Sustainable/Impact Investing] Labelled Bonds and the Pragmatic Turn: Notes from the Climate Bonds Conference 2025 (Oct 22, 2025)

Summary: why labelled bonds—green, social, and transition—remain resilient amid regulatory change, and how CIOs can deploy capital credibly in the era of pragmatic sustainability.

![Sustainable/Impact Investing] Labelled Bonds and the Pragmatic Turn: Notes from the Climate Bonds Conference 2025 (Oct 22, 2025)](/content/images/size/w1200/2025/10/WhatsApp-Image-2025-10-25-at-08.46.17_121e48c8.jpg)

Insights from the 2025 Climate Bonds Conference: why labelled bonds—green, social, and transition—remain resilient amid regulatory change, and how institutional investors are reframing sustainability through pragmatism, data, and delivery.

Date: October 22, 2025 | London

I. Executive Summary

Despite regulatory uncertainty and shifting political sentiment, labelled bond markets remain structurally resilient. Green, social, and transition bonds continue to attract strong investor demand, driven by long-term mandates and rising issuance from hard-to-abate sectors. For allocators, the opportunity lies not in chasing labels, but in financing real-economy transition through credible, data-backed instruments.

II. Background

The Climate Bonds Conference 2025 brought together leading fixed income investors—including representatives from BlackRock, Federated Hermes, Man Group, and BNP Paribas Asset Management—to discuss how the sustainable bond market is adapting to macro headwinds, regulatory fragmentation, and investor scrutiny.

Moderated by Karen Kearney (Treasurer for Stanford University, Climate Bonds Initiative Trustee), the conversation spanned three key themes: investor sentiment, regulation and transition finance, and the evolving balance between public and private markets.

III. Key Takeaways for Capital Allocators

- Sustainable Fixed Income Flows Remain Resilient: Despite negative headlines, sustainable bond funds continue to attract inflows.

- Europe: 12 consecutive quarters of inflows.

- US: steady interest, with a brief Q2 2025 dip but renewed appetite since summer. Greenium spreads remain moderate (≈2 bps in Europe), reflecting balanced supply-demand dynamics rather than investor retreat.

- Labelled Bonds Have Matured Beyond Marketing: As Ashwin Joshi (BlackRock) noted, green and social bonds are now the “cleanest, most auditable channels” for transition finance. Labelled issuance accounts for 15–20% of all new issuance in Europe—a consistent ratio over the past three years, even as macro conditions tightened. Issuer diversity is expanding, with steel, shipping, and heavy industry entering the market.

- The Ecosystem Is Expanding Through Regulation: Christina Bastin (Man Group) and Malika Takhtayeva (BNP Paribas AM) emphasized that while regulation can feel cumbersome, it has forced market participants to improve data quality, disclosure, and cross-sector learning. Frameworks like ICMA’s Climate Transition Finance Handbook and SBTi guidance are catalyzing issuance from hard-to-abate sectors—enabling steel, cement, and shipping companies to issue credible transition instruments.

- Labelled Issuance as a Communication Tool: Beyond capital-raising, labelled bonds are emerging as a diplomatic language of sustainability.

The Tokyo Metropolitan Government’s “Resilience Bond”—a subset of the green bond label—was cited as a case study in signaling civic commitment to adaptation and climate readiness. Another pivotal example came from Hong Kong’s Insurance Authority (IA) and its Risk-Based Capital (RBC) regime, implemented July 1, 2024. For the first time, the IA has introduced preferential capital treatment for recognized green bonds, applying a 0.9 factor to the spread stress in solvency calculations.- What that means: Under RBC rules, insurers must hold capital to cover potential losses if credit spreads widen sharply. Normally, a full (100%) spread stress applies. A 0.9 factor means qualifying green bonds are assumed to face only 90% of that stress—a 10% capital relief. This incentive lowers capital charges for insurers holding green bonds, improving portfolio economics and signaling regulatory alignment with climate stability. In other words, “If you buy verified green bonds, we’ll treat them as slightly safer from a solvency perspective.” A 10% capital relief that materially improves their regulatory risk-return profile. It’s a subtle but powerful signal that regulators are beginning to price climate alignment as prudential stability.

