Sustainable/Impact Investing] The Electrotech Revolution: Notes from the Climate Bonds Conference 2025 (Oct 22, 2025)

Summary: why the Electrotech Revolution—driven by solar, EVs, and battery storage—is reshaping global capital flows, energy security, and long-term investment strategy for institutional investors.

![Sustainable/Impact Investing] The Electrotech Revolution: Notes from the Climate Bonds Conference 2025 (Oct 22, 2025)](/content/images/size/w1200/2025/10/WhatsApp-Image-2025-10-24-at-17.37.46_c9cc8583-1.jpg)

Why the next decade of electrification may outpace fossil fuels — regardless of political noise

Date: October 22, 2025 | London

I. Executive Summary

Despite headlines about ESG fatigue and political polarization, the fundamentals of the energy transition remain intact. The Electrotech Revolution—a convergence of generation, electrification, and storage—is now driving one of the largest reallocations of capital in history. For allocators, the challenge is no longer conviction but execution: how to deploy amid noise without missing the structural inflection point.

II. Background

The Climate Bonds Conference 2025, held in London on October 22, convened asset owners, sovereign issuers, and sustainability leaders to assess the capital flows shaping the energy transition.

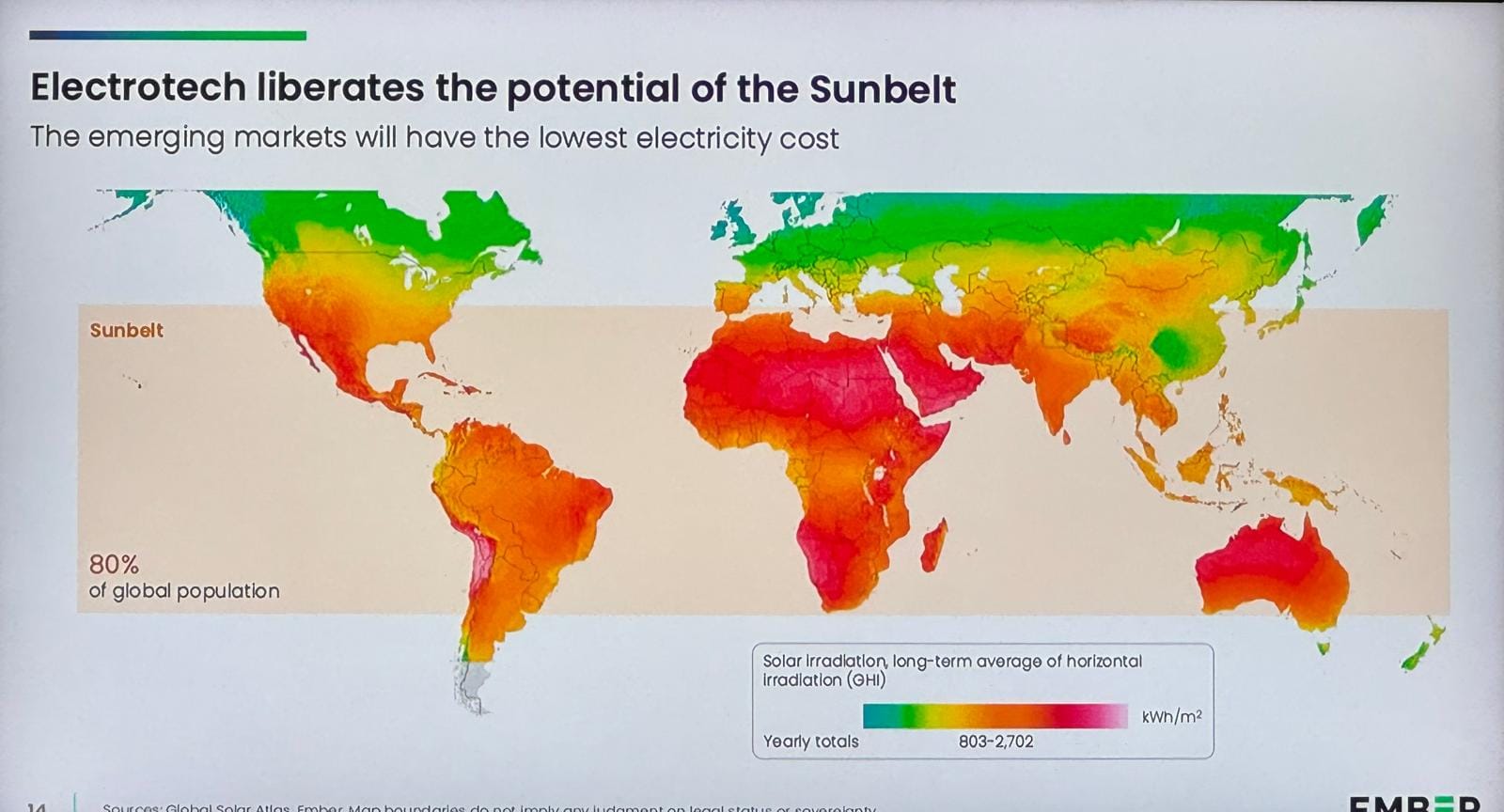

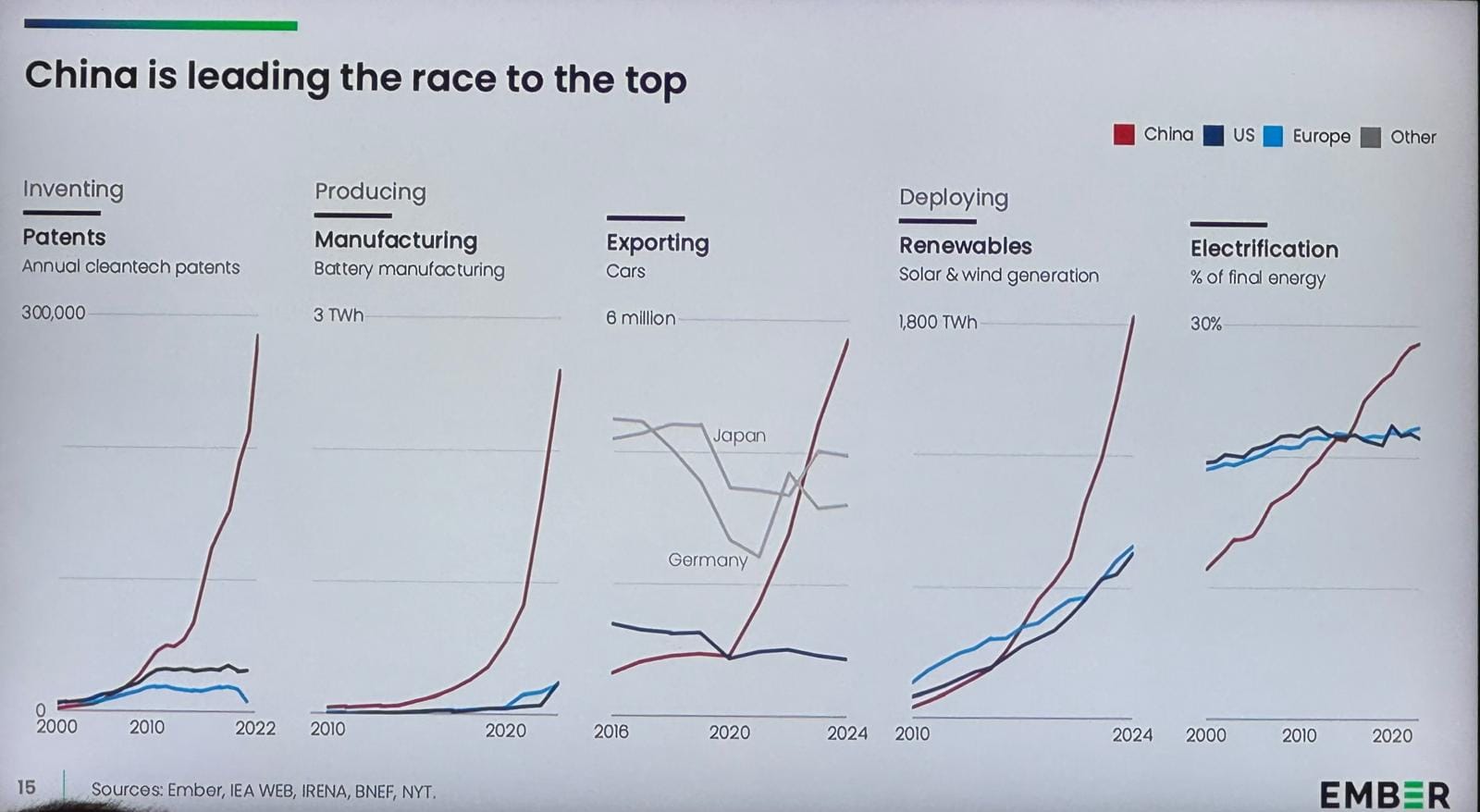

Kingsmill Bond (Ember) delivered a data-heavy keynote reframing the ESG narrative: “This isn’t a moral movement—it’s a technology revolution.” His evidence: exponential cost declines, accelerating deployment, and a decisive geopolitical shift toward energy sovereignty.

