Sustainable/Impact Investing] GIIN Event: Scalable Impact Through Innovation and Institutional Partnership (Oct 21, 2025)

Summary: London GIIN event - proven case studies from Sun King and Reactive Technologies, emerging market opportunities, quality manager selection criteria, and UK Mansion House Compact implications for institutional allocators and CIOs.

![Sustainable/Impact Investing] GIIN Event: Scalable Impact Through Innovation and Institutional Partnership (Oct 21, 2025)](/content/images/size/w1200/2025/10/WhatsApp-Image-2025-10-22-at-07.51.33_460f453f-1-1.jpg)

Hi All,

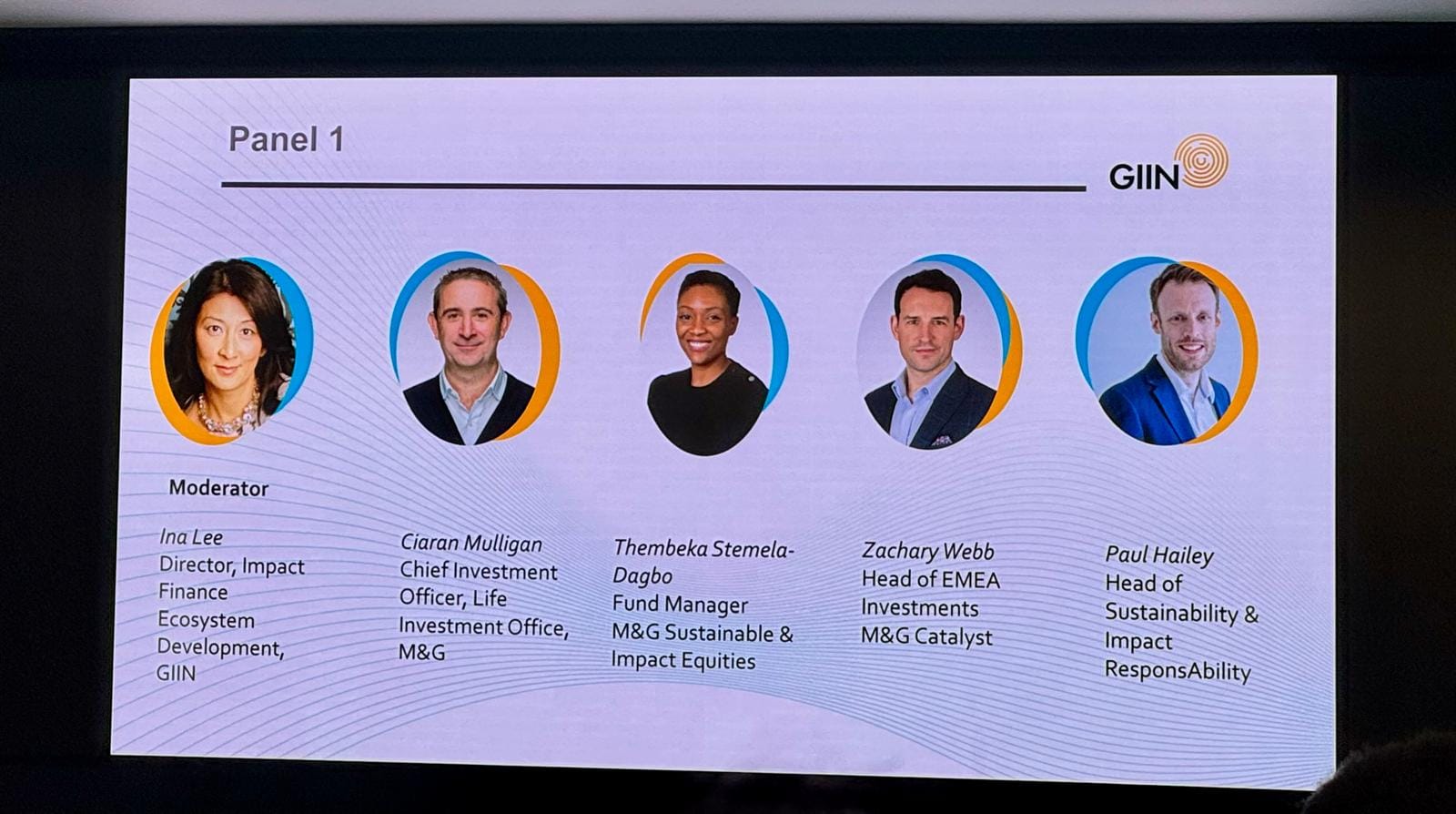

On October 21, 2025, I attended the GIIN London event hosted at M&G, where institutional allocators, impact fund managers, and development financiers convened to assess how impact investing is evolving in practice.

