Personal Finance/Market Insights] Tech Power vs Financial Power: A Battle Reshaping the Future, ft. Peter Thiel

For over a century, finance set the rules of global power. Now, technology is rising as the new architect of society. The contest between Wall Street and Silicon Valley is more than markets—it’s about who will design the systems that govern money, innovation, and the future itself.

![Personal Finance/Market Insights] Tech Power vs Financial Power: A Battle Reshaping the Future, ft. Peter Thiel](https://images.unsplash.com/photo-1504805572947-34fad45aed93?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDQ3fHxjaGFuZ2V8ZW58MHx8fHwxNzU2NDY4NTk2fDA&ixlib=rb-4.1.0&q=80&w=1200)

Hi All,

Have you ever wondered who truly shapes the world? My own search for that answer began in undergrad, as I wrestled with the question of which governance and economic models best serve people. History offered clues, but the deeper I looked, the more I realized that the real story of power is not written only in laws or policies—it is written in the institutions and elites who set the rules of the game.

Recently, I came across a lecture that resonated deeply with these long-held questions. It explored the growing clash between financial power and technological power—two forces now competing for dominance not only in markets but in the very architecture of society.

For most of modern history, finance has been the dominant force because we live in a capitalistic society. Capitalism and the Industrial Revolution both began in the United Kingdom, where the City of London emerged as the financial capital of the world in the 18th and 19th centuries. Britain’s empire, powered by coal, steam, and banking, exported this model globally. By the early 20th century, however, the center of financial gravity had shifted to the United States. Figures like J.P. Morgan steered the American economy through crises, and the creation of the Federal Reserve in 1913 cemented Wall Street and New York as the global hub of financial power. Capital markets and central banks shaped not only money flows but also the geopolitical order.

We are now at an inflection point, where the weight of political and economic power is beginning to shift again—this time from finance toward technology with U.S. world supremacy and hegemony increasingly challenged by China’s re-rise

🏉 Bottom line: To understand today’s markets, we need to look beyond earnings reports and policy announcements. We need to see the underlying power struggle between finance and technology—a contest that will shape money, governance, and the future of the world itself.

I. The Background

1913: Historical Rise of Financial Power

- Origins of Financial Dominance: Fancial power in the US was consolidated over the last century, starting with figures like JP Morgan who intervened in crises and led to the creation of the New York Federal Reserve, cementing the banking sector’s influence in American decision-making.

- Expansion through Crises: Institutions like JP Morgan and the Federal Reserve gained immense power by navigating and managing major financial crises, growing their influence especially after the 1913 founding of the Fed and later globalizing their reach with the rise of the dollar as a fiat and reserve currency after Bretton Woods and the end of the gold standard.

2008: Rise of the Tech Power - #New Elite

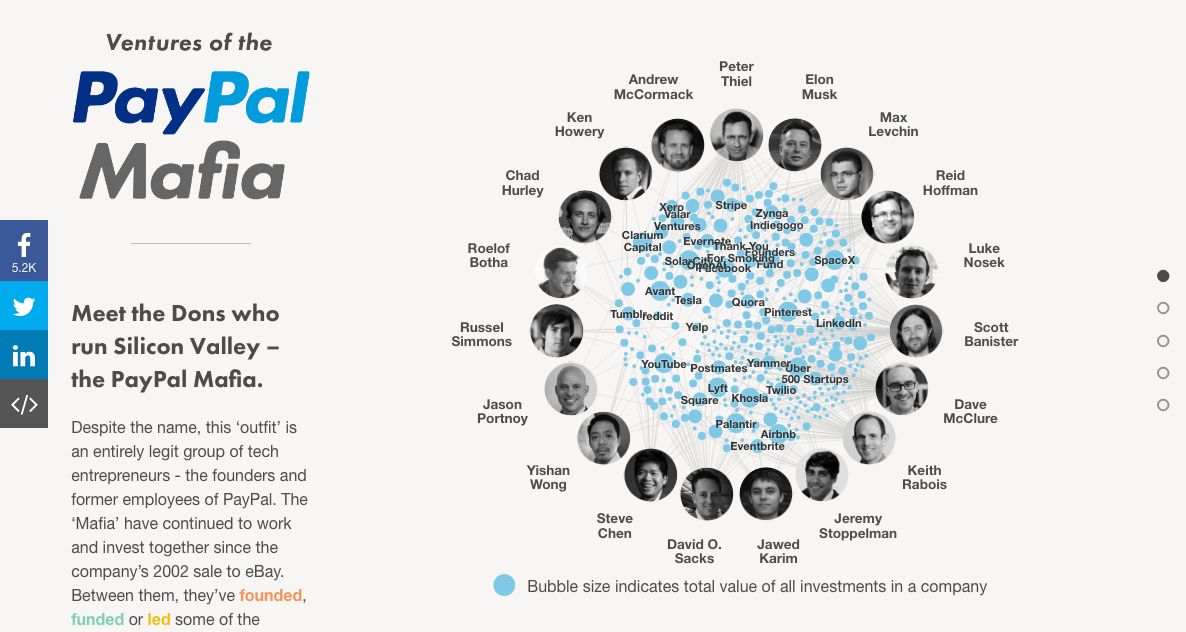

- Tech’s Meteoric Growth: Since the 2008 financial crisis—and especially with the internet and mobile revolutions—big tech companies have increased their market capitalization by 40 times, vastly expanding tech elites’ wealth and power. Leaders such as Peter Thiel, Elon Musk, Alex Karp, and JD Vance now represent this new center of influence.

