Obsidian Memo] 1929 — Lessons from the 1929 Crash & A Reminder That Craft Still Wins (ft. Andrew Ross Sorkin's London Talk)

Lessons from the 1929 crash + Andrew Ross Sorkin’s London talk: what today’s CIOs must learn about hidden leverage, AI-driven growth illusions, and trust decay—plus reflections on leadership, policy, and a signed-copy moment for a New Yorker in London.

![Obsidian Memo] 1929 — Lessons from the 1929 Crash & A Reminder That Craft Still Wins (ft. Andrew Ross Sorkin's London Talk)](/content/images/size/w1200/2026/01/WhatsApp-Image-2026-01-18-at-11.51.11-1.jpeg)

Hi All,

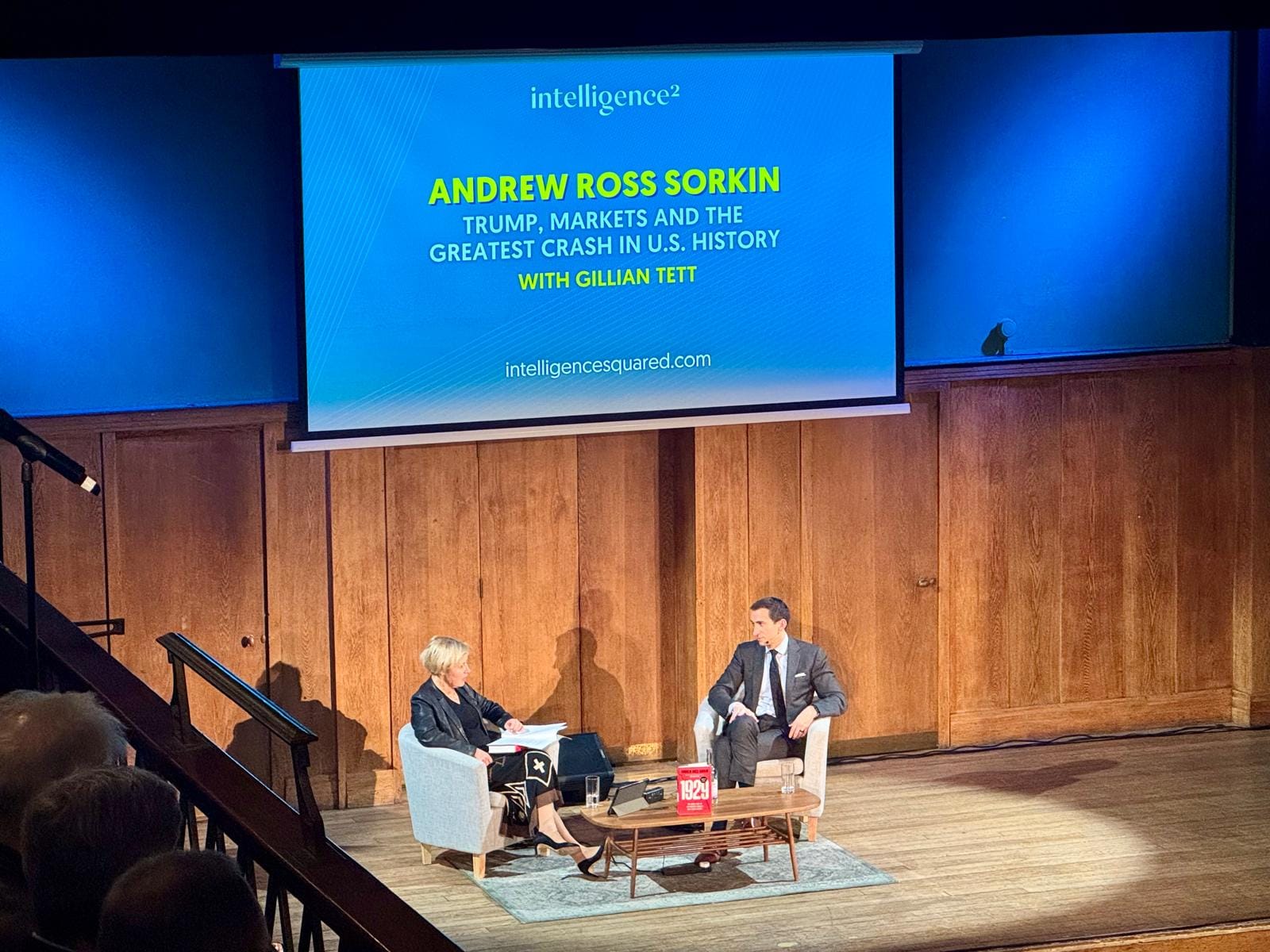

Recently, I attended Andrew Ross Sorkin's author talk in London for 1929: Inside the Greatest Crash in Wall Street History—and left with more than a signed copy. I left with a sharper lens on how cyclical patterns reveal themselves through different wrappers, and what disciplined leadership looks like when you're operating across both crisis timeframes and decade-long horizons.