- Emerging Markets Lead in Innovation: Emerging markets now account for up to 25–30% of labelled issuance in certain local credit markets.

As Ashwin Joshi noted, India’s and Brazil’s sovereign and quasi-sovereign green issuance is expanding rapidly, with growing inclusion of nature-based outcomes—forestry, biodiversity, and adaptation projects.

IV. Market Implications

🔹 For Public Market CIOs

The labelled bond market remains one of the few scalable, transparent vehicles for transition finance.

- Structural resilience: labelled issuance = 15–20% of new European supply (steady since 2021).

- Emerging market share: up to 30% of issuance in local credit markets.

- Global outstanding market: now surpasses $3.2 trillion (up from ~$20 billion a decade ago).

As yields normalize and macro headwinds subside, CIOs should treat labelled debt not as a separate asset class but as a strategic overlay for decarbonization accountability.

The frontier opportunity lies in identifying credible transition frameworks—where carbon-intensive issuers show verifiable pathways rather than perfect baselines.

🔸 For Private Market CIOs

Private credit and project finance are emerging as complementary accelerants to the public labelled market.

While private markets attract headlines for yield and bespoke impact, public bond markets remain the dominant lever for real-world emissions, as:

“Eighty-three percent of global Scope 1 emissions come from tradeable issuers,” noted Christina Bastin (Man Group).

Allocators seeking genuine climate impact must therefore bridge private capital deployment with public refinancing mechanisms, blending catalytic private funding with subsequent labelled bond issuance.

V. Regulation, Transition & the Data Challenge

Regulatory complexity remains a friction point but also a catalyst for maturity:

- EU SDR & SFDR revisions (2025) expected to clarify “transition” vs “impact” definitions.

- ICMA exploring a standalone Transition Bond label.

- IIF’s carbon accounting standardization underway to harmonize issuer-level reporting.

Panelists agreed that the goal isn’t perfect standardization but credible comparability.

As one speaker noted:

“We’re better off with an imperfect trillion-dollar market than a perfect million-dollar one.”

Post-issuance reporting remains uneven, but demand for impact transparency is growing.

Most managers now produce annual bond-level impact reports, with increasing use of AI-enhanced emissions data and emerging tools such as the Avoided Emissions Platform to validate Scope 1–3 outcomes.

VI. In Closing

What stood out was the tone: pragmatic optimism. The conversation was less evangelical, more operational, focusing on 'additionality'. Participants spoke the language of regulation, data, and delivery — evidence that sustainable fixed income is entering a technocratic maturity phase.

Despite the fatigue and politics, demand endures because the underlying drivers — disclosure, data, and accountability — are irreversible. As one manager put it, “Green bonds have become boring — and that’s exactly what makes them investable.”

Walking out of the panel, I felt reassured. Sustainability has survived its adolescence; the market is still here, still evolving, and quietly compounding towards scale.

VII. Further Reading

- ICMA: Climate Transition Finance Handbook (2024)

- Climate Bonds Initiative: Green & Transition Bonds Database 2025

- IIF: Standardizing Carbon Accounting for Issuers (2025 Draft)

- BloombergNEF: Global Sustainable Debt Market Outlook 2025

VIII. Questions for the Obsidian Odyssey Community

In a market shifting from pledges to delivery, which regulatory or balance-sheet signal would most accelerate your own capital reallocation in the next 12 months?