- Collision with Financial Power: This expansion has set the stage for an overt power struggle between traditional financial institutions and rising technology giants, especially as tech seeks dominance in emerging sectors like AI and crypto.

Crypto, Stablecoins, and the Currency Battleground

- Battle for ‘Money’: A critical front in this contest is who controls the future of money. Tech elites back stablecoins and crypto, while the Federal Reserve supports central bank digital currencies (CBDC)—each viewing the other as a threat to their authority and profits.

- Legislative Moves and Pushback: Laws and regulations (like the “genius bill” supporting stablecoins or recent anti-CBDC legislation) reflect the behind-the-scenes battle over who gets to issue and manage new forms of currency.

Power Plays and Political Intrigue

- Political Manoeuvring: Recent incidents including the ousting of key Federal Reserve officials, public shaming of Fed chair Powell, and strategic alliances or firings attributed to “tech power” suggest the fight for control is entering a very public—and consequential—phase.

- Investment Implications: The outcome of these battles may directly influence financial markets, with sudden shocks or changes in direction potentially arising from shifts in the balance of power.

II. New Architects & Future of the World

Trump as a Symbol, Not a Cause

- Trump is a Player: The phenomenon of Trump is not as an originator but as a “player” or frontman in a larger civilizational shift motivated by forces beyond his personal agency.

- America 2.0: Just as the Industrial Revolution established a new civilizational standard (“America 1.0”), the current digital revolution is prompting efforts to design a new societal order—“America 2.0”—fit for the complexities of the digital era.

The True Designers: Silicon Valley Elites

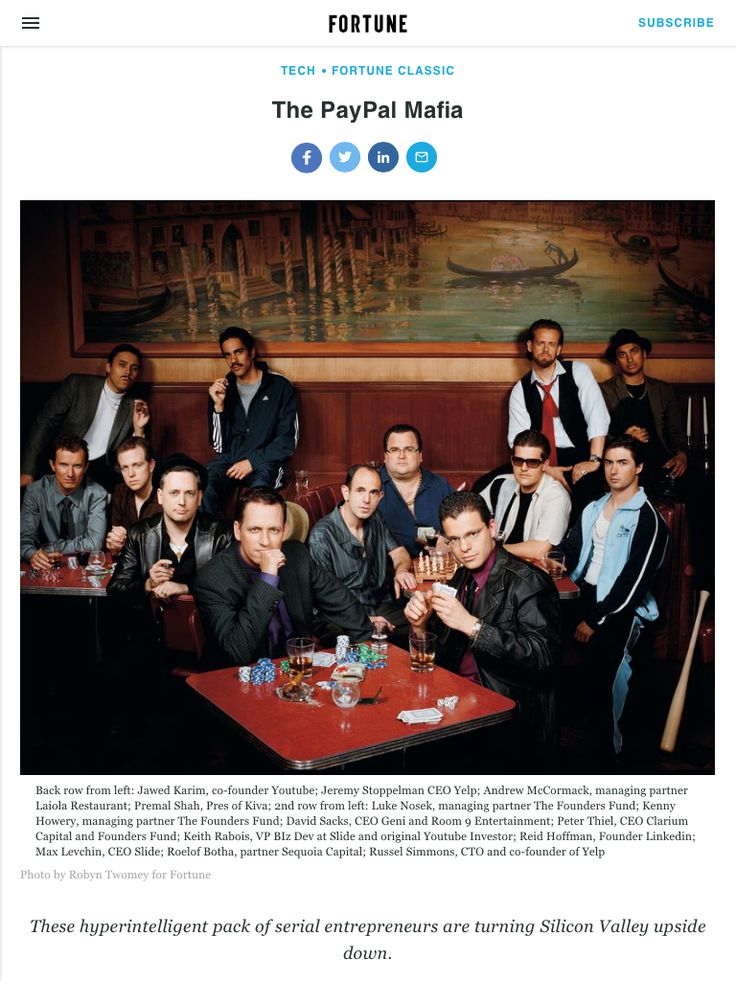

- Real Architects: The real driving force behind this transformation are Silicon Valley innovators and visionaries—especially Peter Thiel (the “godfather” of the PayPal Mafia), Elon Musk, Alex Karp, and rising political figures like JD Vance.

