plans risk collapse without systemic redundancy.

Investor Takeaways

- The hidden fragility. Clean-tech supply chains mirror 1970s oil dependencies — geographically concentrated and politically exposed.

- Historical precedent = playbook. Diversification and R&D during the oil shocks catalyzed the shale revolution; similar innovation can de-risk today’s critical mineral chains.

- Resilience ≠ reliability. Reliability ensures performance; resilience ensures recovery — a key investment lens for evaluating industrial portfolios.

- Policy incentives ahead. Expect new frameworks for onshoring, strategic reserves, and mineral processing diversification.

- Resilience as investment filter. Allocate capital toward firms and assets demonstrating redundancy, flexibility, and regionally balanced sourcing.

- COP30 outlook. Supply chain resilience likely to emerge as a core pillar of global climate strategy, shaping future transition finance.

Closing Insight — Capital at the Crossroads

COP30 will test whether global climate ambition can mature into operational credibility. Brazil’s presidency introduces a template for pragmatic multilateralism: execution, inclusion, and resilience.

For institutional investors, the signal is clear — the next competitive advantage lies not in green rhetoric but in the architecture of delivery: resilient supply chains, standardized carbon accounting, and blended-capital vehicles that can mobilize scale without fragility.

Note) The above detailed summary was put together with the help of AI and reviewed by a human being, me.

![Obsidian Memo] Leadership Ground Truth: What Cuba, Puerto Rico, and Hawai'i Taught Me About Capital and Resilience](/content/images/size/w720/2026/02/Bad-Bunny.jpg)

![Obsidian Memo] The Great Re-Entry: Strategic Realignment and the Industrialization of Private Capital in the 2026 Financial Services Landscape](/content/images/size/w720/2026/02/photo-1496989981497-27d69cdad83e.jpeg)

![Obsidian Memo] Nature Finance & Circular Economy in Practice: A Sustainable Investing Perspective](https://images.unsplash.com/photo-1571785983781-3317703d64a6?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDEyfHxiaW9kaXZlcnNpdHl8ZW58MHx8fHwxNzcwOTU2NzQ3fDA&ixlib=rb-4.1.0&q=80&w=720)

Comments ()