Deep-dive: Detailed Summary

1️⃣ MARKET OVERVIEW: Green & Sustainable Bond Landscape

Global Growth

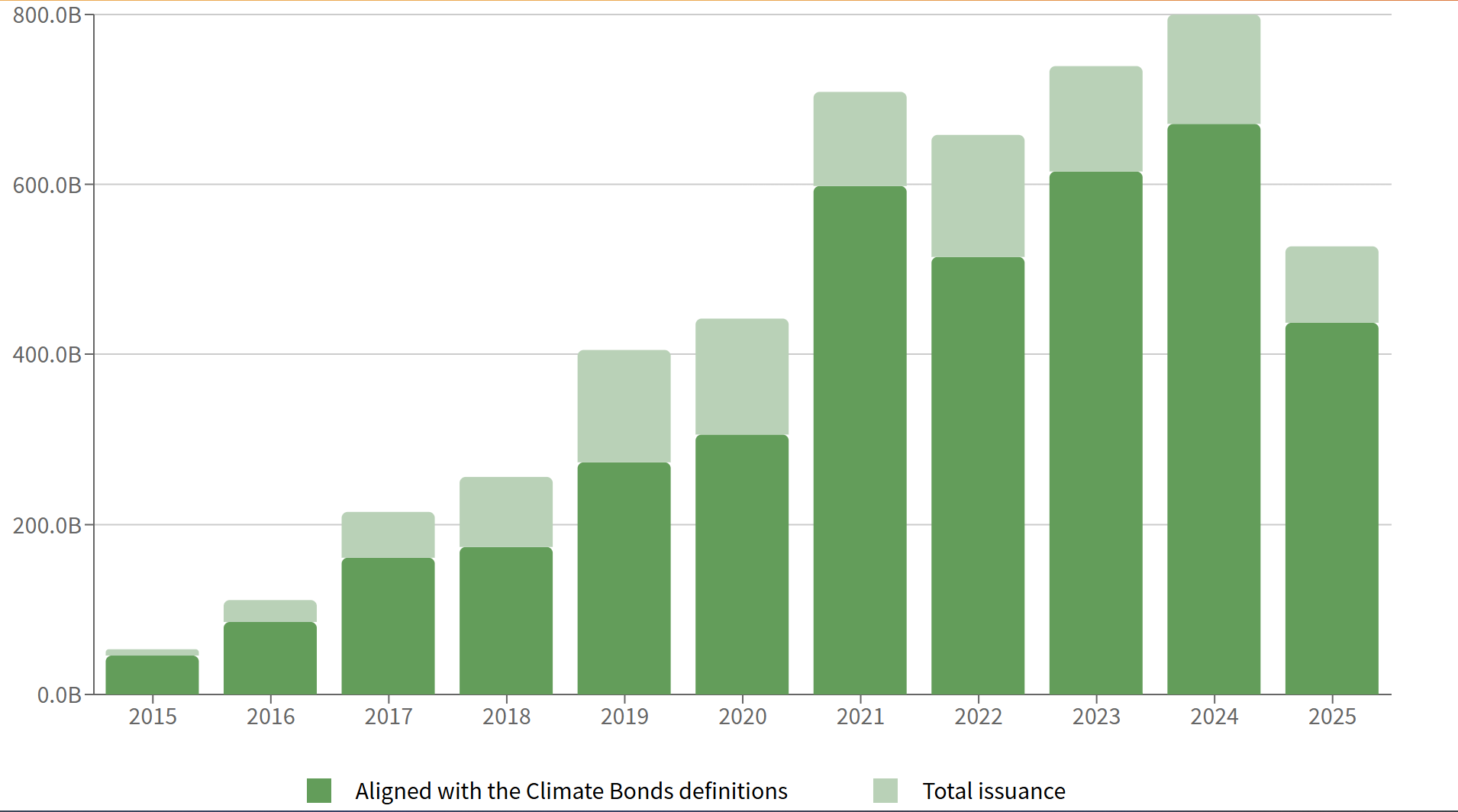

- Market size: Global labelled bond market (Green, Social, Sustainability, SLB) now exceeds USD 3.5 trillion, up from ~$20 billion in 2013.

- Annual issuance: 2024 issuance projected around $900–950 billion, only slightly below 2023’s record.

