Leadership] AI Is the Main Thing — What's in Jon Gray's Winning Leadership Recipe to CEOs & How Blackstone Stays Ahead at $1.2T+ Scale

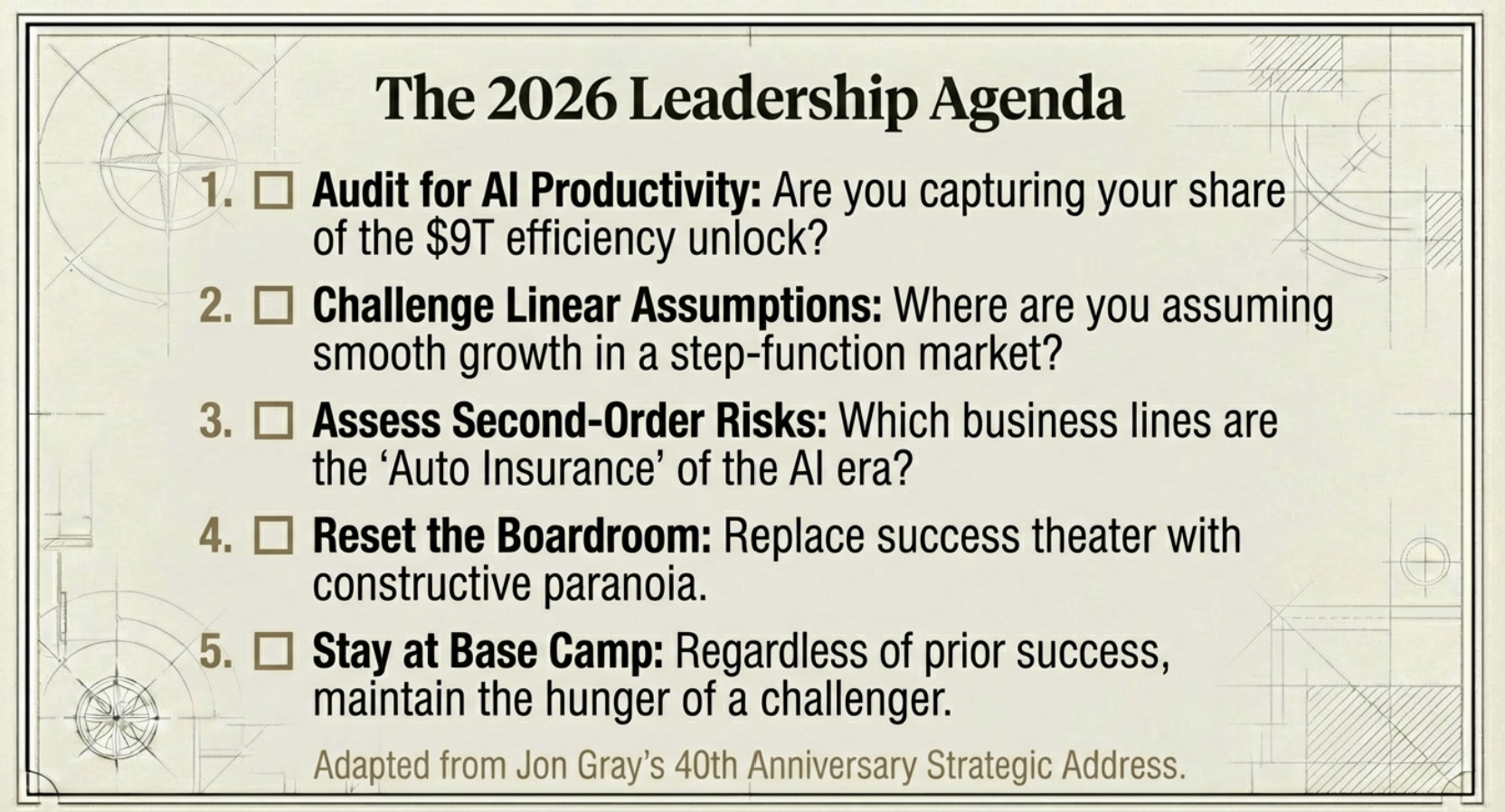

AI is driving a once-in-a-generation infrastructure buildout. The edge isn’t predicting outcomes—it’s executing through disruption risk, staying paranoid in the right ways, and preventing scale from turning into bureaucracy.

![Leadership] AI Is the Main Thing — What's in Jon Gray's Winning Leadership Recipe to CEOs & How Blackstone Stays Ahead at $1.2T+ Scale](/content/images/size/w1200/2026/01/Screenshot-2026-01-20-075711.png)

One of the mistakes we make as humans is we're linear in our thought process and these are step function changes.