III. Key Takeaways for Capital Allocators

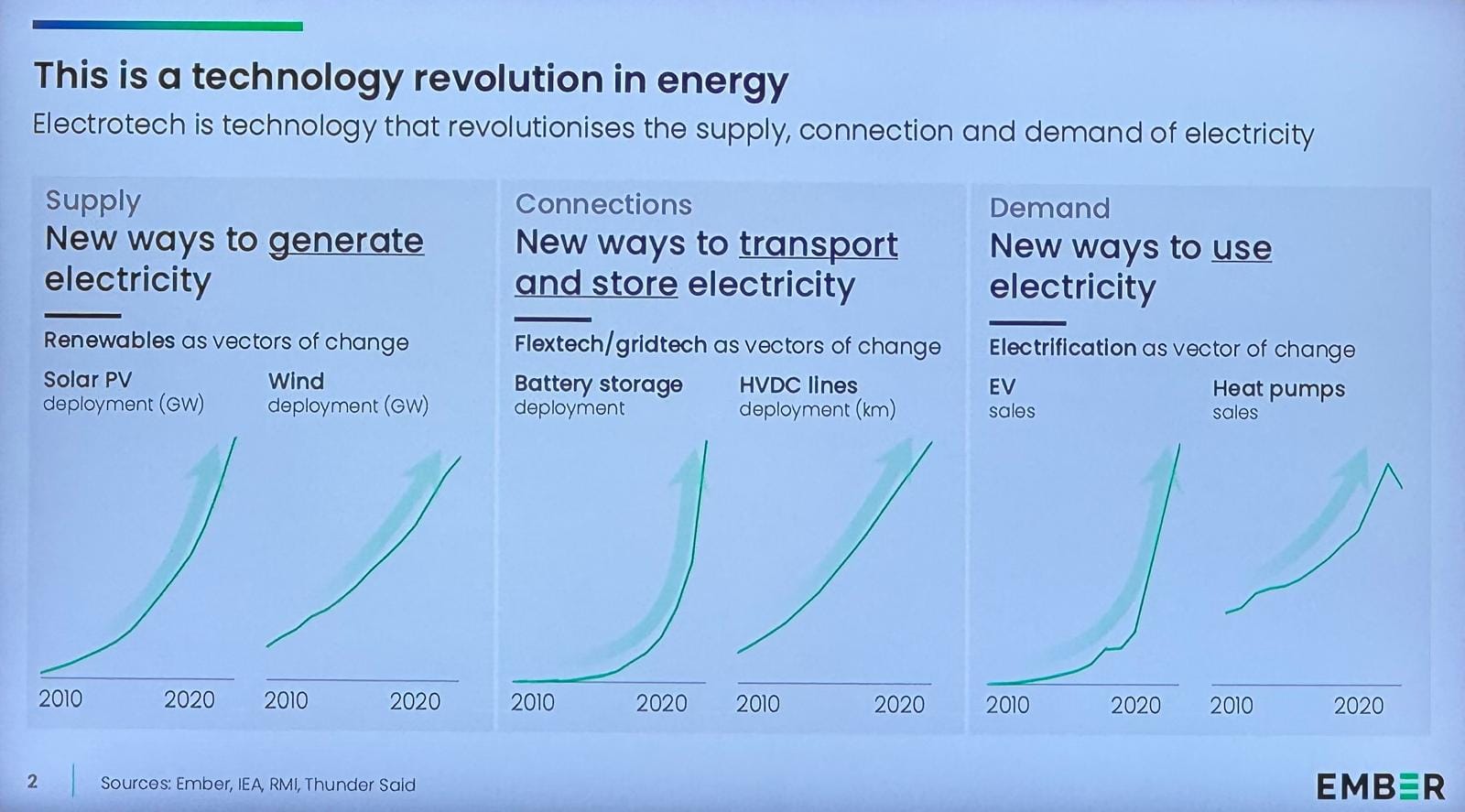

- The Energy Transition Has Entered the “Electrotech” Phase.

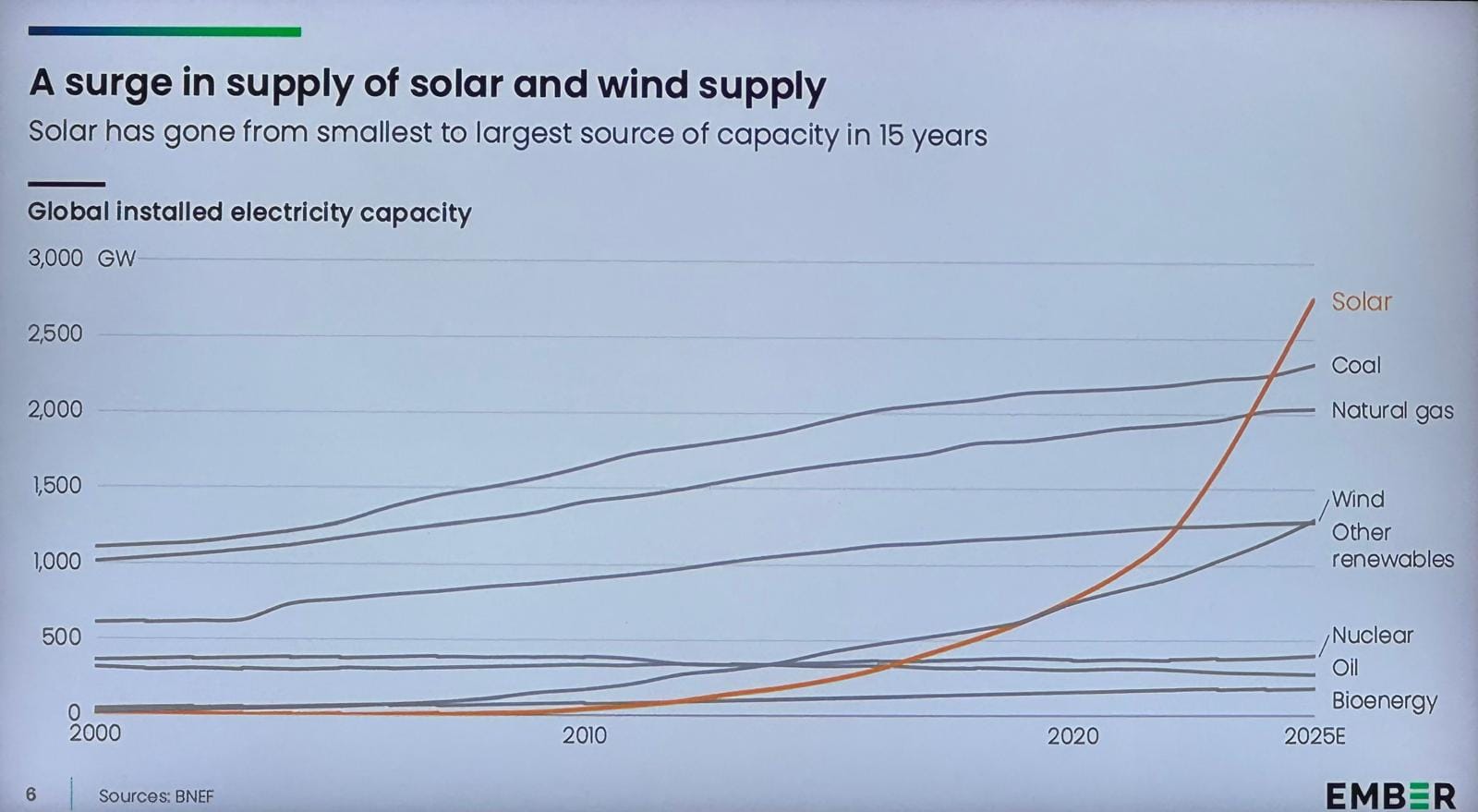

This revolution operates across three interlinked engines:- Generation: Solar and wind, now the largest source of new global capacity.

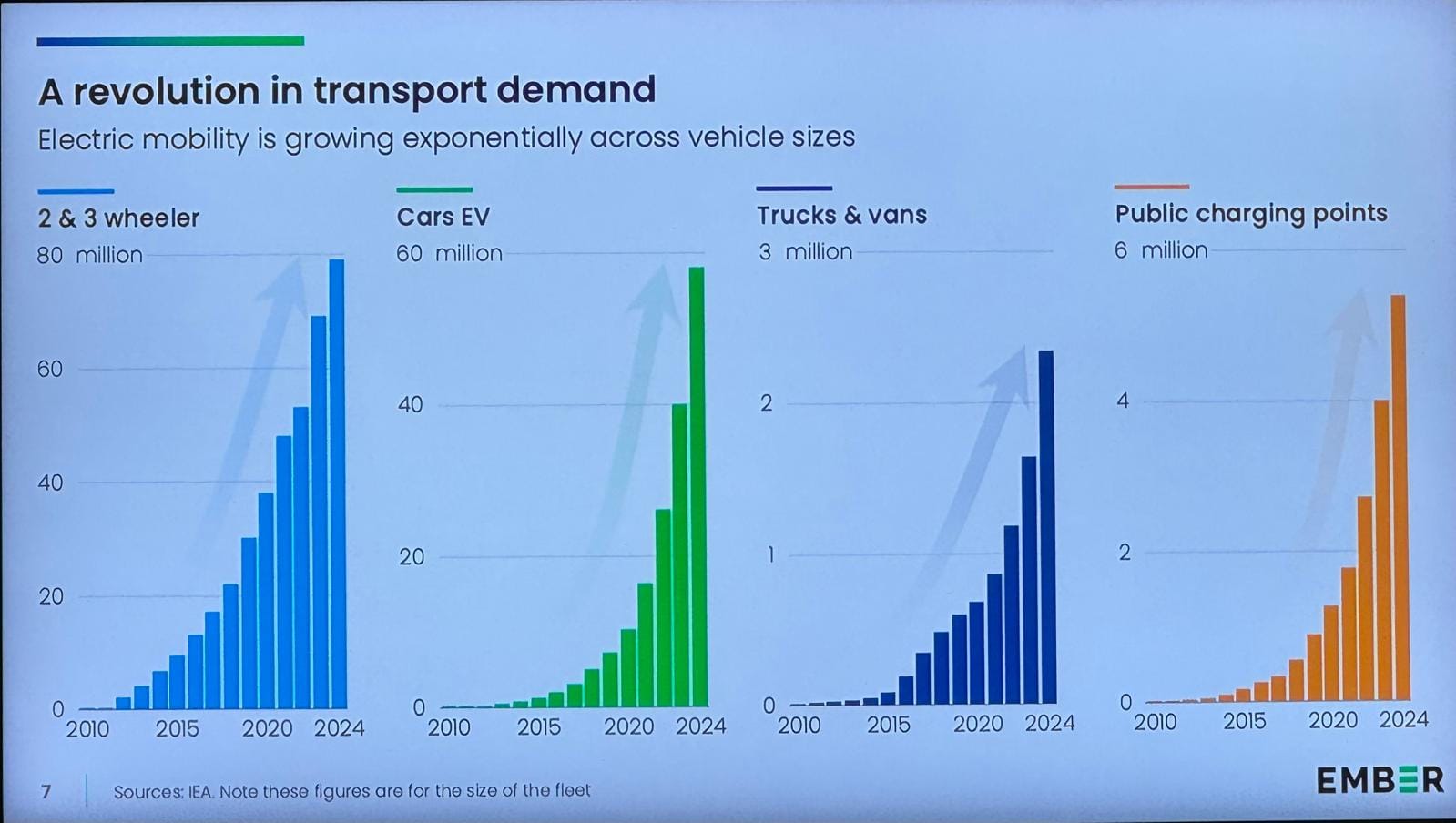

- Usage: EVs, heat pumps, and industrial electrification.