- Silicon Valley’s Vision: These individuals are actively shaping a new blueprint for America, leveraging technology and digital tools as the building blocks for future governance and economic systems.

The Coming Social Order

- Beyond Parties and Individuals: The most significant changes are being planned and executed not in the headlines or through traditional political channels, but by those fundamentally rethinking societal organization at a digital, systemic level.

- Global and Local Impact: This struggle and redesign have far-reaching implications, not just for America but for global markets, geopolitics, and social norms in the digital age.

Peter Thiel's Philosophy - The Limits of Democracy for Innovation

- Peter Thiel’s Critique: Peter Thiel argues that while democracy emphasizes majority rule and consensus, this structure can suppress the creativity and influence of a brilliant minority—those whose innovations drive true societal progress.

- Freedom vs. Democracy: Thiel controversially contends that absolute democracy and freedom may be incompatible; true breakthrough innovation often requires spaces where radical ideas can flourish, sometimes outside majoritarian norms.

Generational and Cultural Backdrop

- Intellectual Rebellion: Thiel and peers like Elon Musk and Alex Karp, reacting against the counterculture and pluralistic ideologies of previous generations (e.g., American “68ers”), sought to redefine American values through projects like the Stanford Review and later, Silicon Valley ventures.

- Quest for New Order: These thinkers believed in the necessity of constructing a new societal order—referred to as “America 2.0”—in response to digital and technological revolutions, envisioning a governance model that empowers innovators and technical elites.

Historical Reflections and Geopolitical Urgency

- Lessons from History: The lecture recalls historic moments when the U.S. harnessed its collective talent for transformative projects (like the Manhattan Project and the Space Race), but warns that current democratic processes may stifle similar large-scale innovation needed to maintain global leadership, especially against China.

- Innovation and National Survival: There’s a prevailing elite anxiety—shared by both Republicans and Democrats—that America must out-innovate China to remain globally dominant. This requires empowering “genius” individuals and creating systems to fully utilize their capacities.

The Future of Governance and Social Order

- From Laws to Code: The governance of the industrial era was built on print, documents, and legal language (“rule of law”); in the digital era, power will shift toward those who master algorithms, code, and data, as rules become embedded in platforms and software (“rule of code”).

- Uncertain New Paradigm: The lecture urged people to recognize that traditional legal and social structures are being upended, and that society is still searching for new rules and values suited to the age of AI and data-driven systems.

III. Conclusion

The contest between finance and technology is not simply about market capitalization, interest rates, or quarterly earnings—it is about who sets the rules of the future. Finance has long claimed the mantle of stability, managing crises and orchestrating the flow of capital across nations. Technology, however, now claims the mantle of imagination, rewriting the very architecture of society through algorithms, platforms, and digital currencies.

The result is a volatile moment in history: one where governance, economics, and even cultural identity are being redefined not only by governments or voters, but by the visions of powerful elites who are building “America 2.0.” Whether this transition leads to greater prosperity or deeper inequality depends on how societies balance the creativity of the few with the participation of the many.

As we stand at this inflection point, the real question is not just which side—finance or technology—will dominate, but whether new systems can be designed to serve humanity as a whole, rather than the narrow interests of any one elite. That is the challenge and responsibility of our age.

IV. Question for the Obsidian Odyssey Community

What do you think? Where do you think the world is headed and who are the real architects of the next paradigm?

IIV. Additional Resources

- Peter Thiel, Zero to One (2014) — foundational text on innovation and power dynamics in Silicon Valley.

- Martin Wolf, The Shifts and the Shocks (2014) — analysis of the 2008 financial crisis and its legacy for financial power.

- Shoshana Zuboff, The Age of Surveillance Capitalism (2019) — exploration of how tech platforms have reshaped democracy and markets.

- Niall Ferguson, The Square and the Tower (2018) — historical perspective on networks, hierarchies, and power.

![Obsidian Memo] 1929 — Lessons from the 1929 Crash & A Reminder That Craft Still Wins (ft. Andrew Ross Sorkin's London Talk)](/content/images/size/w720/2026/01/WhatsApp-Image-2026-01-18-at-11.51.11-1.jpeg)

![Leadership] FII - the Board of Changemakers Summary: Geo-Economics 2025: AI Power, Tokenized Finance, and the New Capital Map](/content/images/size/w720/2025/10/Screenshot-2025-10-31-130048.png)

![Leadership] The new face of wealth: The rise of the female investor (ft. McKinsey Report)](https://images.unsplash.com/photo-1618662062577-1e1483c7b6c4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDN8fGNhcGl0YWx8ZW58MHx8fHwxNzU5MzQ4ODIwfDA&ixlib=rb-4.1.0&q=80&w=720)

Comments ()