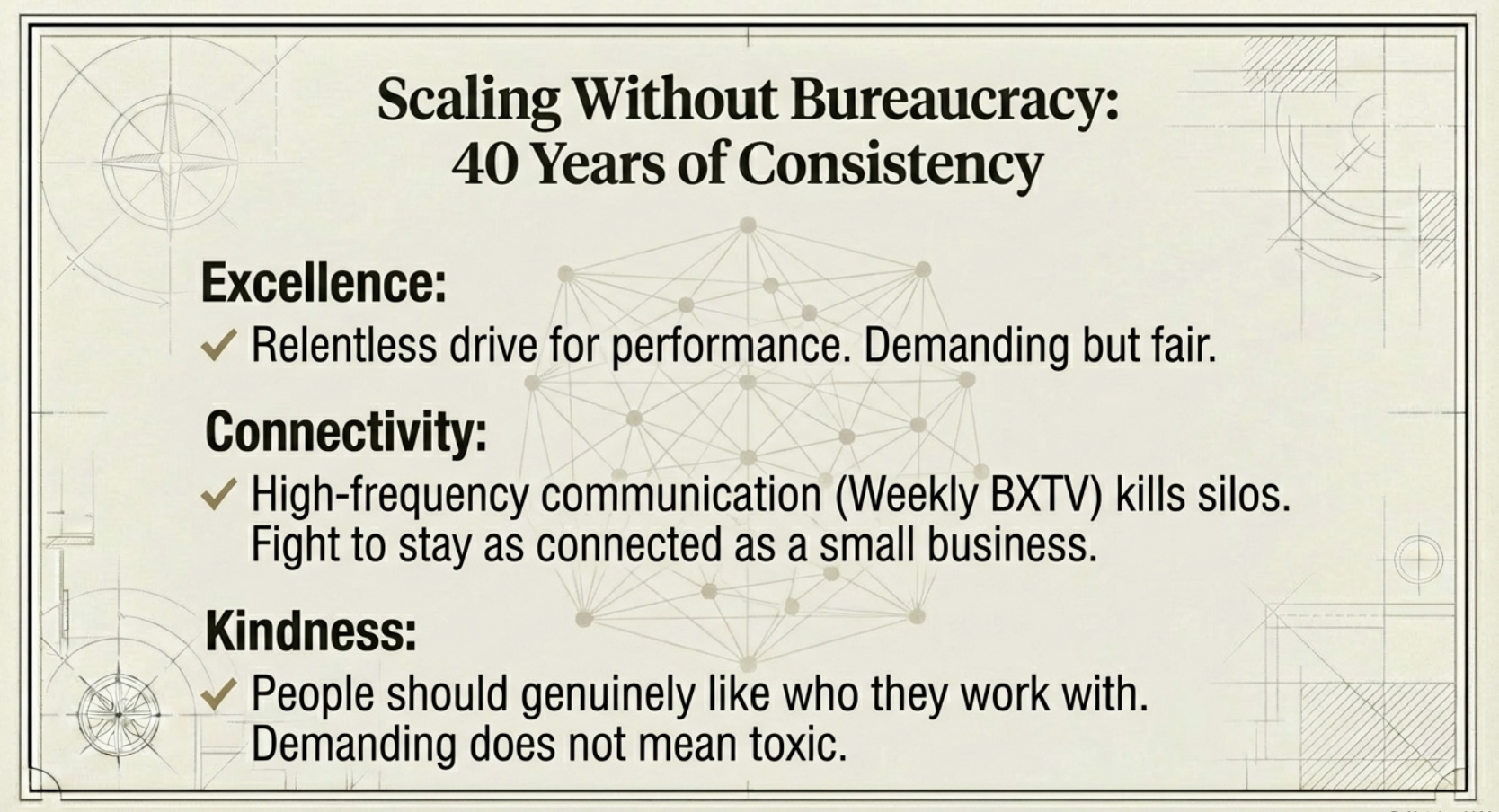

This relentless drive, push for excellence, deep care for the customer and delivering performance because that's what matters in our business, the entrepreneurial spirit that I talked about and really creating a place where people not only have professional and financial success, but they genuinely like the people they work with.

