Leadership] Bloomberg Women, Money & Power 2025 event in London (Oct 1, 2025)

Bloomberg Women, Money & Power 2025—AI, sustainable investing, private markets, M&A, women’s wealth and leadership. Insights from Google, Apollo, State Street, Franklin Templeton, JP Morgan, Goldman Sachs, PIMCO, Blackstone, Brown and Northwestern Endowments, Edmond de Rothschild, etc.

![Leadership] Bloomberg Women, Money & Power 2025 event in London (Oct 1, 2025)](/content/images/size/w1200/2025/10/Screenshot-2025-10-01-201840.png)

Hi All,

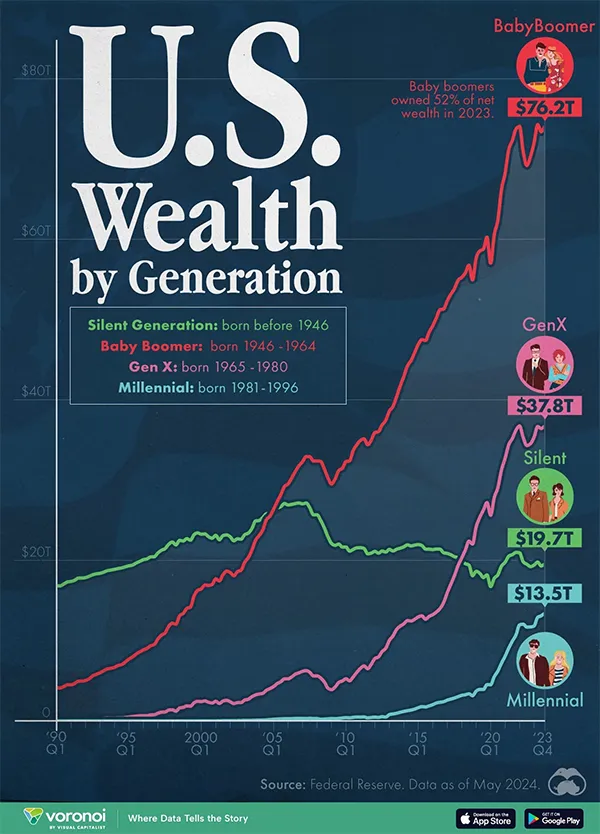

As autumn begins, schoolyards fill up and Q3 closes, so too does the finance conference circuit pick up pace. This week I attended Bloomberg’s “Women, Money & Power 2025” event in London, and the conversations were as weighty as the title suggests. In a world where capital is being redeployed at an unprecedented scale, women now control a growing share of wealth, influencing more key financial decisions than ever before. More than anything, I was thrilled to see the sheer amount of women's representation in the C-suite across these various powerful financial and technological platforms.

Bloomberg’s summit convened some of the most influential voices in global finance for its second year to debate the future of investing, real estate, endowments, philanthropy, consumer banking and private markets.

Over the course of the day I heard executives from Google, Bank of America, Shell, Apollo, State Street, Franklin Templeton, J.P. Morgan, Goldman Sachs, PIMCO, Blackstone, AXA, Brown and Northwestern University Endowments and Edmond de Rothschild (to name a few) talk candidly about generative AI, sustainable finance, deal-making, wealth management and leadership. These sessions were rich with hard data, candid stories and bold predictions, and I wanted to capture the essence of them here—both for myself and for anyone who wasn’t able to attend. Let me know which session was your favorite!

Key Insights from the Event

- AI as Core Infrastructure

- Debbie Weinstein, President of Google EMEA, called AI a general-purpose technology set to unlock €1.2 trillion in productivity gains for Europe.

- Google’s strength lies in its end-to-end integration — from custom AI chips and data centres to leading models like AlphaFold.

- She warned that Europe’s overlapping 100+ digital regulations risk slowing innovation and investment.

- AI’s energy demands are driving a new nexus of data infrastructure and green power, linking technology and sustainability.

- Energy & Capital Convergence

- Karen Fang (Bank of America), Mallika Ishwaran (Shell), and Olivia Wassenaar (Apollo) highlighted $2 trillion in global clean energy investment in 2023 — yet policy volatility, grid bottlenecks, and slow permitting continue to hinder progress.

- Private capital and banks are taking complementary roles: banks provide liquidity and securitisation, while private credit supplies patient, bespoke capital for complex projects.