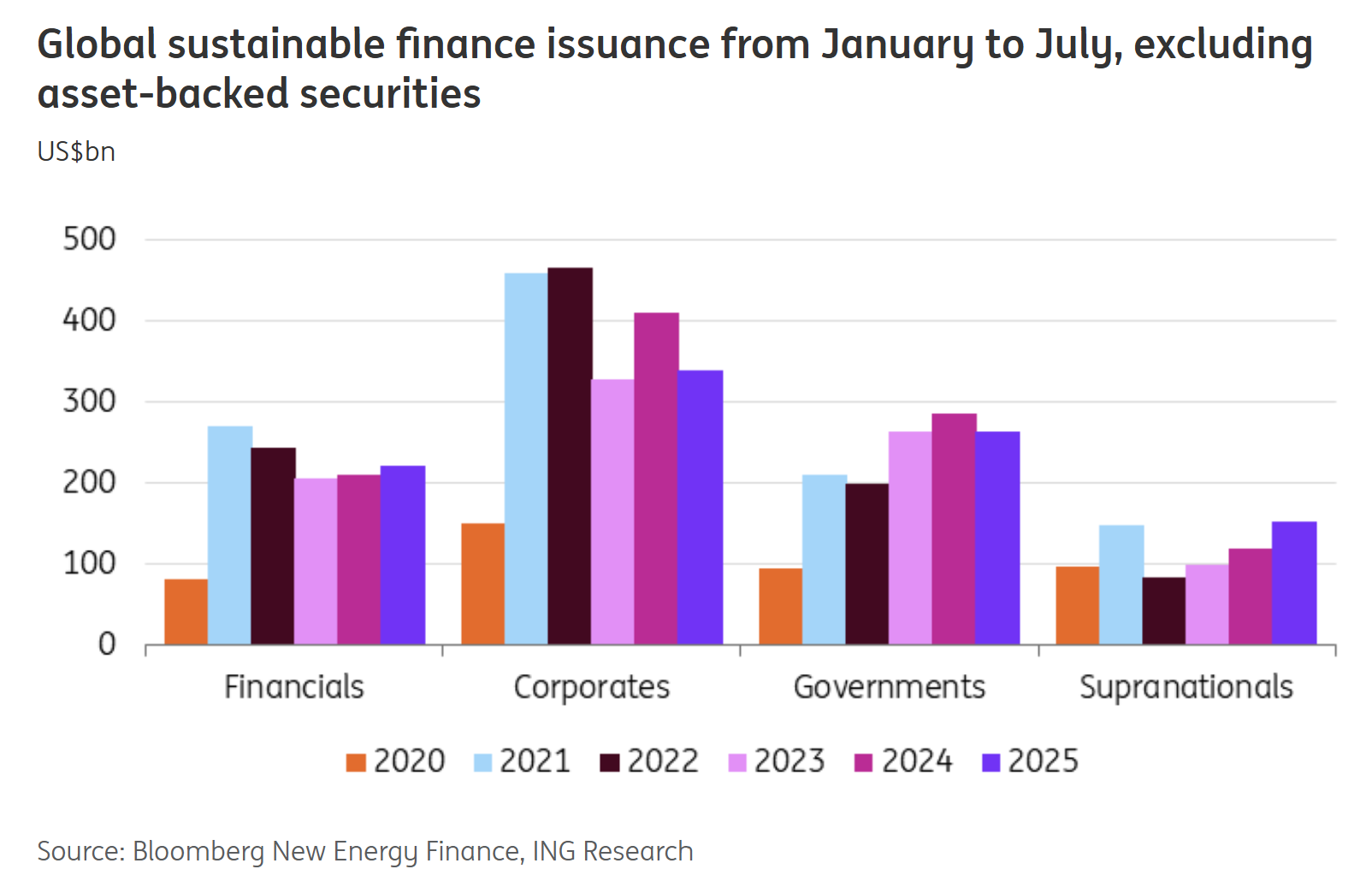

- Share of total bond market: Labelled bonds now represent ~15–20% of new issuance in Europe; ~3–5% in U.S. dollar credit markets.

Fund Flows

- Europe: 12 consecutive quarters of positive inflows into sustainable fixed income funds.

- U.S.: Two years of net inflows, with a brief dip in Q2 2024.

- Contrast: Sustainable equity funds have seen outflows in 2024 (−$10–15bn YTD globally), while sustainable fixed income remains resilient.