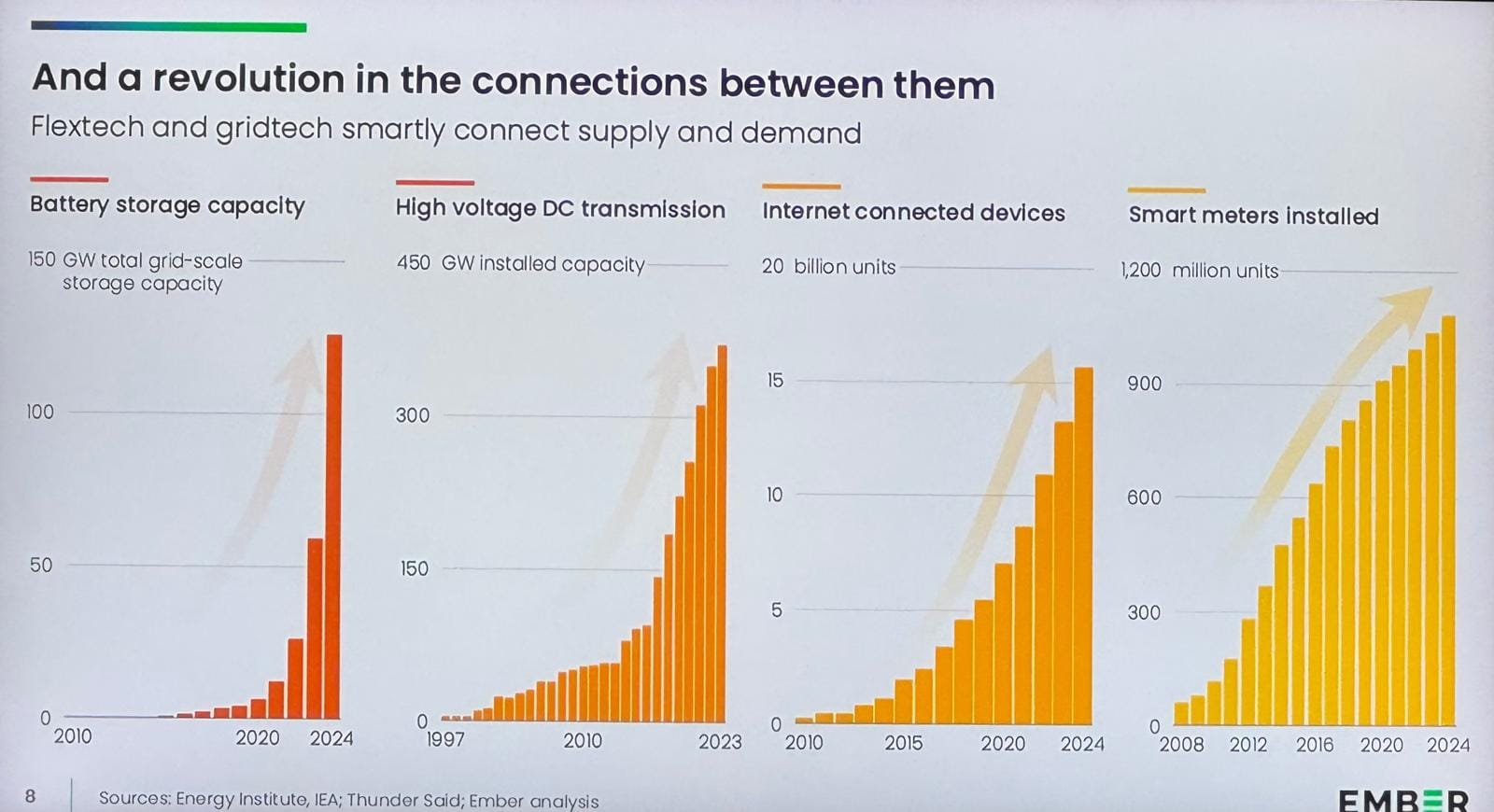

- Connection: Battery storage, grid digitalization, and smart software.

Each segment is scaling exponentially, creating compounding efficiency loops.

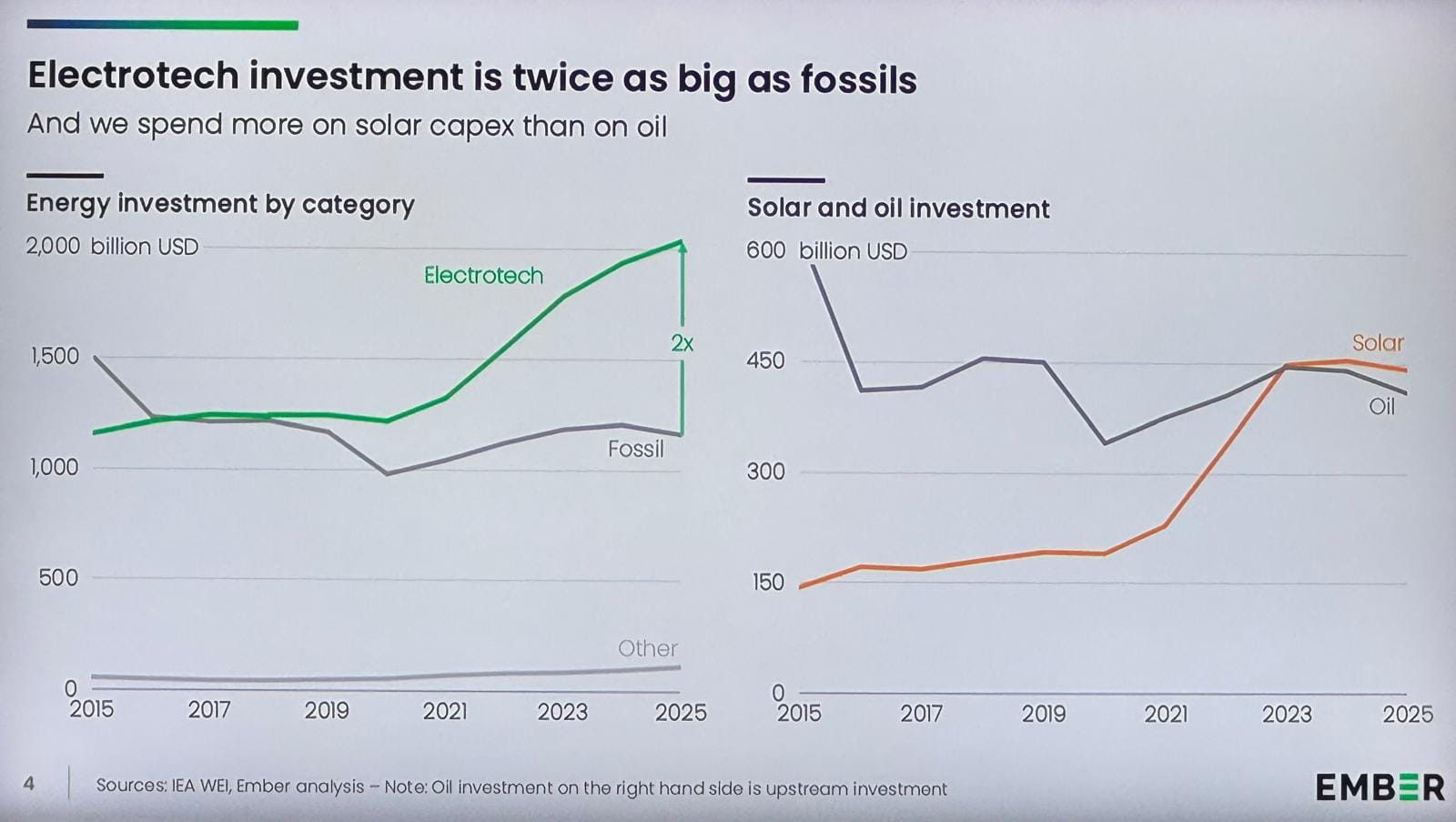

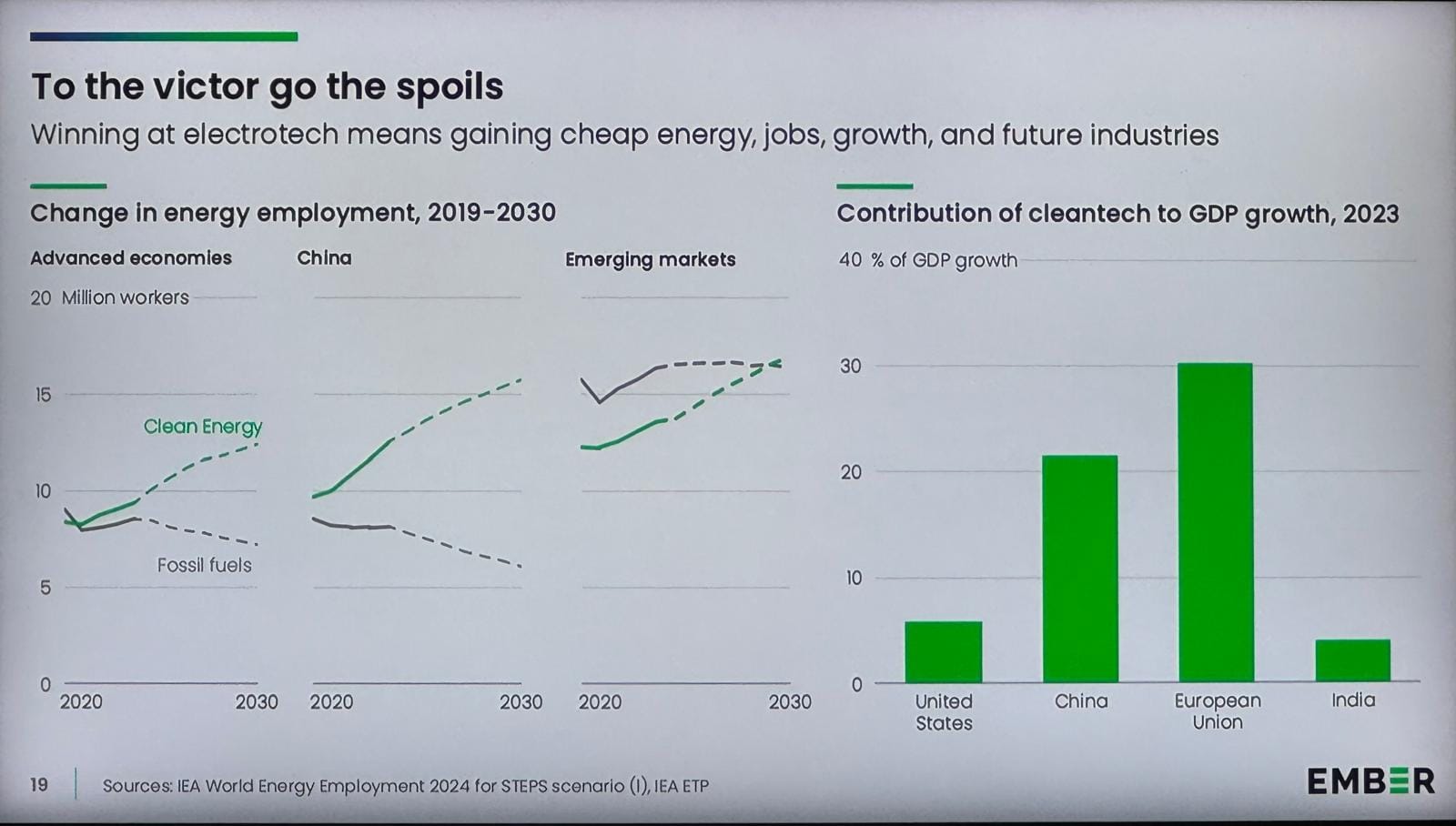

- Capital Flows Have Reversed the Old Order: Over $2.2 trillion flowed into clean electrification in 2024—twice the capital committed to fossil fuels. For the first time, solar investment exceeded oil investment globally. The financial narrative has turned: maintaining fossil infrastructure is now capital preservation, not growth.