As someone who's lived through multiple market dislocations—1997 Asian Financial Crisis, 2000 Dot-Com, 2008 GFC, 2011 US Credit Downgrade, 2020 Pandemic Shock—each taught me something different about resilience, liquidity stress, and what separates reputation from structural stability. Sorkin's work crystallizes those lessons into a framework worth revisiting now.

*Personal note: Squawk Box was the show I woke up to every morning (besides Bloomberg) when I was in New York, and Andrew’s face was always there—on TV, on the trading floor, on every screen. This continued everywhere I went in the world. 'Too Big To Fail' was my textbook to the 08 financial crisis. As a New Yorker now in London, I had a brief, unexpected moment with him that felt like the city had found me again. A flicker of nostalgia—one of those strangely intimate moments you don’t expect from a public encounter. You can see in the photo below: he was visibly surprised when I said I was from NYC, worked in finance, and had been a longtime fan. Yes, I had a bit of a fangirl moment. 🙂

What stayed with me wasn’t just the subject matter (the crash as a deeply human drama). It was the operating cadence behind the work. 1929 was the result of nearly a decade of research and writing—crafted alongside a high-frequency life of markets journalism: DealBook, Squawk Box, the summit circuit, even producing Billions.

That combination—long-horizon craftsmanship + real-time output—is rare. And instructive. Especially for those of us who’ve worked in live markets and are trying to lead, build, and write with enduring clarity.

The book also pulled me back to personal memories—a string of market shocks that are tattooed in my brain and nervous system, and the lessons I carry from each:

- 1997 Asian Financial Crisis: I was 10. Panic in the banks and CEOs of large companies suddenly on the street overnight (the ripple effects on the rest of society) - these images are seared in my brain. Watching South Korea’s economy unravel, FX traders glued to their desks—some unable to leave even for the bathroom—as the won collapsed against the dollar. A masterclass in currency fragility.

- 2000 Dot-Com Bubble: I was still a teenager, but I was surrounded by VC investors who went busted; their pain is stored in my nervous system. Early exposure to the brutal truth that second place doesn't always survive. Not all search engines make it. Investments to the No.2 search engine that didn't become 'Google' went busted.

- 2008 Global Financial Crisis: I was a university student in NYC. An intern on Wall Street. Witnessed in real time from both ends—downtown dorms a few blocks from Wall Street, and a Midtown trading floor internship on Wall Street. Panic was everywhere.

- 2011 U.S. Credit Downgrade: I was an intern in the global fixed income portfolio management team. Observing chaos ripple through fixed income desks—the first time the myth of U.S. invincibility cracked open before our eyes.

- 2020 Pandemic Shock: I was a multi-asset portfolio manager. Riding volatility again—this time with more grounding, under the guidance of senior PMs. A reminder that experience becomes its own ballast.

Each shock taught me something different—but together, they’ve formed a deeper understanding of resilience, calm under pressure, and what it means to keep showing up with clarity.

I. Book Summary

Andrew Ross Sorkin's analysis draws sharp parallels between 1929 and today's AI-driven expansion—highlighting systemic vulnerabilities in leverage concentration, shadow banking opacity, and the disconnect between capital deployment and revenue realization. But the real insight isn't about predicting when the cycle turns. It's about understanding how credibility, incentives, and policy choices extend cycles right up until trust itself becomes the depleted asset.

II. Core Themes from 1929—and Why They Matter Now

1) The illusion is never new—only the wrapper changes: Speculative euphoria doesn't require the same instrument. It only needs the same psychological ingredients: leverage, momentum, social proof, and a narrative that makes risk feel like progress. Today's wrapper is AI infrastructure. The ingredients are unchanged.

2) Credibility can delay reality—until it can't: Reputation capital gets deployed to stabilize sentiment, defend institutions, and keep the machine moving. That works... until trust becomes the thing being depleted. For CIOs: this isn't about market timing—it's about recognizing when institutional credibility (central banks, rating agencies, counterparties) is being stretched thin.

3) Systems break where incentives go asymmetric: When upside is privatized and downside is diffused—across depositors, taxpayers, or systemic backstops—fragility becomes a feature, not a bug. The cleanup is always political, and it always arrives late.

4) "Democratization" can mask risk transfer: Expanding access is sold as progress. But it can also become a distribution channel for complexity and illiquidity—especially when the sales pitch outruns suitability and safeguards. Think: retail options trading, SPACs, crypto access via 401(k)s.

5) After collapse, society renegotiates the rules of capitalism: 1929 wasn't just a market reset—it was a legitimacy reset, followed by Glass-Steagall, the SEC, the FDIC. The system re-prices not just assets, but trust. Today's inequality debates and calls for wealth taxes are early signals of the next renegotiation.