The tone reflected a sector at a turning point: from movement to market. What began as a values-driven ambition is now maturing into an investable asset class — defined by performance discipline, data accountability, and strategic capital deployment.

Conversations centered on how asset owners are asserting leadership, how GPs are building credible strategies, and how scalable impact will depend on rigorous execution, partnership, and a clear alignment between financial and social outcomes.

I. Executive Summary

Impact investing is evolving from niche to necessity. There is a shift from aspiration to execution — with a clear emphasis on scale, rigour, and institutional alignment. The discussion centered on:

- Asset owner leadership: CIOs are becoming architects, not just allocators

- Infrastructure & innovation: Case studies from Sun King and Reactive Technologies demonstrate impact with scale and returns

- Emerging market growth: Demographics, digital infrastructure, and climate urgency converge

- Manager quality: Differentiation now hinges on origination depth, structural creativity, and proof of additionality

- UK policy tailwinds: The Mansion House Compact and Accord signal increasing demand for private market solutions and domestic growth strategies

Bottom line: Key Takeaways for Investors & CIOs

- Impact is no longer niche—it is a viable, scalable strategy that can deliver both alpha and system-level value.

- Proof points matter—from Sun King’s solar revolution to Reactive’s grid diagnostics, outcomes speak louder than claims.

- Relationships are key—deep trust, long-term partnership, and co-creation models will define the most successful allocators and GPs.

- Be selective, not sentimental—rigorous underwriting and clarity on theory of change will distinguish true impact from "Me Too" marketing.

II. The Case for Impact: Addressing Market Failures with Scalable Solutions

Case Study] Sun King: Solar Access Across Africa

- Problem: 775M+ people globally lack access to reliable electricity. In Lagos alone, diesel generators contribute 12% of emissions.

- Solution: Sun King delivers distributed solar through an integrated model: design and production in China, distribution and credit systems in Africa.

- Financial Model: Pay-as-you-go structure replaces kerosene (~$0.10/day) with solar, building credit profiles and long-term ownership. No interest is accrued.

- Results:

- Business tripled in size post-investment.

- Revenues rose from ~$200M to ~$600M.

- Millions of customers transitioned to cleaner, cheaper energy.

- Why it matters: Sun King exemplifies a just transition success story, proving that climate solutions in emerging markets can be economically viable and deeply impactful.

III. Infrastructure Innovation: Making the Grid Smarter, Not Just Bigger

Case Study] Reactive Technologies (UK)

- Problem: Renewable energy like wind/solar lacks grid “inertia,” risking instability and curtailment. Grid operators often pay generators not to produce.

- Solution: Reactive Technologies provides real-time grid inertia measurement—data that allows system operators to better integrate renewables.

- Impact:

- Helped UK grid operator avoid $4B+ in infrastructure upgrades.

- Saves £200M annually—5% of UK’s total grid spend—through better data alone.

- Strategic Insight: Data + diagnostics > Capex. Instead of spending billions on grid reinforcement, precise tech offers smarter system-wide ROI.

IV. Public Equities: Building Credible Impact in Liquid Markets

PAC Strategy & Evolution

- History: Launched in 2018 when impact in public equities was nascent, with limited market acceptance and concerns around additionality.

- Portfolio Construction:

- Blended themes across climate, healthcare, education, and financial inclusion.

- Included emerging and frontier market exposure with disruptive or early-stage models.

- Key Takeaways:

- Demonstrated that impact + public equities can drive alpha over time.

- Attracted large institutional capital through proof of concept and consistent performance.

- Catalyzed mainstream adoption of impact mandates by marrying rigorous ESG analysis with return generation.