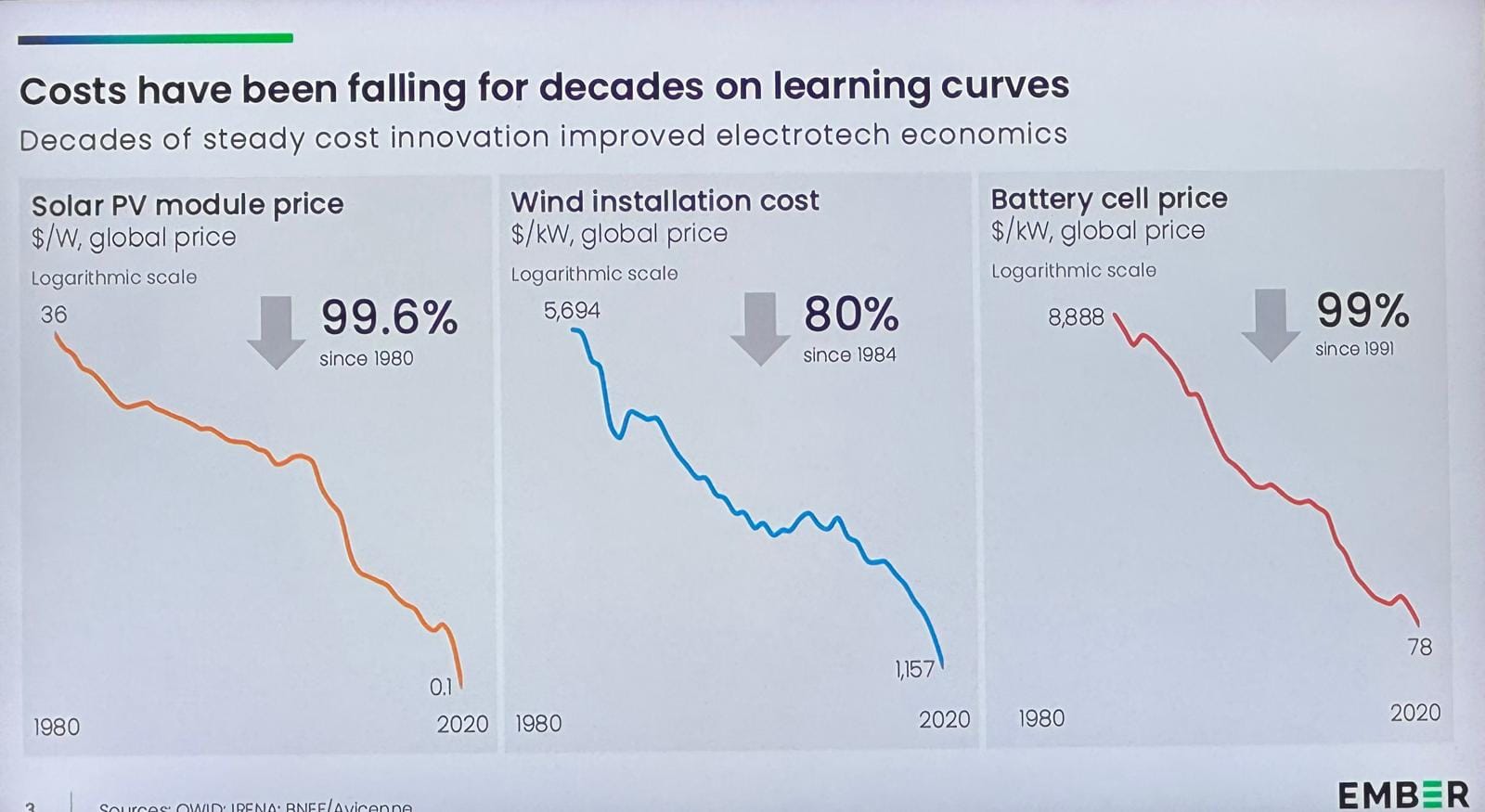

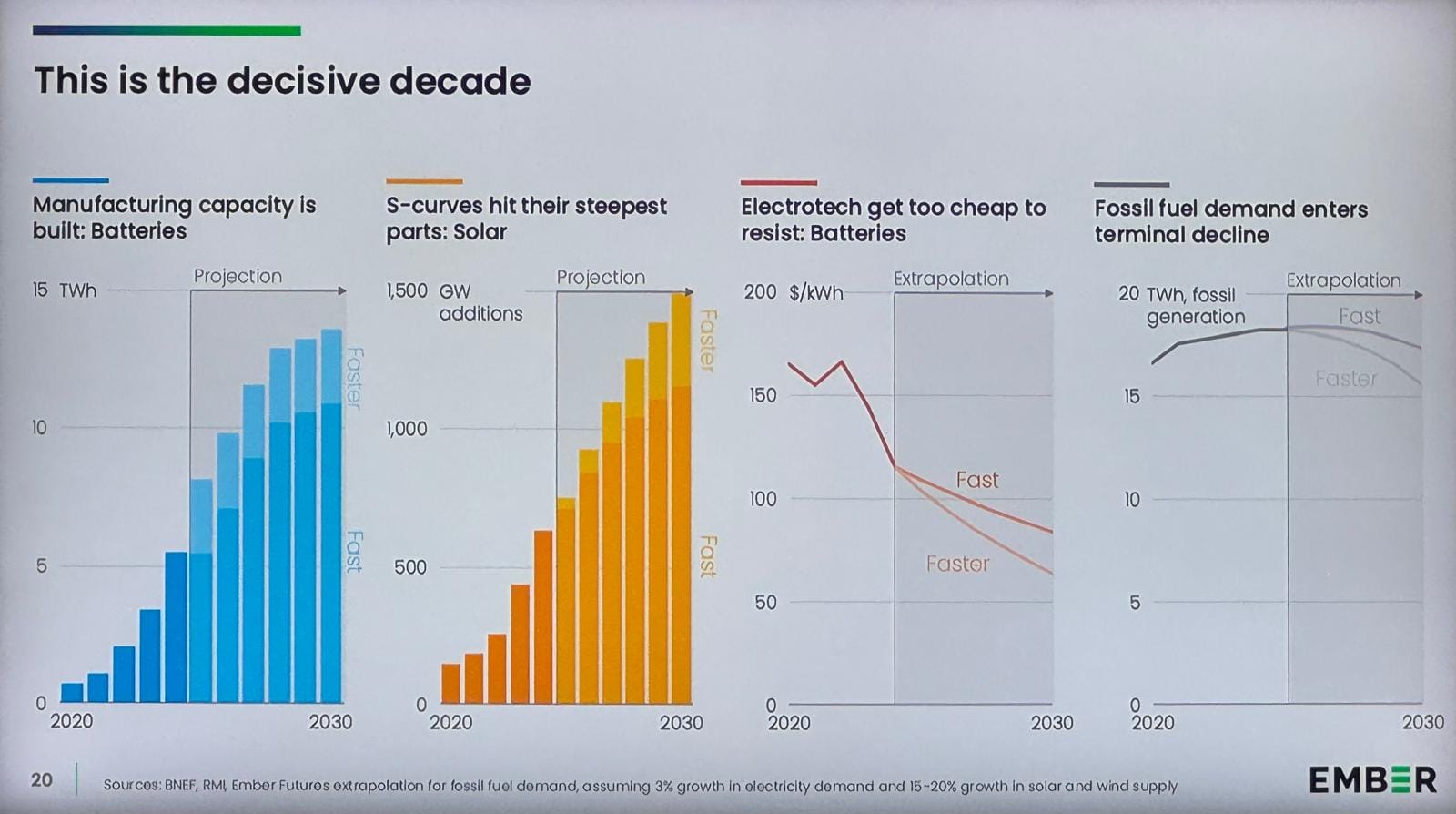

- Technology Cost Curves Are the Real Policy Engine: Renewable technologies follow learning rates of ~20% cost decline for every doubling of deployment. Solar costs have fallen 99% since the 1980s, and battery prices are projected to hit $50/kWh by 2035, down from ~$150 in 2023.

These declines act as the invisible regulator—dictating asset repricing across portfolios. - Geopolitics Is Now the Catalyst for Change:

- The EU imports ~60% of its primary energy as fossil fuels; Japan and Korea import 85%.

- Europe still sends €1 trillion annually to fossil fuel suppliers—a dependence increasingly seen as a security liability.

- Electrification enables energy independence, transforming the “climate transition” into an “energy sovereignty” imperative.

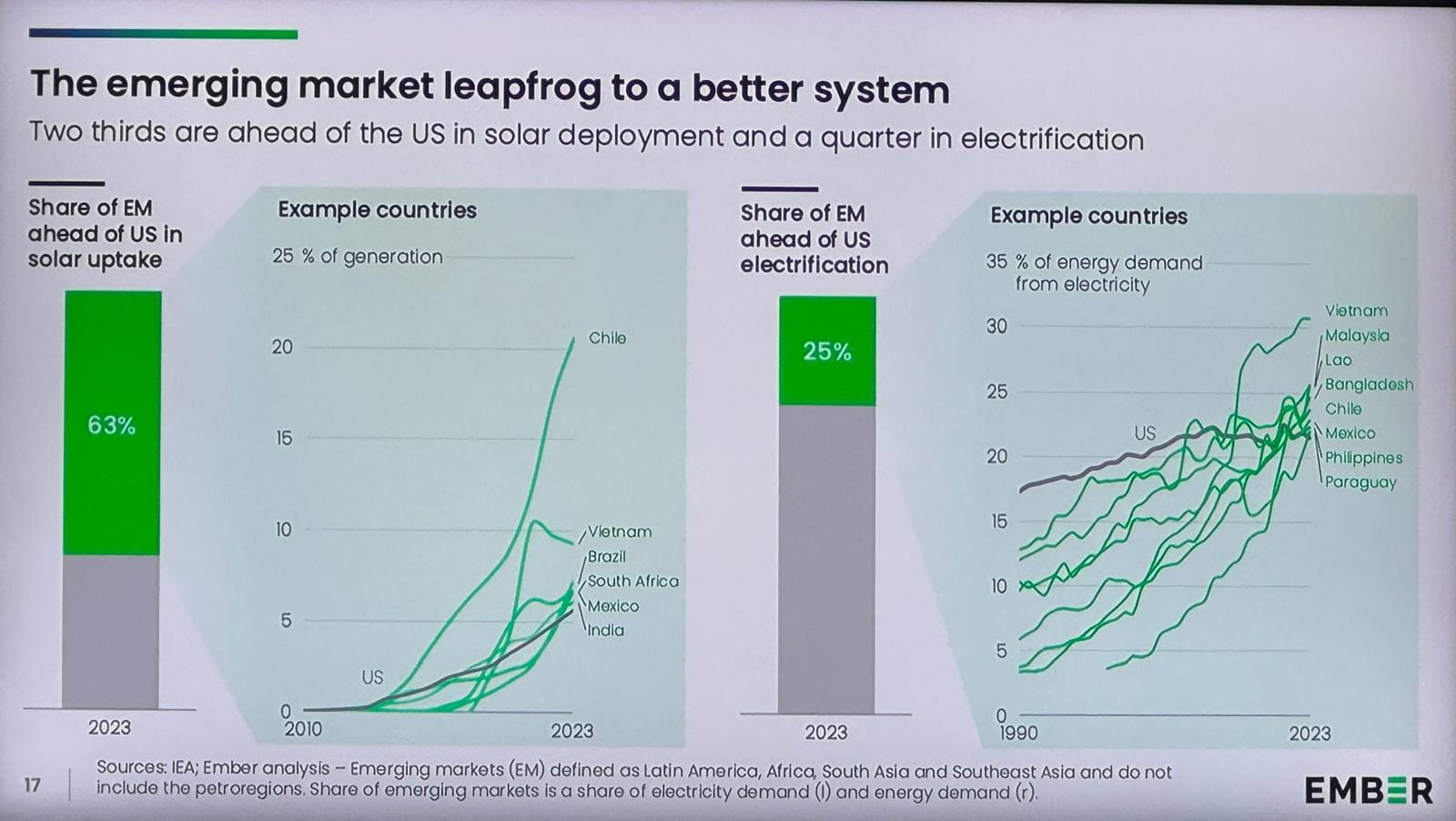

- Emerging Markets Are Leapfrogging: In 2025, two-thirds of major emerging markets (led by India, Brazil, and Indonesia) already generate a higher share of electricity from solar than the United States. EV sales in China now make up 50% of new cars, compared to ~25% globally. Southeast Asia’s electrification rate has overtaken that of Europe. Growth is no longer a Western monopoly—it’s a diffusion story.

