Personal Finance/Market Insights] Powell's Final Stand: What Jackson Hole Really Revealed About Markets and Power - Dovish turn, employment risk tilt, and structural shift per AI and digital currency

Powell’s final Jackson Hole speech underscored a dovish pivot: the Fed signaled openness to rate cuts, moved toward a flexible, data-driven policy framework, and cited labor market stability as its new priority—reflecting AI, digital currency, and global structural shifts.

![Personal Finance/Market Insights] Powell's Final Stand: What Jackson Hole Really Revealed About Markets and Power - Dovish turn, employment risk tilt, and structural shift per AI and digital currency](/content/images/size/w1200/2025/08/0x0-1.webp)

Hi All,

Yesterday (Aug 22, 2025), Jerome Powell delivered a historic speech at the Jackson Hole Symposium that commanded global attention. This wasn't just another Fed chair speech—it was his final Jackson Hole address and a defining moment for central bank independence in an era of intense political pressure, shifting global dynamics, and emerging technologies like AI and digital currencies. Powell walked a careful line throughout his remarks, initially appearing to acknowledge political pressures (i.e. Trump's pressure to cut rates) before ultimately reinforcing the Fed's commitment to independence and data-driven decision-making.

One of the first lessons one of my CIO mentors taught me a decade ago was: PERCEPTION IS EVERYTHING i.e. markets don't react to what's actually happening—they react to what people think is happening (i.e. interpretation of what's happening). Powell understood this perfectly yesterday.

This year's symposium focused on "Labor Markets in Transition: Demographics, Productivity, and Macroeconomic Policy." While everyone was parsing his words for rate cut signals, Powell was actually doing something more sophisticated—he was shaping how the world interprets the massive changes happening in our economy right now. AI is reshaping productivity. Digital currencies are changing how we think about money.

Powell's remarks connected these big structural shifts in labor and productivity to immediate policy decisions. But here's what mattered most: he was influencing perception, not just stating facts. Because in markets, what people believe often matters more than what's technically true.

This anchoring approach helps us understand why his speech felt so significant—he wasn't just addressing today's economic data, but positioning how we should think about the fundamental changes reshaping our financial future.

Disclaimer: I share these reflections in the spirit of learning, archiving and open conversation about personal finance and long-term investing (such as retirement). Please note, they are not financial advice and my personal thoughts only—just insights to consider as you explore your own path.

Bottomline:

Powell's speech marked a major policy pivot: openness to imminent rate cuts, a new flexible policy framework, and a recognition that labor market sustainability now outweighs fears about persistent inflation. Global markets and central banks are watching closely for the ripple effects.

- Dovish turn & markets rallied: Unlike some speculation on the hawkish or owl tone ahead of the speech, Powell signaled the Fed is likely to cut rates in H2, 2025 (increased probability at the September FOMC), citing growing risks to employment, even as inflation from tariffs is seen as temporary—prompting a strong rally in equities and bonds.

- Employment> Inflation - tilting risk weight: The Fed is moving toward a more flexible, data-dependent policy framework, moving away from strict average inflation targeting to better respond to labor market shocks and economic shifts.

- Easing monetary policy worldwide?: Market expectations for a rate cut soared after Powell’s speech, and central banks worldwide are now expected to watch and possibly follow the Fed’s moves to support their own economies.

I. The Core Message: Balancing Risks

Powell described the U.S. economy as being in a “challenging situation.” Powell stressed that inflation is trending toward the Fed’s 2% target, diminishing the need to keep rates elevated for an extended period. Labor market adjustments have been significant, with both demand and supply falling. Job creation has dropped sharply to 35,000 per month, and downside risks to employment are rising. Despite this, Powell sees recent inflation from tariffs as being temporary rather than persistent.

- Labor markets: Still near full employment, but job creation has slowed sharply—down to ~35,000/month from 168,000/month earlier this year. The unemployment rate remains low, yet both supply (per decreased immigration) and demand have softened.

- Inflation: Closer to the Fed’s 2% objective but still above target, pushed higher by tariffs and supply-chain friction. Powell characterized these as transitory shocks rather than entrenched pressures.

- Balance of risks: The Fed now sees upside risks to inflation, but mounting downside risks to employment.

Takeaway: Policy remains data-dependent, but the tilt is clear—the Fed is pivoting toward protecting growth and jobs, not just stamping out prices.