- The next investment frontier lies in grid modernisation, nuclear, storage, and AI-linked energy infrastructure.

- Markets, Inflation & Alternatives

- Yie-Hsin Hung (State Street) and Jenny Johnson (Franklin Templeton) remain cautiously optimistic on markets — forecasting a US soft landing and gradual disinflation — while diverging on inflation persistence.

- Both underscored the rapid expansion of private markets, with partnerships between traditional managers and alts firms like Apollo and Blackstone to broaden access via ETFs and target-date funds.

- Anu Aiyengar (J.P. Morgan), Christina Minnis (Goldman Sachs), and May Nasrallah (PJT Partners) confirmed a rebound in global M&A, led by mega-deals and sovereign capital from the Middle East, particularly Saudi’s PIF.

- Leadership, Wealth & Legacy

- Baroness Ariane de Rothschild outlined a vision of “rooted luxury” — embedding purpose, family values, and real-economy impact at Edmond de Rothschild while flattening hierarchies and nurturing next-generation leadership.

- Emma Walmsley (GSK) reflected on sustainable R&D, science-led engagement, and gender representation as core to her legacy, while reaffirming GSK’s UK commitment amid global competition.

- A unifying theme across leaders: purpose, trust, and culture now drive enduring value more than scale alone — the future belongs to those integrating capital, innovation, and authenticity.

Note: The YouTube summary was put together by AI and verified by a human, me.

Summary

Debbie Weinstein, Google’s EMEA President, shares her optimism about AI’s transformative potential across economies, industries, and society, while addressing concerns around regulation, job displacement, and infrastructure in Europe.

Highlights

- 💡 AI is a general-purpose technology with boundless economic and societal potential, projected to unlock €1.2 trillion in productivity growth for Europe.

- 🚀 Google holds a strong competitive position due to its end-to-end integration—from AI chips and data centres to leading models like AlphaFold and widely used consumer products.

- 🤝 While AI may displace around 7% of jobs, most workers will instead enhance their roles with AI tools, and new job categories—like prompt engineering—are already emerging.

- 🏛️ Overlapping and unclear digital regulations in Europe (over 100 since 2019) are delaying product launches and hindering business innovation, calling for urgent harmonisation and simplification.

- 🌱 Sustainable AI infrastructure requires collaboration between tech firms and governments, with Google investing heavily in renewable energy and urging European leadership in green power development.

Karen Fang, Global Head, Infrastructure & Sustainable Finance, Bank of America; Mallika Ishwaran, Chief Economist, Shell; and Olivia Wassenaar, Partner, Head of Sustainability & Infrastructure, Apollo discuss where the money is flowing across sustainable and traditional energy projects and the future direction of the industry with Bloomberg's Sarah Wells.

Summary

A high-level panel discussion featuring leaders from Bank of America, Shell, and Apollo explores the evolving landscape of energy finance, highlighting the surge in clean energy investment, persistent challenges in policy stability and permitting, and the critical role of private capital in driving the transition—while stressing the need for balanced investment across mature and emerging technologies.

Highlights

- 💡 Global clean energy investment hit $2 trillion in 2023, driven largely by cost-competitive renewables and storage, with 90% of new power generation now coming from green sources.

- ⚖️ Policy stability and long-term industrial strategies—especially in China (40% of global investment) and supported by the US Inflation Reduction Act—are crucial for sustained infrastructure financing, though recent regulatory uncertainty has caused market hesitation.

- 🔌 Grid modernisation, energy security, and firm power supply are becoming as central as sustainability, with rising demand (3–4% annual growth in the US) underscoring the need for resilient, flexible systems including gas, nuclear, and battery storage.

- 🏗️ Emerging technologies like advanced geothermal, small modular reactors, and fusion show promise but remain years away from scalability, while long-duration batteries and low-carbon fuels require greater funding to bridge the commercialisation gap.

- 💼 Private credit and banks play complementary roles: banks facilitate capital flow and securitisation, while private investors provide patient, bespoke capital—though stress is emerging in smaller renewable firms due to policy delays and supply chain bottlenecks.

Yie-Hsin Hung, CEO, State Street Investment Management ($4.12 Trillion AUM) and Jenny Johnson, President & CEO, Franklin Templeton ($60 Billion AUM) discuss promising investment opportunities and the biggest risks facing global markets.