IV. Market Implications

🔹 For Public Market CIOs

Volatility may dominate headlines, but beneath it lies a structural inflection point. The Electrotech Revolution is reshaping performance drivers across sectors.

Public equity allocators should note:

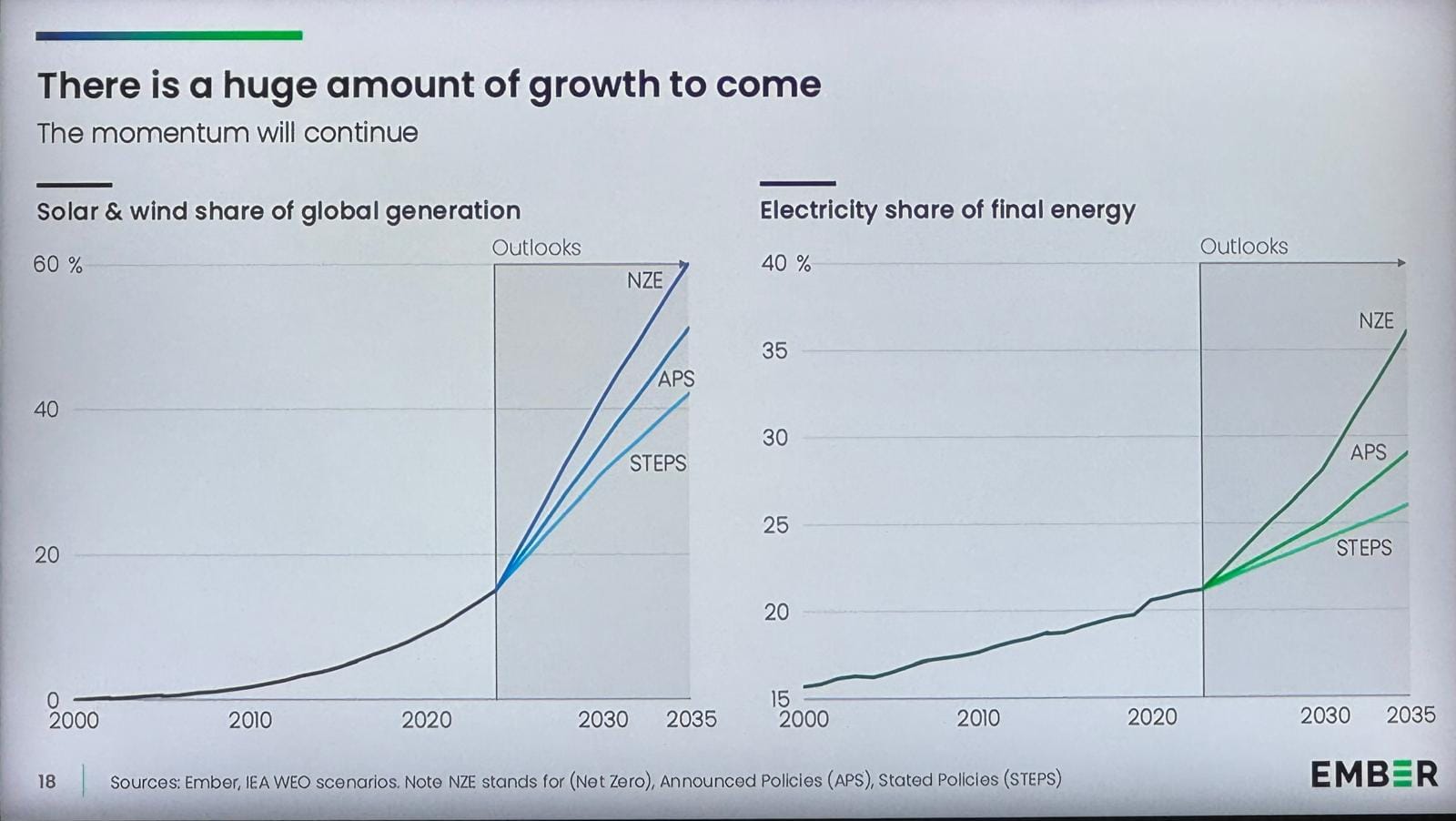

- Clean electrification now accounts for ~10% of global electricity supply, doubling roughly every three years.

- Manufacturing capacity for renewables and batteries is expanding at 2–3x annual rates.

- The cost-curve convergence between renewables and fossil fuels is irreversible—creating a decade-long revaluation window.

The next wave of alpha lies in technology diffusion and infrastructure integration: semiconductor ecosystems, grid digitalization, storage platforms, and transition metals.

Passive ESG exposures are obsolete; CIOs must adopt systemic capital frameworks that price technological inevitability. Expect energy index bifurcation—legacy fossil producers in terminal decline vs. electrification leaders compounding at scale.

🔸 For Private Market CIOs

Private capital will define the infrastructure decade. Solar, wind, and battery manufacturing capacity already exists to reach near-net-zero generation, but deployment lags due to outdated grids and slow permitting—creating the investable bottleneck.

Strategic investment themes:

- High-voltage DC transmission (10x growth over the past decade).

- Battery storage capacity, doubling annually since 2020.

- Localized microgrids and industrial electrification.

- AI-enabled energy management systems and digital twins for optimization.

This is climate tech 3.0: industrial, data-driven, and geopolitically relevant.

The most successful CIOs will combine long-term infrastructure ownership with data intelligence, treating energy systems not as climate assets but as national productivity infrastructure.

V. In Closing

Walking out of the conference, I felt unexpectedly hopeful. Despite the political noise, investor fatigue, and the cyclical nature of ESG headlines, the long-term commitment to the energy transition remains intact.

Rooms like this still fill with pragmatic optimists — portfolio managers, engineers, and policymakers — focused on the mechanics of change. The language has matured; conviction has become quieter, but deeper.

Electrification is no longer a future scenario — it is a balance sheet reality.

As Kingsmill Bond concluded, perhaps ESG should now stand for Energy, Security, and Growth.

For allocators, the question is no longer if this revolution will reshape portfolios, but how soon they choose to position for it.

VI. Further Reading

- Ember: Global Electricity Review 2025

- IEA: World Energy Outlook 2025

- Climate Bonds Initiative: Financing the Net-Zero Transition

- BloombergNEF: Energy Transition Investment Trends 2025

VII. Questions for the Obsidian Odyssey Community

- In a world where electrification is accelerating faster than policy, how can capital allocators distinguish temporary noise from structural inevitability?

- How might our portfolios—and our governance systems—change if we began to treat energy security and climate resilience as the same objective?

Deep-dive: Detailed Summary

1️⃣ CONTEXT: NAVIGATING UNCERTAINTY & POLITICAL NOISE

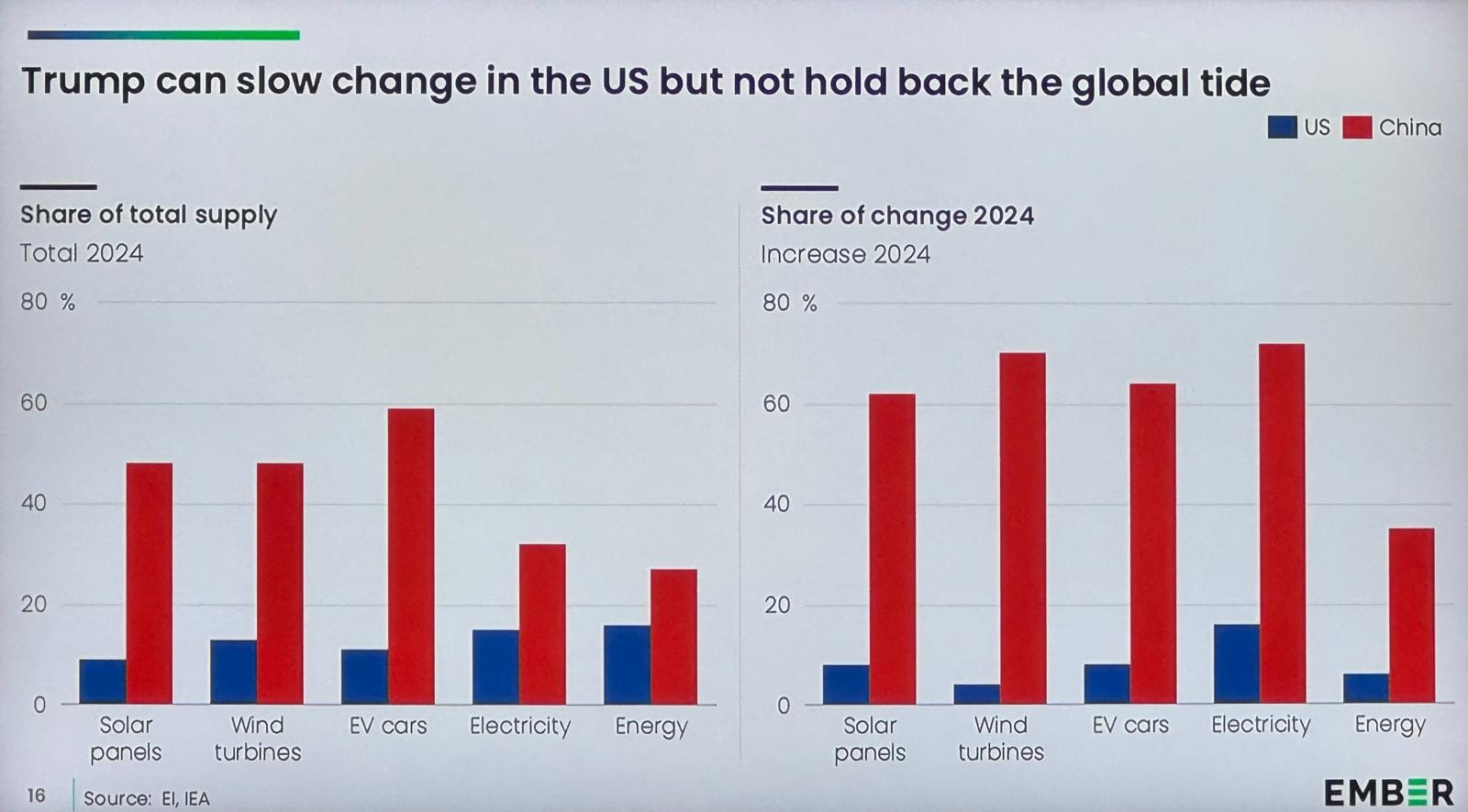

- The speaker began by acknowledging the “elephant in the room” — global uncertainty following Trump’s election, fossil fuel triumphalism, and the weakening ESG narrative.

- Key message: This is “noise.” The structural forces driving the energy system’s transformation are as powerful as ever.