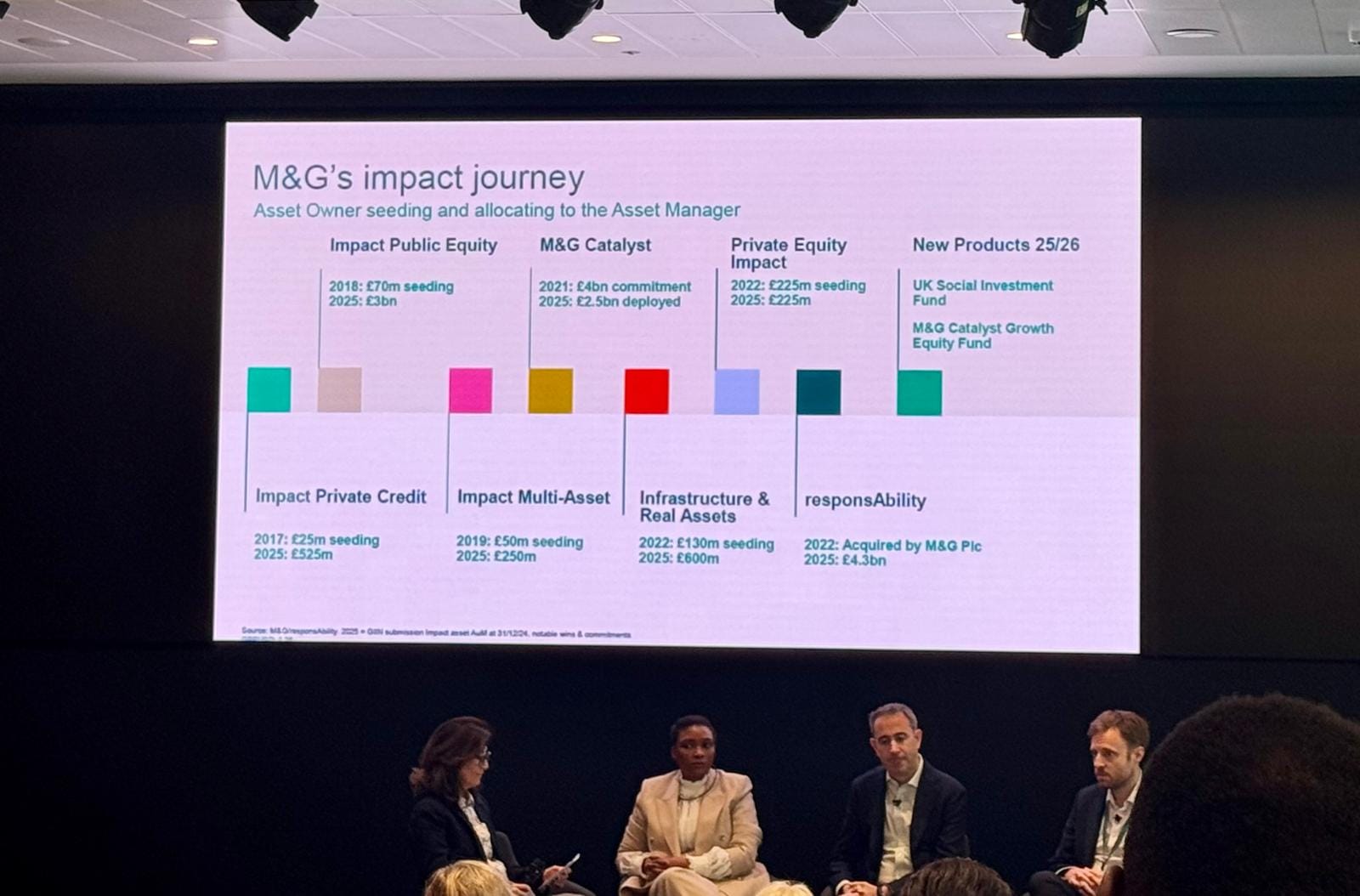

V. Strategic Partnerships: Responsibility Acquisition and Platform Synergies

ResponsAbility Acquisition

- Background: A pioneer in impact investing, especially across sustainable agriculture, food systems, and SME finance.

- Post-Acquisition Impact:

- Expanded origination capacity and credibility.

- Enabled deployment of patient capital (e.g., mezzanine debt) into family-run SMEs in Latin America.

- Drove measurable changes: adoption of regenerative practices, improved worker conditions, and better resource usage.

- Lesson for Allocators: “Go-anywhere” flexibility and strong local expertise can unlock value in hard-to-reach markets.

VI. What Makes a High-Quality Impact Manager?

What separates top-quartile GPs? Key Characteristics CIOs are looking for:

| Attribute | Description |

|---|---|

| 🔍 Origination Quality | Deep local networks, differentiated sourcing beyond mainstream deals |

| 🧠 Team Resilience & Vision | Leadership that balances financial acumen with authentic impact conviction |

| 📊 Process Rigor | Ability to demonstrate intentionality, materiality, and additionality |

| 🏗️ Structural Innovation | Willingness to innovate across capital structure (e.g., mezz, hybrids) |

| 📈 Return-Impact Integration | Clear thesis on how impact drives financial outcomes (not at expense of) |

VII. Emerging Markets: Innovation, Demographics, and the Case for Long-Term Capital

- Massive Untapped Demand: 650M+ rural Indians now online vs. near-zero five years ago. Similar tailwinds across Africa.

- Accelerated Growth: Distributed energy and digital infrastructure in EMs seeing >20% CAGR in certain sectors.

- Manager Role: Help companies “graduate” from local capital to institutional-grade scale via capacity building and long-term backing.

- Success Story Highlight: Firms like M-KOPA, Sun King, and other distributed services are transforming underserved markets and generating strong financial returns.

