Personal Finance/Market Insights] Howard Marks, 13Fs, and the Road Ahead for 2025

Markets have been turbulent since April, with 13F filings showing a shift from pricey big tech into healthcare, construction, and rate-sensitive sectors. Howard Marks warns equities are overvalued—urging rebalancing, patience, and defensive positioning.

![Personal Finance/Market Insights] Howard Marks, 13Fs, and the Road Ahead for 2025](https://images.unsplash.com/photo-1626726173195-469dfc1e8abd?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDUwfHxpbmZsZWN0aW9uJTIwcG9pbnR8ZW58MHx8fHwxNzU1NTI3MTEwfDA&ixlib=rb-4.1.0&q=80&w=1200)

Hi All,

I hope you’re finding moments of ease this summer (at least for those of us in the Northern Hemisphere), even with the heat waves sweeping across the UK, US, Europe, and Asia.

I haven’t shared many posts on markets and personal finance recently, but it’s certainly been a wild ride since April—what some have called Trump’s liberation day. Earlier in the year, Howard Marks stood out as one of the few voices urging investors not to panic during the April market bottom. His reminder was simple but powerful: betting on disaster often leads to poor results if disaster doesn’t actually arrive. He’s since refined his view with a new note (Aug 14), which I’ll touch on below.

On top of that, the latest round of Q2 13F filings has landed, offering a glimpse into how the biggest institutional investors are positioning themselves for the rest of the year. With H2 2025 now underway, I wanted to share a few thoughts on what to watch, how to navigate this shifting landscape, and—most importantly—hear your perspectives as well.

As always, Obsidian Odyssey is meant to be a space for dialogue as much as reflection. I’d love to hear what you’re noticing in your own portfolios, what you’re cautious about, and where you see opportunity.

Disclaimer: I share these reflections in the spirit of learning and open conversation about personal finance and long-term investing (such as retirement). Please note, they are not financial advice and my personal thoughts only—just insights to consider as you explore your own path.

I. Key takeaways from the Q2 13F filings

🏈 Bottom line:

These moves indicate top institutional and legendary investors are shifting away from expensive big tech names and diversifying into undervalued healthcare, construction, and “rate-sensitive” sectors for the second half of 2025. There’s notable consensus—and even overlap—among the “super-investors” portfolios right now, signaling caution and opportunity in neglected sectors. While 13F filings are lagging indicators and don’t necessarily reflect current or future positioning, they remain valuable as a sense check.

Recent Portfolio Shifts by Legendary Investors

Warren Buffett

- Major reduction in Apple: Cut its portfolio weight from 50% down to 22%.

- New positions and expansions: Increased allocation to UnitedHealthcare (UNH) and other healthcare stocks, as well as select construction and steel sector stocks.

- Portfolio now favors “interest-rate-cut beneficiaries”: Emphasis on construction and healthcare, sectors expected to benefit from possible Fed rate cuts.

- Note: Buffett’s move into UNH comes after substantial price drops, now offering over 3% dividend yields and attractive valuations.

Stanley Druckenmiller

- Similar themes to Buffett: In Q2, significantly increased exposure to healthcare (especially biotech), construction, and airlines.

- Top picks: Eli Lilly (LLY), DR Horton (DHI), Lennar (LEN).

- Trimmed former favorites: Reduced stakes in Coupang (CPNG) and Tesla (TSLA); small-scale re-entry into certain big tech, like Microsoft (MSFT).

Saudi Sovereign Wealth Fund & Michael Burry

- Bought key healthcare names: UNH, LLY, etc.

- Reduced big tech weightings: Tesla, Nvidia, Amazon, and others.

- Unusual overlap: Major funds and famed investors flocked into similar stocks this cycle—especially healthcare after significant underperformance.

Source: https://whalewisdom.com/

II. Key takeaways from Howard Marks' August Memo

🏈 Bottom line:

Recognize that US equities and other risk assets have entered a clearly overvalued zone after years of persistent bull markets and optimism. Instead of increasing exposure or aggressively chasing growth, smart investors—both retail and institutional—should rebalance, reduce risk in expensive assets, and hold more in cash or stable assets. However, avoid all-or-nothing, panic-driven moves. Diversification, selectivity, and readiness to weather future volatility are paramount.