Market Premiums

- Greenium: Average yield differential between green and vanilla bonds is ~2 bps tighter in developed markets (Europe), widening to ~7 bps for social bonds.

- Investor demand: Books remain oversubscribed, especially for EUR-denominated and emerging market issuances.

2️⃣ INVESTOR SENTIMENT & ALLOCATOR BEHAVIOR

- Persistent appetite: Institutional demand for labelled debt remains robust, anchored by asset-owner net-zero targets.

- Sector diversification: Growth in hard-to-abate sectors — steel, shipping, cement — now accounts for ~8–10% of new labelled issuance.

- Regulatory tailwinds: EU taxonomy and ISSB frameworks driving discipline and disclosure.

- Regional diversification:

- Europe: 15–20% of new issuance remains GSS-labelled.

- Asia-Pacific: Accelerating participation (Japan’s “Resilience Bonds”; Korea, Singapore, India scaling).

- EM sovereigns: Now ~25% of EM hard-currency new issues include a green or sustainability label.

3️⃣ EMERGING MARKETS & NATURE-BASED FINANCE

- Emerging market issuance share: Up to 25–30% of local-currency credit in markets such as India, Brazil, and Indonesia now labelled sustainable.

- Sovereign trend: More than 40 sovereigns have issued green or sustainability bonds since 2016; 2024 saw 9 new EM sovereign entrants.

- Nature-based outcomes: Increasing integration of biodiversity and natural capital metrics — led by Brazil, Indonesia, and Kenya.

- BlackRock research highlight: “Bonds and Boundaries” white paper identifies investable nature-linked public market universe for the first time.

4️⃣ TRANSITION FINANCE & DISCLOSURE EVOLUTION

Transition Bonds

- BNP AM: Advocating for a separate Transition Bond label, distinct from Green Bonds, focused on fossil-fuel heavy sectors.

- ICMA Transition Finance Handbook: Under revision; new guidelines expected Q4 2025.

- Carbon accounting: IIF working group developing methodology standardisation for issuer-level and sovereign carbon metrics (due 2025).

Disclosure & Reporting

- Post-issuance data coverage: Only 60–65% of issuers currently provide measurable impact data.

- Scope-level granularity: <20% disclose Scope 3 emissions.

- Emerging platforms:

- Avoided Emissions Platform – mapping emissions factors by technology.

- Project Carbon (Citi, IIF) – harmonising impact verification.

Investor Reporting

- Man Group: Tracks >22 environmental data fields; uses alternative datasets and AI to harmonise post-issuance impact data.

- BNP AM: Conducts bond-by-bond impact analysis, distinguishing between reported vs estimated metrics; seeks inclusion of full carbon footprint (Scope 1–3) in issuer disclosures.

5️⃣ REGULATION, TAXONOMIES, AND SDR/ESG 2.0

- EU SFDR transition:

- Article 8/9 definitions under review; “SDR 2.0” expected to streamline and clarify sustainable investment categorisation.

- Aims: Reduce ambiguity, improve comparability, allow innovation.

- EIOPA regulatory incentive:

- EU insurance authorities now offer capital requirement haircuts for green bonds in risk-based capital models (Solvency II).

- Seen as one of the strongest regulatory signals yet in support of green debt.

- France: Ministry of Environment integrating CBI biodiversity criteriaare into national green bond frameworks.

- CBI 2025 priority: Expand biodiversity categories beyond agriculture and forestry to include marine ecosystems and restoration.

6️⃣ U.S. POLICY & GLOBAL OUTLOOK

- U.S. labelled issuance share: ~3% of total U.S. corporate bonds, lagging EU by factor 5×.

- Drivers:

- Slower regulatory push (SEC disclosure still pending).

- “Pragmatism” replacing ambition in rhetoric (“practicality” cited by panelists).

- However, power transition, data-center build-outs, and IRA subsidies creating record clean-energy project pipelines.

- Japan’s approach: Government committed to net zero without adopting SFDR-style labelling — provides flexibility but slows data maturity among local asset managers.

7️⃣ PRIVATE MARKETS & CAPITAL ALLOCATION TRENDS

- Fixed income market: ~$140 trillion globally.