VIII. The Mansion House Accord: UK’s Strategic Push for Private Capital

The Mansion House Compact (2023) and Accord (2025) reflect growing UK pension appetite for domestic growth and unlisted assets. Key takeaways:

- 5–10% of DC pension assets to be invested in private markets by 2030.

- Up to £50B mobilised, half into UK companies, growth equity, and infrastructure, incl. clean energy.

- Early-stage challenges: trustee hesitancy, product pipeline readiness, and regulatory clarity.

- Strategic opportunity: For managers positioned in UK-focused real assets and private markets, the Compact opens new allocator channels.

VIIII. Looking Ahead: The Next 5 Years in Impact Capital Allocation

Key Themes:

- Platformization: Institutional allocators will increasingly favor partners that can deploy across public/private, debt/equity, and global/UK mandates.

- Modular Mandates: Flexibility to tilt toward thematic impact (e.g. health, inclusion, food) as per beneficiary needs.

- Return Dispersion: Quality of origination and execution will increasingly separate top-quartile from the rest in both PE and credit.

- Innovation Loop: Impact funds will act as labs for next-gen financial models that the mainstream later adopts (e.g. dynamic ownership, regenerative business models).

Bonus: Deep dive into the Institutional Capital Shift – Mansion House Accord (2025)

- In May 2025, 17 leading UK pension providers signed the Mansion House Accord, committing to invest at least 10% of their default Defined Contribution (DC) funds in unlisted equities and other private market assets by 2030.

- At least half of this allocation is intended for UK-based private market investments, subject to the availability of suitable opportunities and fiduciary duties.

- According to HM Treasury, this could unlock up to £50 billion to support “UK businesses and major infrastructure projects, including clean energy developments.”

- The Accord builds on the 2023 Mansion House Compact and is part of a broader effort to boost UK growth and productivity by aligning long-term pension savings with productive finance.

- At launch, baseline allocations were low (~0.36% of DC default funds invested in unlisted equities, or ~£800M), highlighting the scale of the challenge ahead. But the Compact is already influencing institutional behaviour, opening new private market pipelines and aligning fiduciary duty with productive capital deployment.

📊 Key Commitments and Targets

| Initiative | Commitments |

|---|---|

| Mansion House Compact (2023) | 11 major UK pension providers to allocate at least 5% of their default DC funds into unlisted equities by 2030 |

| Mansion House Accord (2025) | Expanded to 17 providers committing 10% of DC default funds into private markets — with minimum 5% UK-based |

| Capital Mobilisation Target | Up to £50 billion total, with ~£25 billion committed to UK companies and infrastructure |

🧭 Strategic Implications for CIOs & Investors

- Growing demand for UK-aligned private market products, including growth equity, infrastructure, and private credit.

- Product opportunity for asset managers able to design scalable, outcome-oriented vehicles.

- Trustee and consultant pressure to demonstrate long-term value, innovation, and measurable economic impact.

- Transparency and reporting expectations will rise as implementation scales.

🔮 Outlook & Key Considerations

- Timeline: The next 6–7 years (to 2030) are critical for scaling investible opportunities and tracking progress.

- Domestic investment shift: The 5% UK-specific allocation reflects a renewed focus on domestic productive capital.

- Challenges: Early-stage implementation requires addressing sourcing gaps, liquidity and valuation concerns, conservative trustee mindsets, and regulatory clarity.

- Strategic signal: This is a clear policy-backed nudge — large UK pension pools will increasingly channel capital into unlisted equity, infrastructure, and innovation ecosystems.

📚 Recommended Resources

- ABI: Mansion House Compact Progress Update (Oct 2025)

- HM Treasury: Government Press Release (May 2025)

Note) Bonus: Deep dive into the Mansion House Compact was put together with the help of AI and reviewed by a human, me.

![Obsidian Memo] Leadership Ground Truth: What Cuba, Puerto Rico, and Hawai'i Taught Me About Capital and Resilience](/content/images/size/w720/2026/02/Bad-Bunny.jpg)

![Obsidian Memo] The Great Re-Entry: Strategic Realignment and the Industrialization of Private Capital in the 2026 Financial Services Landscape](/content/images/size/w720/2026/02/photo-1496989981497-27d69cdad83e.jpeg)

![Obsidian Memo] Nature Finance & Circular Economy in Practice: A Sustainable Investing Perspective](https://images.unsplash.com/photo-1571785983781-3317703d64a6?crop=entropy&cs=tinysrgb&fit=max&fm=jpg&ixid=M3wxMTc3M3wwfDF8c2VhcmNofDEyfHxiaW9kaXZlcnNpdHl8ZW58MHx8fHwxNzcwOTU2NzQ3fDA&ixlib=rb-4.1.0&q=80&w=720)

Comments ()