Summary

Senior leaders from State Street and Franklin Templeton discuss global market risks, inflation outlooks, private markets expansion, technological disruption, and leadership in asset management, highlighting divergent views on monetary policy and the growing importance of alternatives.

Highlights

- 💡 Despite geopolitical tensions and structural challenges in China, both CEOs remain broadly constructive on markets, with State Street forecasting a US soft landing and Franklin Templeton emphasizing disinflationary trends in services and housing.

- 📉 Inflation expectations differ: Franklin Templeton sees inflation cooling to 2.6% by 2025 and advocates for aggressive rate cuts, while State Street warns of stickier inflation due to wage pressures and fiscal stimulus, expecting fewer rate cuts than markets anticipate.

- 🔗 Private credit and alternatives are expanding rapidly, driven by regulatory shifts and demand for yield, with both firms forging strategic partnerships (e.g., Apollo, Blackstone) to scale access for retail investors via ETFs and target date funds.

- 🤝 Leadership focus has shifted toward cultural integration, collaboration across teams, and client-centricity, especially when merging traditional and alternative asset capabilities, with emphasis on long-term value over quick hires or acquisitions.

- 🚀 Technological change, AI, and innovation are reshaping the industry, prompting major investments in digital tools, personalised solutions, and operational efficiency, while leaders stress adaptability, continuous learning, and ethical values in hiring.

Anu Aiyengar, Global Head of Advisory & M&A, J.P. Morgan; Christina Minnis, Global Head, Credit & Asset Finance & Head, Global Acquisition Finance, Goldman Sachs and May Nasrallah, Executive Chairwoman, PJT deNovo discuss what's next for global dealmaking and if the momentum will continue.

Summary

A dynamic panel discussion featuring insights from J.P. Morgan, Goldman Sachs, and PJT Partners on the resurgence of mega M&A deals, the role of Middle East sovereign wealth funds, evolving private capital markets, AI-driven investments, and resilient valuations despite geopolitical and economic uncertainty.

Highlights

- 💼 Mega M&A rebound amid uncertainty: Despite early-year volatility from tariffs and geopolitical tensions, global M&A volume reached $3.4 trillion in nine months—on track for a 30% year-on-year increase—with 49 megadeals over $10 billion, including the record $55 billion EA Sports LBO.

- 🌍 Middle East capital reshaping global deals: Sovereign wealth funds like Saudi’s PIF are shifting from passive to strategic investors, driving major US tech and sports investments (e.g., EA, Intel, Anthropic) as part of broader national diversification strategies such as Vision 2030.

- 💰 Strong credit markets enabling larger deals: Robust investment-grade and private credit markets, along with innovative financing structures, are supporting ever-larger transactions; Goldman Sachs sees potential for $60–70 billion LBOs with strong equity backing.

- 📈 Private capital adapts with creativity: With fewer IPOs and high entry multiples, PE firms are embracing secondaries, partial monetisations, and strategic exits; sponsor-backed IPO activity is reviving, up 18% YoY, signaling healthier exit ecosystems.

- 🔌 AI and energy transition driving real investment: Hundreds of billions in CapEx are flowing into AI infrastructure—especially data centres—while credit investors find value in structured greenfield energy projects linked to digital demand, such as LNG and renewable power, offering resilience and yield.

Summary

Baroness Ariane de Rothschild discusses the evolving landscape of wealth management, emphasising purpose-driven investing, generational transition, and the balance between innovation and legacy within Edmond de Rothschild. She highlights clients’ growing demand for meaningful investments amid global uncertainty, while advocating for flat organisational structures, human-centric banking, and long-term sustainability.

Highlights

- 💡 Clients increasingly seek pragmatic, long-term strategies with diversified assets due to rising geopolitical uncertainty and debt concerns, favouring purpose-led investments over short-term gains.

- 🌱 The bank’s private equity approach focuses on greenfield projects with social impact—such as soil regeneration and smart cities—partnering with technical experts to drive change in the real economy.

- 👪 Succession and next-generation engagement are guided by giving family members space to innovate, lead, and even fail, fostering authentic leadership rooted in values, not obligation.

- 🏢 A cultural shift at Edmond de Rothschild includes flattening hierarchies, co-locating teams in open spaces, and integrating non-financial family businesses (like vineyards and cheese production) to reinforce a “rooted luxury” ethos centred on service, product, and goodwill.