My hope is that all of you who interact with our people, they may be demanding, but they're also kind people. There's a sense of team play. And that does seem to run through the building. - Jon Gray

Key takeaways:

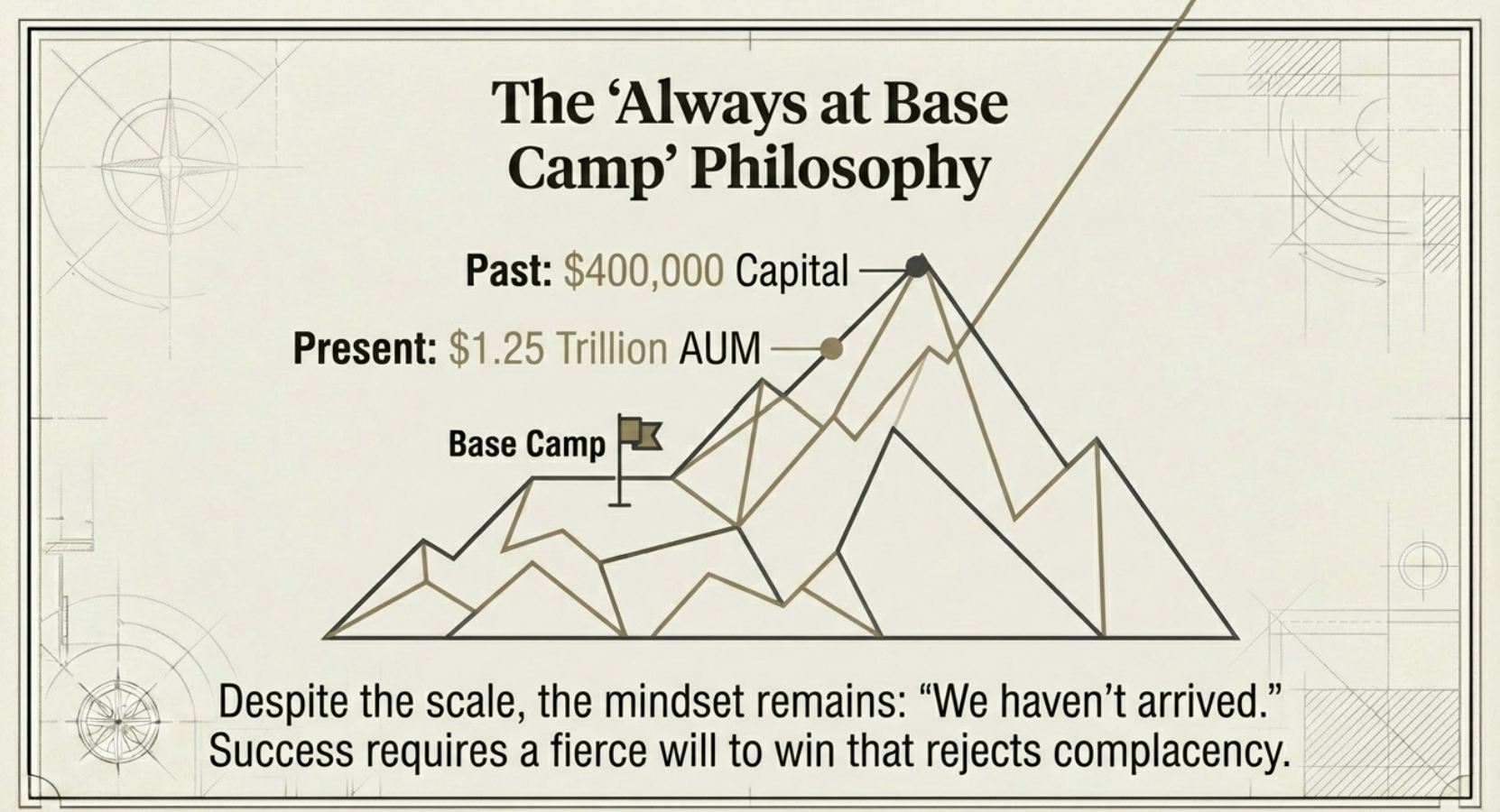

Jon Gray (President & COO, Blackstone) lays out a pragmatic CEO lens on 2026: AI (artificial intelligence) is the defining variable; the capex cycle is directionally rational even if bubbles form; and the real leadership job is building an institution that stays fast, self-critical, and culturally tight as it scales. Blackstone now manages $400k -> $1.2T+ in AUM, so the “stay entrepreneurial” message isn’t branding—it’s an operating constraint.

- AI sits at the top of the 2026 agenda—with near-term impact across coding, customer engagement, content, and rules-based functions (accounting/legal/compliance/processing).