1. Market Environment: Tone Has Shifted

- Earlier in 2025, Howard Marks famously encouraged investors to buy near the April market bottom, urging against panic even amidst dire headlines—his view: betting on disaster usually yields poor results if disaster does not actually strike.

- As of August, his stance has clearly shifted: "Now is the time to reduce exposure to expensive stocks."

- The US stock market, by nearly every metric (PER, PBR, market cap/GDP, spreads), is as highly valued—or even more so—than at previous peaks like the dot-com bubble.

2. Value vs. Price: Core Principles

The true value of an asset comes from fundamentals (profitability, growth prospects, balance sheet health, management, etc.).

- In the short term, price is far more volatile than value, driven heavily by investor sentiment—greed, fear, and FOMO—rather than fundamentals.

- Gaps between price and value are typically resolved only over the long term:

- Do not try to time this convergence with extreme actions (all-in, all-out, massive shorts/cash).

- "The market can remain irrational longer than you can remain solvent." (Keynes)

- High valuations (overpriced assets) predict lower future returns; low valuations (underpriced assets) imply higher future returns—but only with patience and a long-term view.

- Marks diagnoses the current risk as elevated: market prices are now far above fundamental values.

3. Today’s Stock Market Analysis

- The S&P 500’s average PER (23x), along with multiple other indicators, has reached dot-com or greater heights.

- Unlike prior debates, the "expensiveness" of the US market is now a persistent feature, not a short-term anomaly.

- Much of this premium is justified by anticipated productivity gains from AI and sustained US leadership—but Marks warns against excessive optimism/faith in new paradigms, echoing FOMO (“fear of missing out”) and TINA (“there is no alternative”) driven markets.

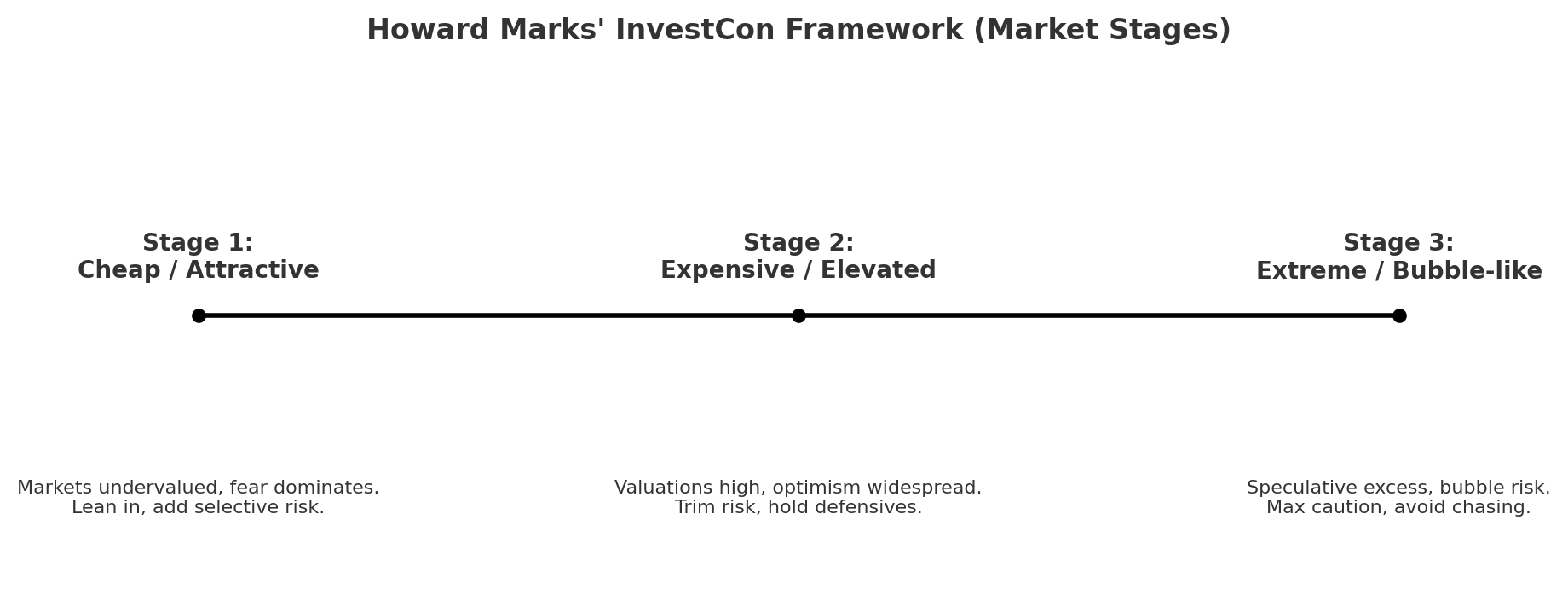

4. Investment Strategy (INVESTCON Framework)

Marks lays out a defensive playbook with several stages ("InvestCon"), advising never to react with panic-selling or all-out shorts, even at extremes.