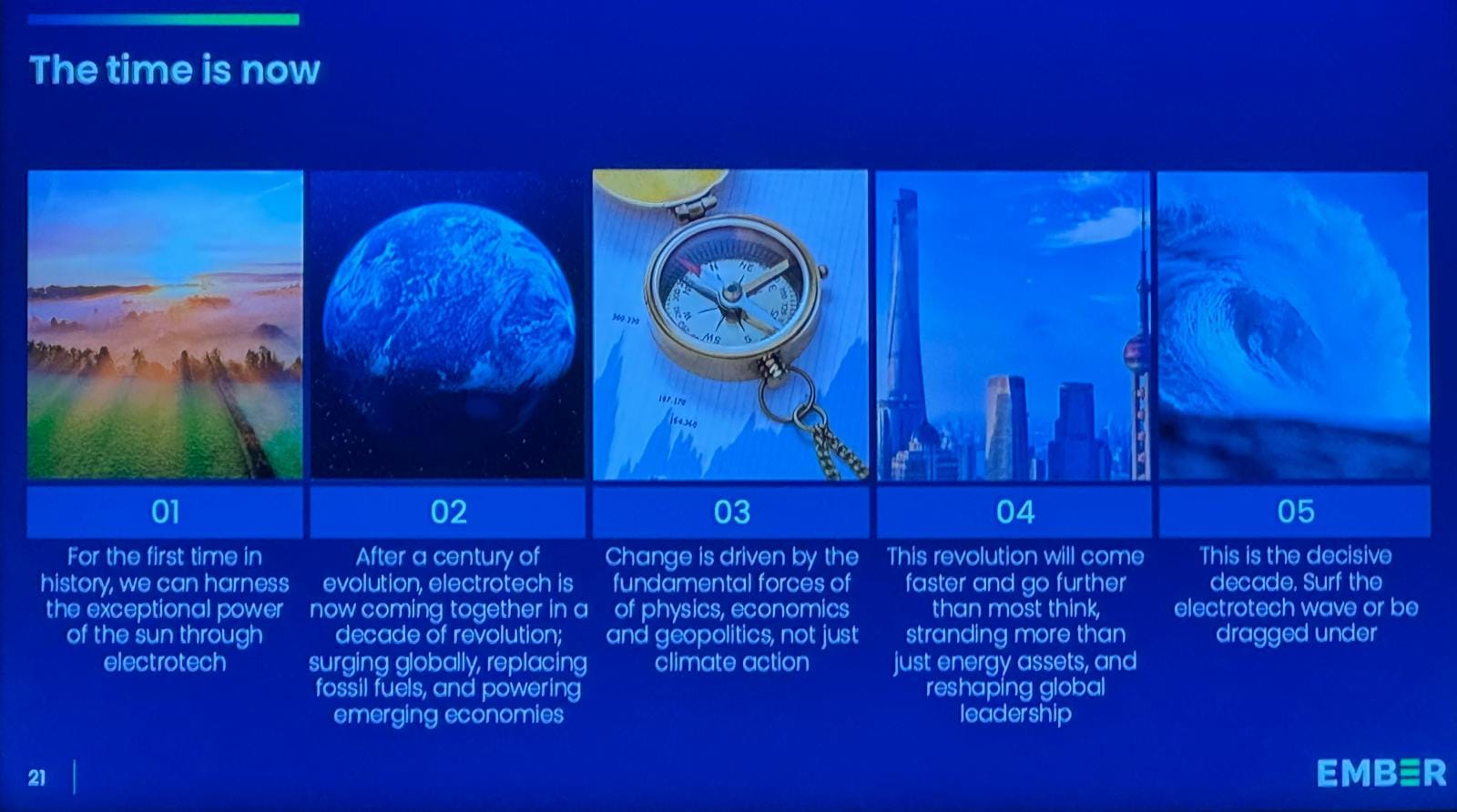

- Framing: “Net zero may be over, but the Electrotech Revolution is here.”

2️⃣ DEFINING THE ELECTROTECH REVOLUTION

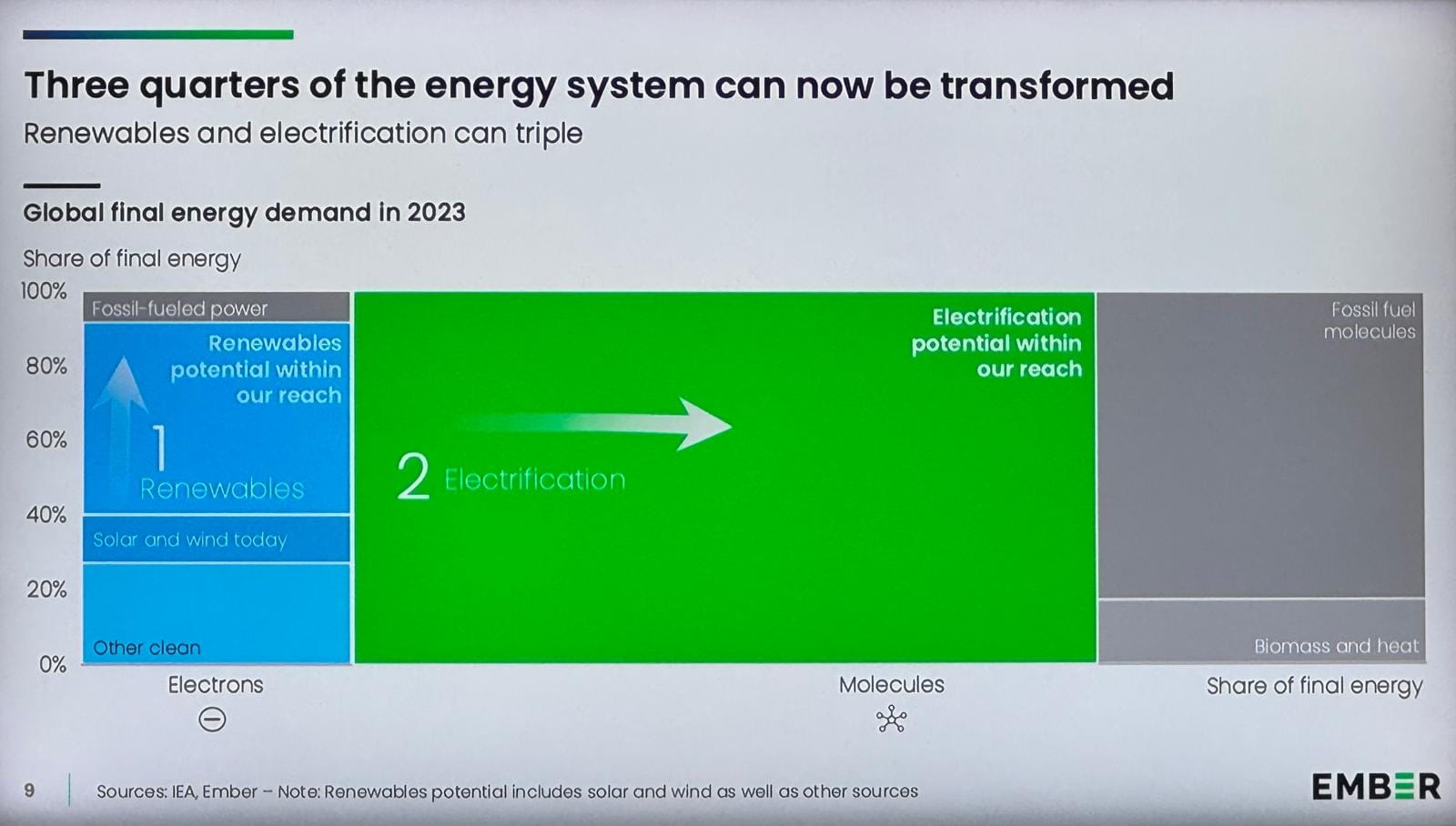

The revolution consists of three interlinked transformations:

- Generating electricity — exponential growth in renewables such as wind and solar.

- Using electricity — electrification of vehicles, buildings, and industry.

- Connecting supply and demand — batteries, storage, software, and smart grids.

Each part is undergoing rapid technological evolution and cost decline, feeding into a reinforcing cycle of innovation and adoption.

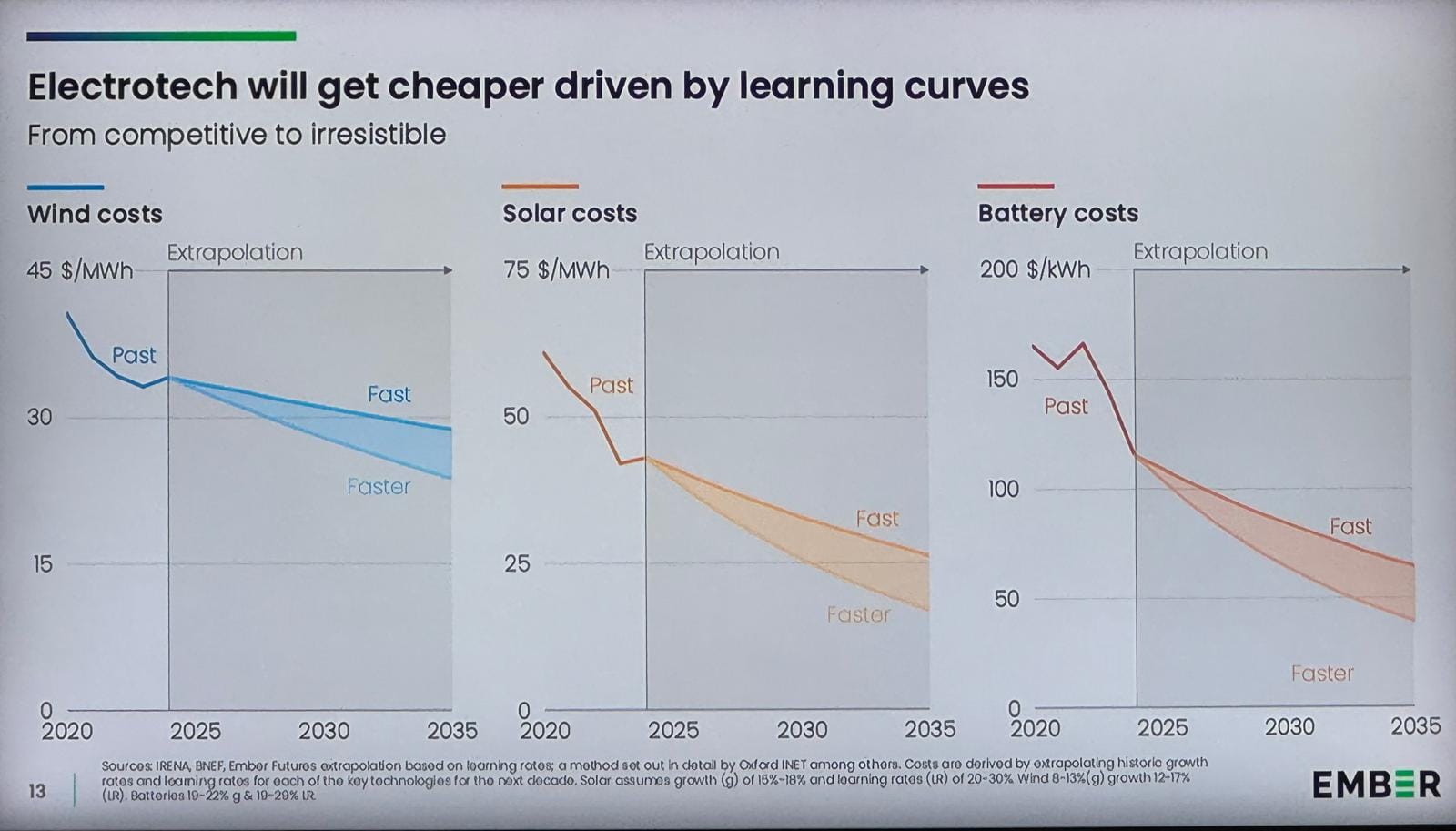

3️⃣ THE HEART OF THE SHIFT: FALLING COSTS & LEARNING CURVES

- Technologies in the electrotech system are modular and follow steep learning curves, falling roughly 20% in cost for every doubling of deployment.