III. Key Insights for CIOs & Finance Leaders

1) Capital Efficiency vs. Capital Abundance: The AI Infrastructure Build-Out

- AI-related capex now masks fundamental economic weakness—Jason Furman's analysis suggests US GDP growth would be effectively flat (~0.1%) without data center investment

- We're witnessing vendor financing at scale (Nvidia financing OpenAI's chip purchases), creating circular leverage that obscures true capital formation

- Historical precedent: The internet wasn't wrong. The monetization timeline and capital efficiency assumptions were. AI will likely follow the same path—transformative over decades, but with significant valuation resets along the way.

2) Shadow Banking & Systemic Opacity: The Unmapped Risk Layer

- Credit migration from regulated banks to private credit funds has created structural blind spots—no disclosure requirements, limited Fed visibility, unclear cross-collateralization

- Institutional implication: Traditional stress testing frameworks may be measuring the wrong exposures. Counterparty risk assessment requires new frameworks beyond banking system monitoring.

- Investor lesson embedded here: Liquidity is not a footnote. It's the oxygen of the system. When it thins, everything reprices at once.

3) Policy Volatility as a Portfolio Input

- Tariff policy parallels (Hoover 1930, Trump 2025) demonstrate how political imperatives override economic rationality—but with a critical difference: market reaction speed now serves as a governance mechanism

- Bessent's moderating influence suggests Treasury retains some stabilization capacity, but equity and bond market volatility increasingly functions as the primary constraint on executive discretion

- Investor lesson: Policy is part of the investment environment, not an externality. Markets don't operate "outside government"; they operate inside rulebooks that change after failure.

4) Tax Architecture & Capital Formation Distortions

- Current tax code creates perverse incentives: estate tax loopholes, preferential capital gains treatment, real estate depreciation shields, and tax-advantaged philanthropy collectively reduce productive capital recycling

- Institutional angle: Understanding these structures matters for ESG frameworks, stakeholder capitalism discussions, and long-term return expectations in a potential tax reform environment

- The "affordability crisis" isn't just political—it reflects fundamental questions about capitalism's legitimacy that will shape regulatory frameworks and market access over the next decade

5) Portfolio Positioning Considerations

Sorkin's guidance translates to institutional context:

- For defined benefit plans: Duration of liabilities matters more than ever—near-term obligations require liquidity buffers (10-20% recommended), especially given bond market sensitivity to policy shocks

- For endowments/foundations: The "professional optimist vs. professional skeptic" tension is real—over 100 years, optimism wins, but career risk and drawdown tolerance require thoughtful liquidity management

- Leverage monitoring: If you can't map where leverage sits in your ecosystem (counterparties, underlying investments, vendor financing chains), you can't properly risk-adjust returns. If you're underwriting leverage, you're underwriting behavior.

IV. The Investor Lessons I'm Carrying Forward

- Liquidity is oxygen: When it thins, everything reprices at once—and institutional size becomes a liability, not an advantage.

- Narratives move faster than data: Your job is to resist the crowd's certainty—especially when the story feels socially rewarded.

- Reputation is a balance sheet: It compounds slowly, and it can gap-down overnight. This applies to counterparties, rating agencies, and your own institutional credibility.

- Leverage is a governance question: You're not just underwriting returns—you're underwriting behavior under stress.

V. The Leadership Insight

Watching Sorkin discuss a decade-long research project—built from primary sources, diaries, and archival records—while maintaining daily/weekly market journalism output reminded me of something critical:

The leaders who win long-term aren't the ones with the most intensity in a season. They're the ones who can sustain clarity across years.

High performance isn't just speed. It's dual-track execution:

- Keep showing up at a high cadence (markets, decisions, crises)

- While quietly building a body of work that has weight (frameworks, relationships, institutional memory)

That's the standard worth holding.

VI. Question for the Obsidian Odyssey Community

Given the opacity in today's shadow banking system and the concentration of economic growth in AI infrastructure spending:

What's one lesson from past market crashes you actively build into your decision-making today—and where do you think leaders are still underestimating risk?

Specifically: Are we properly stress-testing for liquidity events where traditional safeguards may not function as expected? And what new risk metrics are you building into your investment process to account for leverage and counterparty exposure that doesn't sit on bank balance sheets?

VII. Other resources...if you are short on time.

This is the one I attended in London:

If you want something more US-friendly:

![Obsidian Memo] Leadership Ground Truth: What Cuba, Puerto Rico, and Hawai'i Taught Me About Capital and Resilience](/content/images/size/w720/2026/02/Bad-Bunny.jpg)

![Obsidian Memo] Leadership Lessons for Founders: Building “You, Inc.” Without Burning It Down](https://images.unsplash.com/photo-1474917518260-23f84bd71c75?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDQyfHxzYWlsaW5nfGVufDB8fHx8MTc3MDkyODg3Mnww&ixlib=rb-4.1.0&q=80&w=720)

![Obsidian Memo] Davos 2026: Reflections on Geopolitics, AI, Energy, and the Future of Sustainable Capitalism](https://images.unsplash.com/photo-1551524484-635f78221cc4?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDR8fGRhdm9zfGVufDB8fHx8MTc3MDY2MTg4M3ww&ixlib=rb-4.1.0&q=80&w=720)

Comments ()