- Currently, Market is at Stage 2:

- Reduce exposure to aggressive, highly valued assets, and increase allocation to defensive assets (cash, high-quality bonds, defensives).

- “Hold back on new purchases” unless exceptionally compelling opportunities are found.

- Fully exiting US stocks isn't recommended, especially if you understand the fundamental reasons behind their premium (such as productivity and AI leadership). Instead, trim risk and rebalance.

- Marks believes we are currently in Stage 2—markets are not yet in outright bubble territory, but they are clearly overvalued relative to fundamentals. This means investors should focus on protecting gains, moderating risk, and waiting for better opportunities rather than aggressively chasing growth.

The “InvestCon” Framework

In his recent memo, Howard Marks introduces a staged framework—what we can think of as an “Investment Conditions (InvestCon)” scale—that helps investors decide how aggressive or defensive to be at different points in the market cycle.

- Stage 1 (Attractive / Cheap Markets):

Markets are undervalued, sentiment is fearful, and assets look cheap relative to fundamentals. This is when Marks encourages leaning in—buying more, adding risk selectively, and taking advantage of bargains. - Stage 2 (Elevated / Expensive Markets – Today’s Situation):

Markets have become stretched. Valuations are high, optimism is widespread, and the balance between risk and reward is less favorable.

→ The playbook here:- Reduce exposure to highly valued or speculative positions.

- Increase allocations to defensive assets like cash, quality bonds, or resilient companies.

- Be selective and patient—avoid chasing momentum or crowd-driven trades.

- Don’t fully exit equities, but trim risk and rebalance portfolios.

- Stage 3 (Extreme / Bubble-like Conditions):

Valuations reach historical extremes, speculative behavior dominates, and risk of a correction is very high. Here, Marks advises maximum caution—holding substantial defensives, avoiding new risk, but still resisting all-or-nothing panic selling.

5. Conclusion & Actionable Advice

- The core message: "Trim expensive stocks, build up risk management, and boost your defensive allocation."

- This does not mean a major crash is imminent, but implies that forced, aggressive buying right now carries high risk.

- For long-term investors, keep a laser focus on:

- Market psychology versus fundamental value

- The danger of complacency when valuations are stretched

- The wisdom of defensive positioning, diversification, and patience for opportunities.

For Institutional Investors:

- Carefully reassess risk posture and exposures, especially to highly priced or crowded trades.

- Adjust portfolios incrementally toward a more defensive stance if valuations and sentiment are stretched.

- Continue rigorous fundamental analysis and scenario planning; avoid overreliance on backward-looking performance.

For Retail Investors:

- Recognize that index or crowd-driven prices can be detached from long-term value—even for years.

- Avoid FOMO; don’t chase “hot” stocks or trends just because prices have been rising.

- Favor diversification, quality, and companies/assets with clear, sustainable earning power.

- Sleep well at night—adjust risk so portfolio losses wouldn’t provoke panic.

![Obsidian Memo] 1929 — Lessons from the 1929 Crash & A Reminder That Craft Still Wins (ft. Andrew Ross Sorkin's London Talk)](/content/images/size/w720/2026/01/WhatsApp-Image-2026-01-18-at-11.51.11-1.jpeg)

![Leadership] FII - the Board of Changemakers Summary: Geo-Economics 2025: AI Power, Tokenized Finance, and the New Capital Map](/content/images/size/w720/2025/10/Screenshot-2025-10-31-130048.png)

![Leadership] The new face of wealth: The rise of the female investor (ft. McKinsey Report)](https://images.unsplash.com/photo-1618662062577-1e1483c7b6c4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDN8fGNhcGl0YWx8ZW58MHx8fHwxNzU5MzQ4ODIwfDA&ixlib=rb-4.1.0&q=80&w=720)

Comments ()