II. Updates to the Fed’s Policy Framework

In one of the most consequential moments of the speech, Powell unveiled changes to the Fed’s long-run consensus statement. These updates mark the Fed’s attempt to modernize its toolkit for a post-pandemic, higher-rate world. Powell announced that the Fed is revising its monetary policy framework, moving away from the strict “average inflation targeting” used since 2020. The old system was criticized as too inflexible, causing delayed responses during shocks (like the pandemic and the early-2020s inflation burst). The new framework will be data-dependent and much more flexible, enabling the Fed to react to sudden rises in inflation or labor market shocks rather than relying on long-term averages.

Highlights:

- No more ELB obsession: References to the effective lower bound are gone. Ultra-low rates are no longer the defining norm.

- Goodbye “makeup” strategy: The Fed dropped flexible average inflation targeting, ending the commitment to overshoot inflation for past misses.

- Refined employment language: Employment may run above sustainable estimates without automatically triggering tightening.

- Balance emphasized: The Fed will weigh inflation and employment objectives with greater flexibility, not rigidly prioritize one.

III. Political Pressures & Fed Independence

The political context cannot be ignored. Trump has openly demanded rate cuts while attacking Fed officials—including Governor Lisa Cook. Against this backdrop, Powell’s reaffirmation of independence was deliberate. By quoting Volcker, Powell aligned himself with a tradition of Fed Chairs who valued credibility over politics.

"This is the eighth time I've had the honor to speak from this podium. Each year, this symposium offers the opportunity for Fed leaders to hear ideas from leading economic thinkers and focus on the challenges we face. The Kansas City Fed was very wise to lure Chair Vocar here to this national park more than 40 years ago, and I am so proud to be part of that tradition. Thank you very much."

Markets heard the dovish pivot. Historians may hear something else: a defense of the Fed’s institutional integrity in a turbulent era.

IV. Why It Matters: Implications for the Economy & Markets

| Implication | Why It Matters |

|---|---|

| Rate Cut in Sight? | Markets now expect a September easing, reshaping borrowing costs and fueling risk appetite. |

| Clarity on Fed Strategy | A modernized framework improves predictability while keeping flexibility intact. |

| Confidence in Fed Independence | Powell’s Volcker reference reassures investors that credibility remains central. |

| Economic Outlook at Crossroads | The Fed is cautious, reflecting genuine uncertainty about 2025’s direction. |

V. Market Reactions & Investor Lens

Immediate Reaction:

- Dow Jones surged 846 points to a record close.

- Nasdaq gained over 2% in response to dovish signals.

- Bond yields fell; the U.S. dollar softened.