- Private credit market: ~$3 trillion and growing at +10–15% CAGR.

- Trend: Allocators rotating towards private credit and infrastructure for yield and impact.

- Panel consensus:

- Private markets are essential for early-stage project finance (e.g., renewables, carbon capture).

- But 83% of global Scope 1 emissions stem from publicly tradable issuers (corporates with listed equity or debt).

- Therefore, decarbonisation requires both public-market engagement and private-market innovation.

8️⃣ CHALLENGES & SOLUTIONS IDENTIFIED

| Challenge | Data / Metric | Panel Insight / Emerging Solution |

|---|---|---|

| Fragmented post-issuance reporting | Only ~60% issuers disclose impact data | AI-enabled harmonisation, CBI + IIF standards coming |

| Complex labelling for first-time issuers | 12–18 months average to prepare | Once frameworks built, re-issuance cycles shorten to 3–6 months |

| Regulatory ambiguity (SFDR, SDR) | 40% of asset managers report confusion on definitions | Expect clearer SDR by late 2025 |

| Market “green fatigue” in U.S. | Labelled share 3–5% vs EU’s 20% | “IRA-driven” issuance expected to grow 2026–2028 |

| Biodiversity finance underdeveloped | <5% of green bonds explicitly include biodiversity | CBI expanding categories in 2025 |

9️⃣ KEY QUOTES & TAKEAWAYS

“Green bonds remain one of the cleanest and most direct ways to deploy capital to the transition.” — Ashwin Joshi, BlackRock

“We prefer sustainable companies over merely sustainable securities.” — Jake Goodman, Federated Hermes

“Transition bonds need a distinct identity — clarity creates credibility.” — Malika, BNP AM

“We’re better off with an imperfect trillion-dollar market than a perfect million-dollar one.” — Jake Goodman, Federated Hermes

“Data, data, data — transparency is the foundation of credible impact.” — Christina Baston, Man Group

🔟 STRATEGIC OUTLOOK (2025–2030)

| Theme | Forecast / Projection |

|---|---|

| Labelled bond issuance | >$5 trillion cumulative by 2030 |

| Emerging market share | Rising from ~25% to 40% of total new issuance |

| Nature-linked & biodiversity bonds | Expected CAGR +20–25% (2025–2028) |

| Transition bond adoption | New label standard by 2026; could reach $500 bn outstanding |

| Data standardisation | IIF & ICMA frameworks to reduce metric variance by ~30–40% |

| Private vs public mix | 80% of net-zero capital still expected via public markets |

🧭 CONCLUSION

The panel agreed that momentum remains strong despite geopolitical and regulatory headwinds.

Key themes include:

- Diversification of issuers (hard-to-abate sectors, EM sovereigns)

- Rising investor scrutiny on post-issuance impact

- Push for clearer, standardised definitions (Transition, SDR 2.0, biodiversity)

- Continued dominance of public markets for decarbonisation scale

- Ongoing innovation in data harmonisation and nature-based finance

Tone of the session: Pragmatic optimism — the market is maturing, not slowing.

Note) The above detailed summary was put together with the help of AI and reviewed by a human being, me.

About Obsidian Odyssey

Obsidian Odyssey explores the intersection of capital, consciousness, and long-term stewardship. Subscribe for weekly executive reflections on sustainable investing, leadership, and the future of capitalism — written for CIOs, portfolio managers, and next-generation capital architects.

![Obsidian Memo] Foundational Frameworks for Sustainable Finance: A First Principles Approach](/content/images/size/w720/2026/01/1_9Kg0XkVUpLJ_5qLrGto5hA.webp)

![Sustainable/Impact Investing] Regulations Cheatsheet - State of Play (December 2025)](/content/images/size/w720/2025/12/Screenshot-2025-12-08-073043.png)

![Sustainable/Impact Investing] Building for Planetary Renewal - Urban Sequoia (A lecture by Mina Hasman, Sustainability Director at SOM)](/content/images/size/w720/2025/10/Screenshot-2025-10-30-221501.png)

Comments ()