- 🤝 Despite digital transformation, human trust remains central; technology complements but does not replace personal relationships in wealth management, especially as neobanks begin adopting traditional banks’ regulated, human-facing models.

Summary

GSK CEO Emma Walmsley reflects on her tenure, upcoming transition, innovation pipeline, and leadership legacy, emphasising sustainable R&D investment, science-led engagement, and gender representation in leadership.

Highlights

- 🌟 After nine years leading GSK, Walmsley is focused on ensuring a smooth handover to successor Luke Myles and delivering key drug approvals before stepping down.

- 💊 GSK’s future growth hinges on a robust innovation pipeline, with 15 high-potential drugs—especially in cancer, respiratory, and HIV—expected to launch by 2030, many within the next three years.

- 🤝 Walmsley advocates for constructive, science-based dialogue with governments, especially in the US and UK, stressing the need for fair pricing models that support continued R&D investment.

- 🏛️ She reaffirms GSK’s commitment to the UK despite its small sales share (2%), calling for improved commercial conditions and recognition of innovation value to attract further investment.

- 👩💼 As one of few female FTSE 100 CEOs, Walmsley champions diversity, mentoring women leaders and urging aspiring female executives to dream big and pursue top roles unapologetically.

Summary

A compelling exploration of women’s enduring role in shaping the global economy throughout history, challenging myths that relegate women to passive or domestic roles. Dr. Victoria Bateman reveals how women have long been active creators of wealth, innovators in finance, and pioneers in business—integral to economic booms and warning signs of decline when their freedoms are restricted.

Highlights

- 💡 Women have always been co-creators of wealth, from Stone Age hunters (40% female in the Americas) to Bronze Age textile traders who powered early global commerce.

- 🏦 Female financial pioneers like Priscilla Wakefield (UK, 1798) and Maggie Walker (USA, post-Civil War) founded banks for the underserved, laying foundations for national savings systems and Black economic empowerment.

- 🌍 Across cultures—including under Islamic law—women managed inheritances and invested independently, proving that female economic agency is not a modern Western phenomenon.

- 📉 Civilisations rise when women participate fully in the economy and decline when their freedoms are curtailed, as seen in Rome, the Abbasid Caliphate, and dynastic China.

- 📚 In 18th-century publishing, women dominated the novel market (10 of 12 top sellers), with Jane Austen taking high-risk commission deals—highlighting enduring struggles and strategies for creative and financial independence.

Alessandra Galloni, Editor-in-Chief, Reuters and Zanny Minton Beddoes, Editor-in-Chief, The Economist discuss how journalists are covering money and power in the current moment with Bloomberg's Stephanie Flanders.

Annette Kröger, CEO Europe, PIMCO Prime Real Estate; Kathleen McCarthy-Baldwin, Global Co-Head, Real Estate, Blackstone; and Isabelle Scemama, Global Head, Alts, AXA IM discuss how shifting geopolitics, trade dynamics, and office space demand are reshaping real estate investment strategies with Bloomberg's Dani Burger

Amy Falls, Vice President & Chief Investment Officer, Northwestern University and Jane Dietze, Chief Investment Officer, Brown University discuss the path forward for University endowments with Bloomberg's Caroline Gage.

Julia Hoggett, CEO, London Stock Exchange discusses the future of the UK capital markets with Bloomberg's Lizzy Burden.

Bonus

Check out this other post on 'The rise of female investor' much inspired by the below Bloomberg podcast episode.

Agenda Excerpt

![Obsidian Memo] Leadership Ground Truth: What Cuba, Puerto Rico, and Hawai'i Taught Me About Capital and Resilience](/content/images/size/w720/2026/02/Bad-Bunny.jpg)

![Obsidian Memo] Leadership Lessons for Founders: Building “You, Inc.” Without Burning It Down](https://images.unsplash.com/photo-1474917518260-23f84bd71c75?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDQyfHxzYWlsaW5nfGVufDB8fHx8MTc3MDkyODg3Mnww&ixlib=rb-4.1.0&q=80&w=720)

![Obsidian Memo] Davos 2026: Reflections on Geopolitics, AI, Energy, and the Future of Sustainable Capitalism](https://images.unsplash.com/photo-1551524484-635f78221cc4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDR8fGRhdm9zfGVufDB8fHx8MTc3MDY2MTg4M3ww&ixlib=rb-4.1.0&q=80&w=720)

Comments ()