- Solar costs have declined ~99% since the 1980s, making renewables increasingly dominant.

- Fossil fuels are being maintained before decline, while the electric system is being built to power the future.

As costs fall, capital allocation surges:

“There is now twice as much capital going into the electric system as there is into the fossil system.”

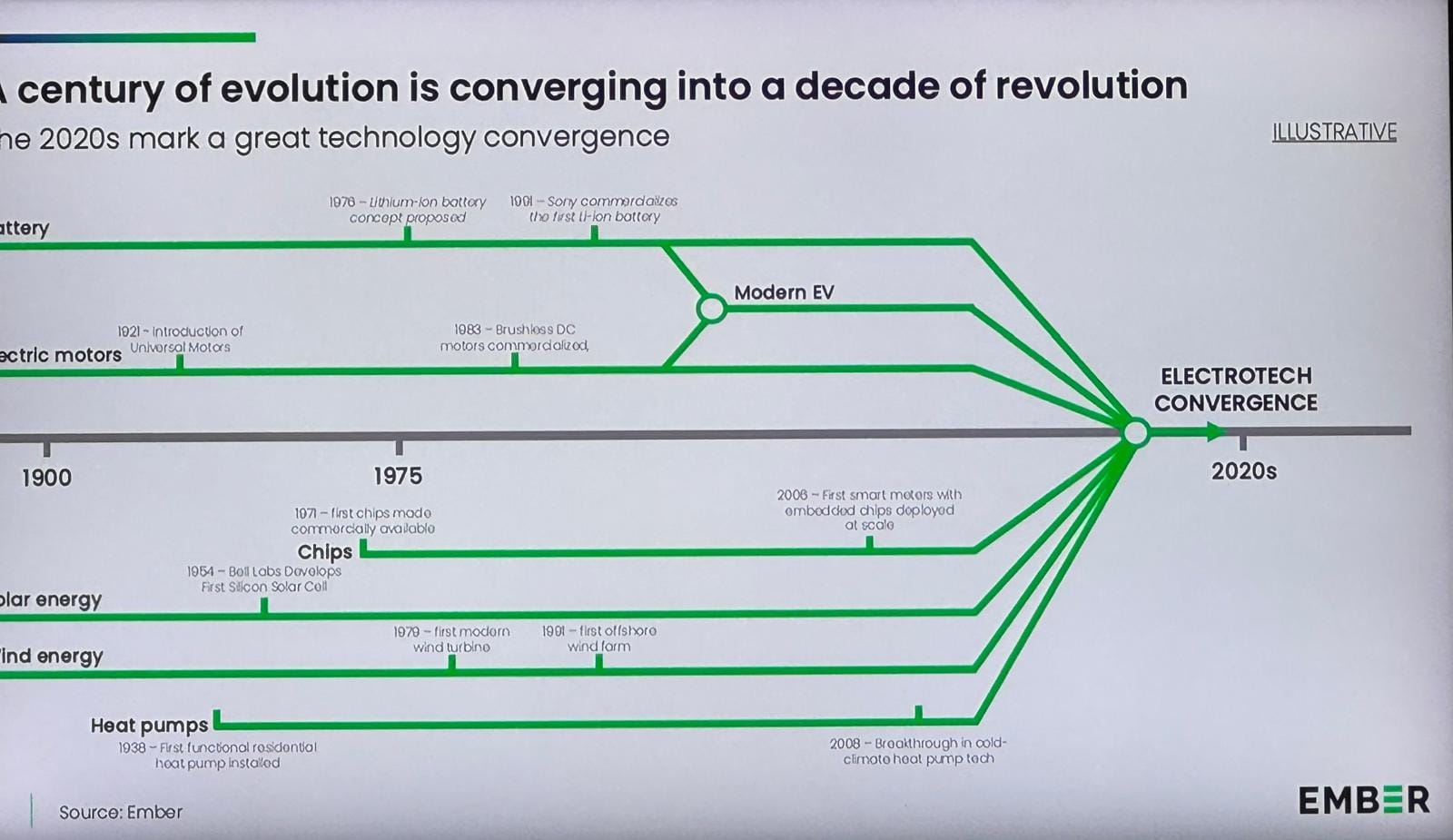

4️⃣ A CONVERGENCE OF TECHNOLOGIES

- Mutual reinforcement:

- Cheaper solar sustains the battery sector.

- Cheaper batteries, in turn, accelerate solar.

- This convergence forms a “river of change”—a self-reinforcing feedback loop that defines this decade as a period of accelerated technological revolution.

5️⃣ GROWTH TRAJECTORIES: SOLAR, WIND, AND ELECTRIFICATION

- Solar expansion:

- From near zero 15 years ago to the largest source of global capacity today.

- Deployment doubles every three years.

- In summer 2025, solar provided around 10% of global electricity, with all growth in global demand met by solar and wind.

- Electrification of end-use:

- Electrification has resumed rapid growth after decades of plateau.

- Electric vehicles (EVs) are a key driver — expected to grow another 25% this year, reaching about 25% of global market share, and up to 50% in China.

- Example: EVs in China cost around $8,000, charge for $10, making adoption economically obvious.

- Storage and grid technologies:

- Battery storage is doubling annually.

- High-voltage DC lines have expanded tenfold in a decade.

- Connected devices (e.g., smart meters) are proliferating rapidly, linking demand flexibility with supply stability.

6️⃣ THE LIMITS MYTH: “THE LAST 20%”

- Fossil fuel advocates often argue that sectors like cement, steel, and aviation are unsolvable.

- Message: The “ceiling of the possible” keeps rising each year.

The speaker countered: these represent only the “last 20%.”

“We can solve everything else — 70–80% of generation and roughly three-quarters of end demand can be electrified.”

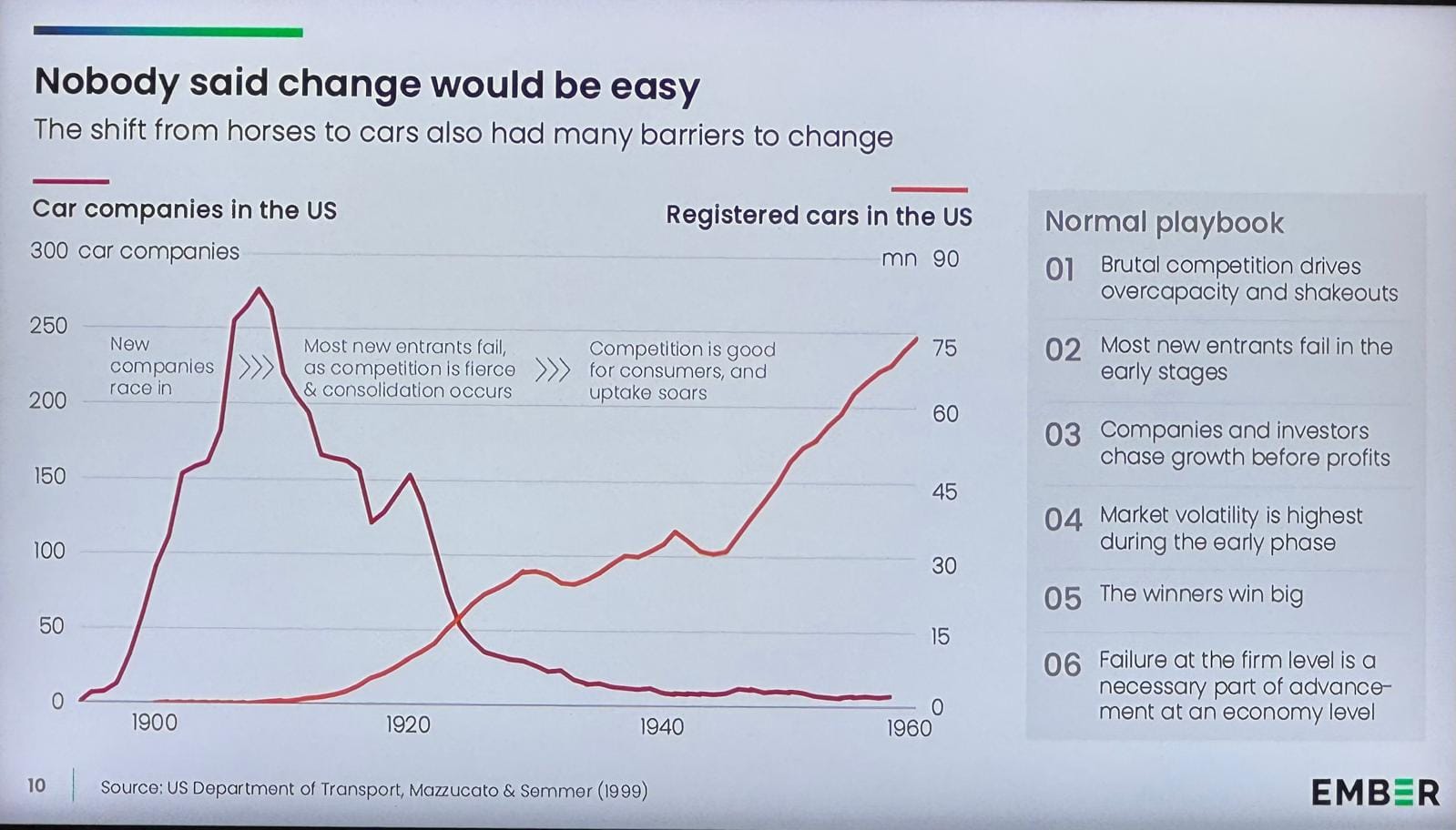

7️⃣ FRICTION: TECHNOLOGY VS. INERTIA

- The revolution faces inertia, lobbying, and legacy regulation that protect fossil incumbents.

- The European wind sector illustrates this tension — innovation colliding with systemic resistance.

- Analogy: The early 1900s shift from horses to cars — most pioneers failed, but the few who succeeded triggered an irreversible transformation.