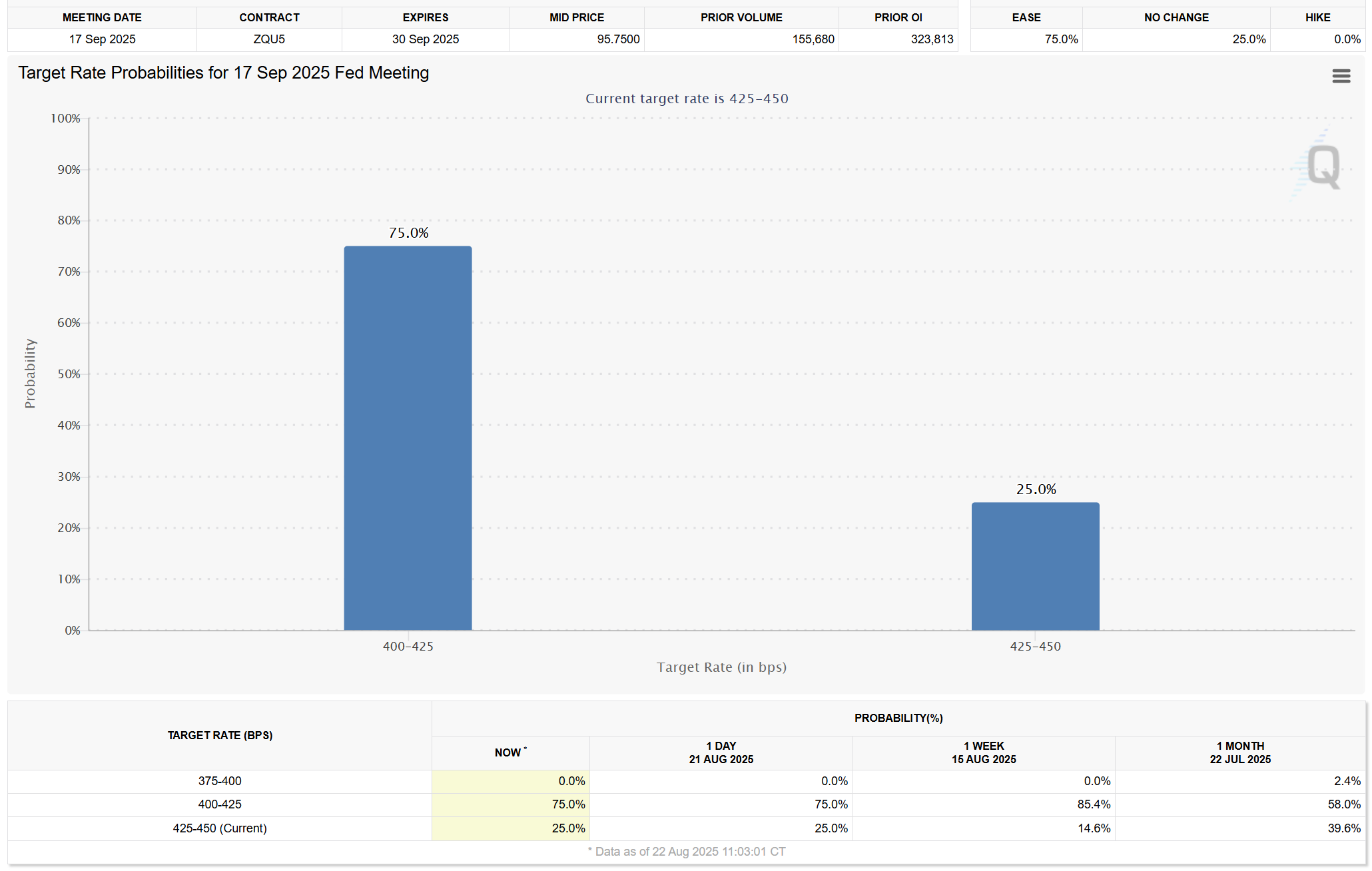

- Futures markets now price a 75% probability of a September cut as of Aug 22. Right after the speech, it went up to 91%, but has come down since.

Investor Takeaways: Where the Opportunities Are

- Equities:

Fundstrat’s Tom Lee called Powell’s remarks a “green light” for stocks. His view: dovish policy plus slowing labor markets set up broad market rallies. Small caps, cyclicals, and rate-sensitive sectors (housing, financials, industrials) are positioned to benefit if credit eases. - Small Caps & Cyclicals:

With the Fed already 100 basis points closer to neutral than a year ago, easing financial conditions could unleash performance in smaller companies and credit-linked sectors. - AI & Crypto:

AI and digital assets. Lower yields fuel growth themes, and crypto is getting a regulatory tailwind. Institutional adoption parallels past structural shifts in U.S. finance. Tom Lee highlights AI and crypto as key beneficiaries of a looser Fed backdrop. Lower yields and abundant liquidity provide oxygen for speculative and growth themes.Cryptocurrencies, in particular, are drawing strength not just from monetary conditions but also from regulatory shifts and institutional adoption, marking a structural re-rating of the sector. - Thematic Undercurrents: Stablecoins & Labor Markets

The symposium’s theme—stablecoins and labor market impacts—signals central bankers are preparing for disruptions. Digital money and AI-driven productivity shifts will reshape both inflation dynamics and employment in ways that monetary policy must adapt to. This isn’t a side note. It signals that central bankers are acknowledging a future where digital currencies and AI-driven shifts in labor supply/demand reshape the economic playbook. Powell’s remarks on slower labor force growth due to tariffs and tighter immigration policies underline this structural change. In an AI-driven world, productivity, automation, and digital money flows will increasingly define monetary policy constraints.

VI. Conclusion

Powell’s Jackson Hole 2025 speech will be remembered for three things:

- Perception over truth: Markets moved because investors believed a dovish turn had arrived.

- Independence under fire: Quoting Volcker, Powell staked his legacy on credibility amid political heat.

- Structural pivot: The Fed is modernizing its framework to face AI disruption, tariff shocks, and the era of digital currencies.

Perception, as always, is everything. And right now, perception is bullish.

VII. Resources

Fun watch

Description: Aug 22, 2025, Bloomberg. America’s wealthiest community isn’t New York or San Francisco — it’s Jackson Hole, Wyoming. Beyond hosting Fed Chair Jay Powell and central bankers from around the world once a year, Teton County has become a haven for billionaires, who are lured by natural beauty, tax advantages, and cowboy culture. But rising real estate prices and deep inequality now test whether this community can preserve its traditions and spirit.

![Obsidian Memo] The Great Re-Entry: Strategic Realignment and the Industrialization of Private Capital in the 2026 Financial Services Landscape](/content/images/size/w720/2026/02/photo-1496989981497-27d69cdad83e.jpeg)

Comments ()