- Misallocations are guaranteed in any step-function cycle (railroads → internet → AI), but dismissing the shift is the bigger error.

- The real investment cycle is infrastructure: chips, data centers, and power—digital + energy build-out as the foundation for productivity gains.

- Disruption is the underpriced risk: the multiple moves when the market recognizes the future has changed—well before full penetration.

- Winning culture = will to win + paranoia: no “success theater,” constant questioning, “base camp” mindset—paired with an anti-bureaucracy connectivity discipline.

1. AI: “Absolute top of the list”

Gray treats AI as a step-function shift—ubiquitous capability at low cost that will flow into coding, customer engagement, content, and the rule-based backbone of firms (accounting, legal, compliance, processing).

2. The capex math: big spend can still be rational

His anchor is simple: global labor costs are enormous; even a modest productivity lift compounds into trillions of value—so building digital + energy infrastructure at scale is not automatically “irrational,” even if some capital gets misallocated.

3. Bubbles happen. Missing the regime change is worse

He acknowledges the historical pattern: railroads → internet → today. Misallocations are part of the transition. The bigger error is underweighting the structural shift because you’re scared of the froth.

4. The real investor question: where is the enabling constraint?

His focus sits in the foundation: chips, data centers, and especially power—because that’s what turns AI from a narrative into an economy-wide productivity layer.

5. Disruption risk is the under-discussed side of the trade

Gray pushes leaders to ask: what breaks? He uses intuitive examples (Yellow Pages, taxi medallions) to make the point that adoption can be non-linear—and repricing can happen before the full operational impact is visible.

6. Linear thinking is the executive failure mode

He frames AI as discontinuous: the world moves in jumps. Strategy needs scenario branches, not single-point forecasts.

7. Winning culture = fierce will + constructive paranoia

His “teams that win” model: relentless drive, constant questioning, and boardroom candor that sounds almost like a turnaround—because complacency is the silent killer in periods of fast change.

8. 40-year endurance comes from values staying stable

He credits longevity to consistency: performance obsession, entrepreneurial spirit, deep care for clients, and high standards—without becoming brittle.

9. Demanding and kind is a real advantage

He’s explicit that intensity doesn’t have to mean toxicity: responsive teams, genuine collaboration, people who like working together—this becomes a compounding edge in a high-pressure business.

10. Anti-bureaucracy is a system, not a slogan

He links Blackstone’s scale story to consistency of core values: excellence, client/results obsession, entrepreneurial spirit, and people who actually like working together. He explicitly says the enemy is bureaucracy—and calls out deliberate connectivity mechanisms (e.g., weekly BXTV) to keep a scaled institution aligned and fast—so information moves, teams stay close, and bureaucracy doesn’t calcify decision-making.

Leadership Lessons I am taking away

The leadership lesson here is that great institutions don’t win by predicting a smooth future — they win by building for discontinuity. Gray’s point is that step-function shifts (like AI) punish linear thinking, so the job is to stay intellectually honest, scenario-based, and willing to reprice reality early. That requires a culture with two gears at once: relentless performance and deep client obsession, paired with “constructive paranoia” — no success theater, constant questioning, meetings that sound like a team trying to earn the next base camp, not celebrate the last summit. And as the platform scales, the differentiator isn’t slogans; it’s systems that keep the firm fast and connected while resisting bureaucracy — because speed, candor, and team play compound just like capital, especially when you demand excellence without losing kindness.

Note) This synthesis was produced with the help of AI. Slides were put together with the help of NotebookLLM and reviewed by me.

Bonus: Other videos are worth taking a look at

![Obsidian Memo] Leadership Ground Truth: What Cuba, Puerto Rico, and Hawai'i Taught Me About Capital and Resilience](/content/images/size/w720/2026/02/Bad-Bunny.jpg)

![Obsidian Memo] Leadership Lessons for Founders: Building “You, Inc.” Without Burning It Down](https://images.unsplash.com/photo-1474917518260-23f84bd71c75?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDQyfHxzYWlsaW5nfGVufDB8fHx8MTc3MDkyODg3Mnww&ixlib=rb-4.1.0&q=80&w=720)

![Obsidian Memo] Davos 2026: Reflections on Geopolitics, AI, Energy, and the Future of Sustainable Capitalism](https://images.unsplash.com/photo-1551524484-635f78221cc4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDR8fGRhdm9zfGVufDB8fHx8MTc3MDY2MTg4M3ww&ixlib=rb-4.1.0&q=80&w=720)

Comments ()