8️⃣ THE THREE UNSTOPPABLE DRIVERS

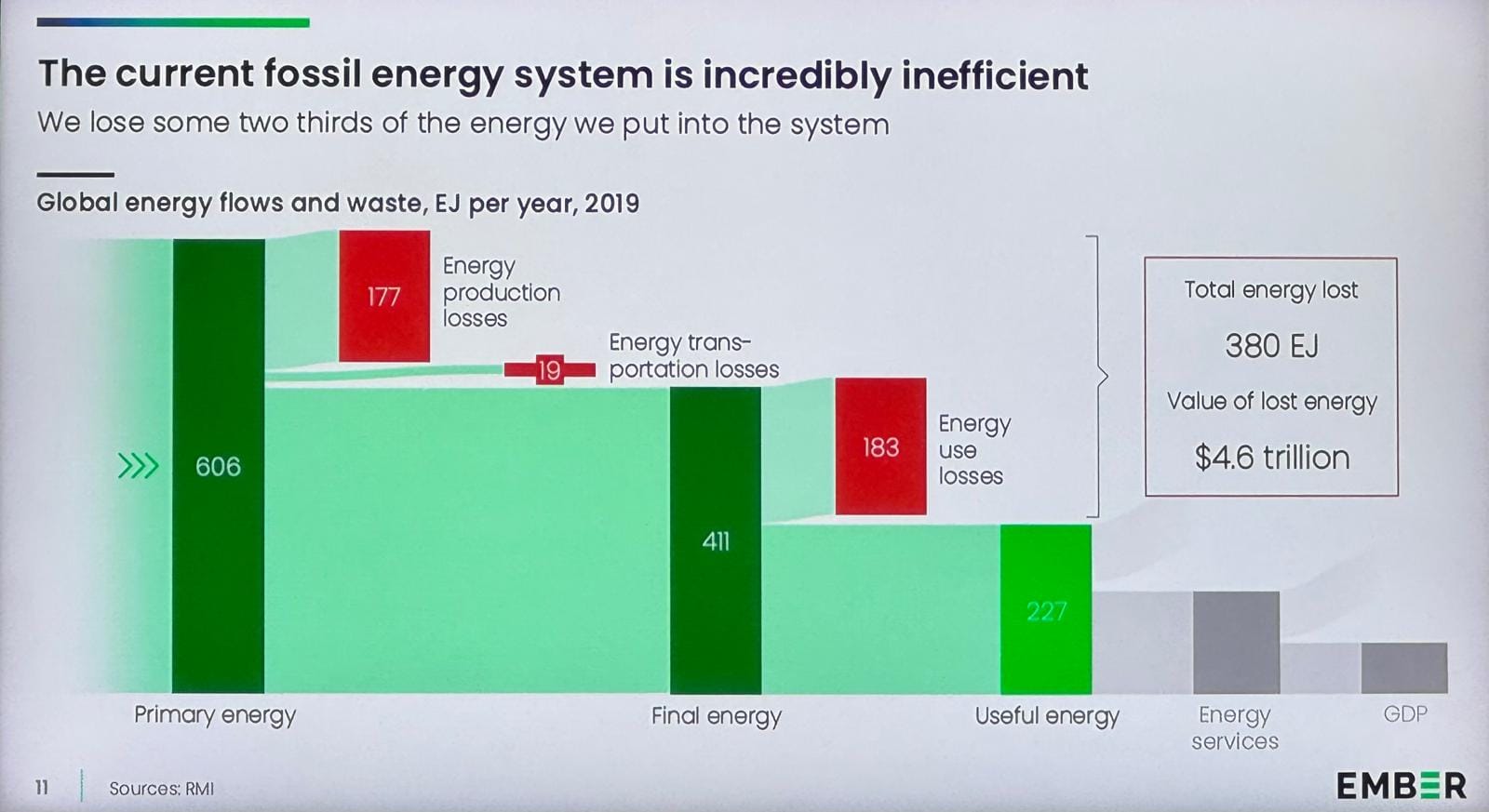

1. Physics – Efficiency

- The fossil system converts ~600 exajoules of primary energy into ~200 exajoules of useful energy, wasting two-thirds.

- Electrification targets this inefficiency directly — a vast opportunity for systemic redesign.

2. Economics – Cost

- Exponential deployment = exponential cost decline.

- Projections (based on learning curves):

- Solar at $25/MWh within a decade

- Batteries at $50/kWh within a decade

- “Low costs are the ultimate solution to overcome barriers.”

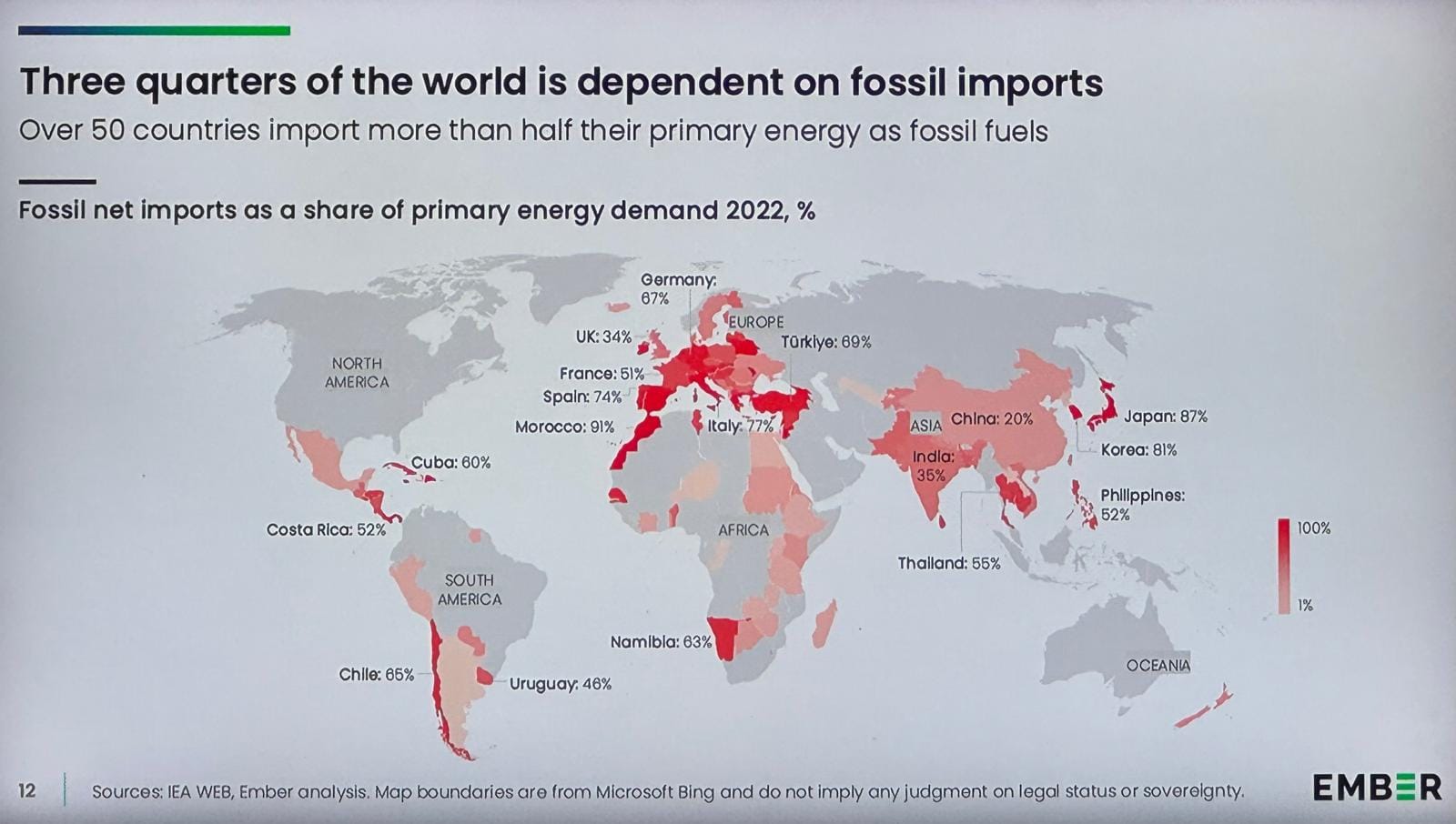

3. Geopolitics – Energy Security

- The majority of the world’s population lives in fossil fuel–importing countries:

- UK imports ~40% of primary energy as fossil fuels;

- Europe ~60%;

- Italy/Spain ~75%;

- Japan/Korea ~85%.

- Dependence on imported hydrocarbons is “a desperate degree of dependency.”

The speaker described the present moment as one of “fossil blackmail”, referencing reliance on gas from Russia, Qatar, and the U.S.

“We don’t need to pay the blackmail anymore. It is a security imperative to use our own wind, our own sun, our own technology.”

9️⃣ GLOBAL GEOGRAPHIES OF CHANGE

- China:

- Leads the manufacturing and deployment race, exporting renewables and electrification technologies globally.

- Western economies must adopt them to remain competitive.

- Emerging Markets:

- Experiencing a “leapfrog” effect — outpacing the West in electrification and renewables.

- Southeast Asia already surpassing Europe and the U.S. in electrified transport.

- Two-thirds of emerging markets now ahead of the U.S. in solar share of generation (driven by India, Brazil, South Africa, Mexico).

🔟 THE 2025–2035 TRAJECTORY

- According to IEA framing cited by the speaker:

- By 2035, renewables could reach ~50% of global generation.

- Around one-third of the total energy system could be electrified.

- This decade (2020s) is decisive:

- Manufacturing capacity for solar and batteries is already sufficient to reach “net zero” scale.

- The S-curves are now entering their steepest phase.

- Market recognition of the fossil system’s terminal decline will soon follow.

11. CONCLUSION & CALL TO ACTION

- The transformation is already underway — the task is to join the party and direct capital toward the new system.

The speaker closed by reframing the ESG acronym as:

“Energy, Security, and Growth.”

Final message:

“We can harness the sun. The time is now. Change is on schedule — it’s going to happen faster than you think.”

🎯 Key Takeaways

| Theme | Insight |

|---|---|

| Macro View | Political turbulence is transitory; technological momentum is structural. |

| Core Driver | Costs continue to fall 20% per doubling; clean technologies are self-reinforcing. |

| Sector Dynamics | Electrification now covers vehicles, grids, and industrial use cases. |

| Security Imperative | Energy independence is a geopolitical driver of decarbonisation. |

| Next Decade | The 2020s are the decisive decade—when cost parity becomes dominance. |

Note) The above detailed summary was put together with the help of AI and reviewed by a human being, me.

About Obsidian Odyssey

Obsidian Odyssey explores the intersection of capital, consciousness, and long-term stewardship. Subscribe for weekly executive reflections on sustainable investing, leadership, and the future of capitalism — written for CIOs, portfolio managers, and next-generation capital architects.

![Obsidian Memo] Foundational Frameworks for Sustainable Finance: A First Principles Approach](/content/images/size/w720/2026/01/1_9Kg0XkVUpLJ_5qLrGto5hA.webp)

![Sustainable/Impact Investing] Regulations Cheatsheet - State of Play (December 2025)](/content/images/size/w720/2025/12/Screenshot-2025-12-08-073043.png)

![Sustainable/Impact Investing] Building for Planetary Renewal - Urban Sequoia (A lecture by Mina Hasman, Sustainability Director at SOM)](/content/images/size/w720/2025/10/Screenshot-2025-10-30-221501.png)

Comments ()